Easing of Covid restrictions in China provides boost to economic recovery

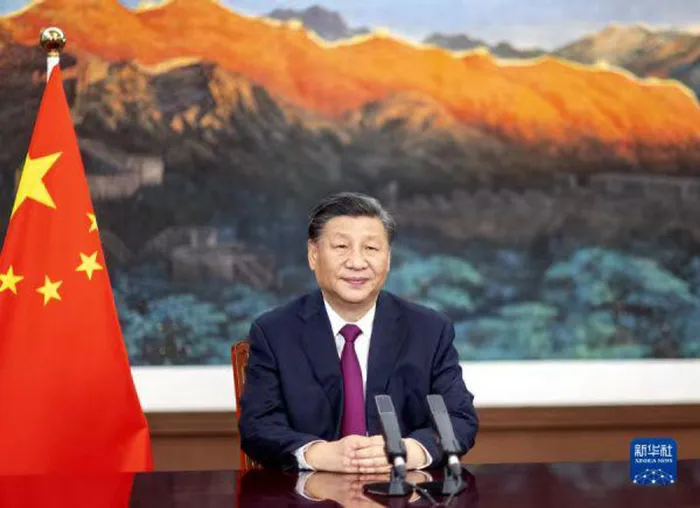

The easing of Covid-19 restrictions in China in early December has already provided a boost to economic recovery, with Foxconn, which supplies Apple products from its factory in China, reporting a 14.2% month-on-month (m/m) jump in December revenue to $20.5 billion (R348.2 billion). Chinese president Xi Jinping

The company's Zhengzhou plant is estimated to be responsible for as much as 70% of iPhone production.

"As production and operations have gradually returned to normal at the Zhengzhou campus in December 2022, Components and Other Products and Smart Consumer Electronics Products delivered double digit growth (month-over-month)," Foxconn said in a statement.

Foxconn noted that its Zhengzhou plant had 'basically returned to normal' in December, and economists expect that this return to normal will be reflected in other parts of the economy, with early tracking data such as subway passenger numbers confirming this expectation.

This is, to a certain extent, confirmed by the Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in services industries such as retail and travel, which rose to 48 in December from 46.7 in November.

This is also reflected in the jump in Chinese shares, with Tencent re-entering the club of the world’s 10 most-valued companies on 4 January 2023. The jump in its share price reflects the optimism among investors that China’s economic growth will rapidly return to its position as the single largest provider of global economic growth.

This renewed optimism is likely to be reflected in the Lunar New Year celebrations as China and Southeast Asia celebrate the Year of the Rabbit. The weeks leading up to the festivities are often filled with feasts, banquets, gatherings and reunions, and this will be especially so in 2023 after two years of strict Covid-19 restrictions that prevented many families from being with their loved ones over this festive season.

The Lunar New Year on 22 January normally results in the world’s largest human migration as migrant workers collect wages and return home to their villages to celebrate with family. It normally starts two weeks before the holiday, so data on railway passenger numbers will be carefully monitored to see whether economists’ optimism is warranted.

China’s approval of a plan by Jack Ma’s Ant Group to raise $1.5 billion for its consumer unit in the past week added to the widespread optimism as economists think the move signalled a change in policy priority from controlling Covid to one of boosting economic growth.

The rebalancing of policy priorities already started in May 2022 as Chinese economic growth rate slowed to only 0.4% year-on-year (y/y) in the second quarter from 4.8% y/y in the first quarter of 2022 growth was boosted by further economic stimulus measures in August 2022.

"Given the current circumstances, we must seize the window of opportunity and maintain the appropriate policy scale. The funds available should be put to best use. This will expand effective investment, boost consumption and help keep economic activities on a steady course," Premier Li said.

The August stimulus package amounts to a total of 1.1 trillion yuan consists of 300 billion yuan of the policy-backed and development-oriented financial instruments to specific projects, which will be increased by 300-plus billion yuan, with the balance of the special-purpose bond quota worth over 500 billion yuan should be well utilized pursuant to law and issued by the end of October. This will help boost effective investment, spur consumption and address the problem of insufficient loan demand.

After three years of a strict Covid containment policy, there is pent-up demand for many things that entails interacting with other people, and includes going to the cinema, restaurants and spas.

Consumers will remain risk-averse, so we will not see an immediate return to pre-Covid spending, but we will see a more gradual return to normal as savings are rebuilt.

How much has been given up in the fight against Covid is, to a certain extent, reflected in Tencent’s market capitalisation. On 4 January 2023, Tencent had a market value of $442 billion, but this was less than half of the $949 billion it enjoyed at a peak in January 2021. Now that it has returned to the Top Ten, investors expect a great year this year, with the Chinese stock market having its best start to a new year since 2009.

Related Topics: