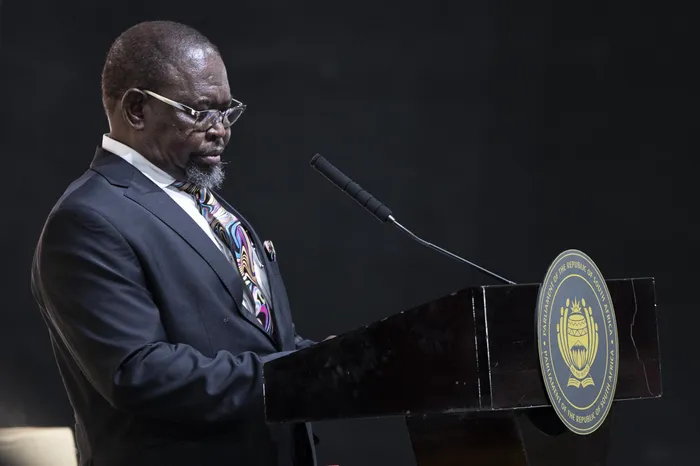

Finance Minister Enoch Godongwana presented his budget in Parliament on Wednesday after an unprecedented postponement last month.

Image: Armand Hough / Independent Newspapers

Finance Minister Enoch Godongwana has announced that the National Treasury will embark on a significant overhaul of the nation’s budget process.

This initiative aims to reassess the foundational assumptions that guide budget allocations, with the goal of optimising public expenditure and ensuring it aligns more closely with the current needs of the country.

The announcement comes amid concerning projections regarding the country’s financial health, with gross government debt expected to reach R5.69 trillion - approximately 76.1% of the gross domestic product (GDP) - this year.

The debt levels are anticipated to stabilise at 76.2% of GDP by the fiscal year 2025/26. In tandem, debt-service costs are projected to surge from R389.6 billion in 2024/25 to R478.6bn by 2027/28, comprising roughly 21.7% of revenue in 2024/25.

Godongwana said the proposed budgetary reforms will allow the Treasury to carry out a systematic evaluation of public spending as the consolidated government spending is budgeted to increase at an annual above-inflation average of 5.6%, from R2.4trln in 2024/25 to R2.83trln in 2027/28.

He said this would also enable the government to prioritise investment over debt service, which now consumes 22 cents of every rand of revenue and is significantly higher than in peer countries, driving up borrowing costs for households and businesses.

“We recognise the urgent need to address this. We are not deaf to the public’s concern about wasteful and inefficient expenditure,” he said.

Since 2013, the National Treasury and provincial treasuries have performed over 240 spending reviews, looking into everything from administrative efficiencies to the effectiveness of essential service delivery programmes in sectors like health and education.

The findings from these reviews are expected to be presented to Cabinet next month, as part of a larger effort to eliminate inefficiencies and improve the overall effectiveness of government spending.

“As the National Treasury, we are ready to take the lead to improve the effectiveness and efficiency of spending,” Godongwana said.

“We will undertake an audit of ghost workers, starting with national and provincial departments, use the ongoing, detailed review of labour market activation programmes and public employment programmes, [and] implement significant changes to the budget process by reassessing the initial assumptions informing budget allocations, with a view to creating room for improved spending.”

Economists hailed as the single most important feature of the budget the government’s committed to fiscal consolidation, with the debt-GDP ratio peaking imminently in 2025/26 fiscal year.

Anchor Capital economist, Casey Sprake, said any revisions will likely remain centred around fiscal consolidation with debt peaking in FY25/26, unchanged weekly bond issuance, and increased infrastructure spending, should the Budget fail to secure enough support from the Government of National Unity’s partners to be formally passed in Parliament.

“The crux of the conundrum facing South Africa at the moment is that our economy is simply not growing at a sustainable rate to support the growing expenditure required from the fiscal side. Hard decisions need to be made with regards to trimming expenditure," Sprake said.

“There needs to be a thorough review of government spending to identify (and then act to remove) areas of wastage and inefficiency across the state, as well as a clear prioritisation of spending that is directly aimed at improving the growth.”

While proponents of fiscal anchors acknowledge they were not a catch-all solution for South Africa's fiscal woes, they believed that a well-structured fiscal anchor could significantly bolster the alignment of fiscal policies with sustainability goals.

Dr Elna Moolman, Standard Bank Group head of South Africa macroeconomic research, said though fiscal anchor was not the solution to South Africa’s economic challenges, it nevertheless would provide some answers.

“Treasury’s discussion document on fiscal anchors echoes our view that this is not a “panacea” (evidenced by the failure of many countries with fiscal anchors to meet their fiscal objectives); it might nevertheless still introduce beneficial guidance and focus to the fiscal negotiation process,” said Moolman.

“The consultation process on a fiscal anchor will likely be protracted; the discussion report merely sets out the basic choices.”

BUSINESS REPORT