Oxford Economics warns US tariff hikes signal a downturn in global economic outlook

US TARIFFS

The announcement of substantial tariff hikes by the US administration marked a turning point in global economic outlook, as reflected in the latest Global Risk Survey conducted by Oxford Economics.

Image: White House/Facebook

The announcement of substantial tariff hikes by the US administration marked a turning point in global economic outlook, as reflected in the latest Global Risk Survey conducted by Oxford Economics.

Launched on April 3, just hours after the US declared 'Liberation Day,' the survey revealed a significant deterioration in business sentiment, continuing a trend of pessimism that lasted throughout the three-week sample period.

The latest quarterly survey, completed by 125 clients across sectors, reveals a complex landscape driven by fears of imminent trade wars, economic sluggishness, and shifting global dynamics.

The Global Business Sentiment Index, derived from these surveys, indicated a worrying forecast: global gross domestic product (GDP) growth is projected to decelerate to just 1.2% by late 2025.

This is half the growth rate businesses anticipated in January and 0.6 percentage points below the most recent baseline. Such downward revisions underscored the urgency with which businesses are recalibrating their expectations in the wake of policy changes.

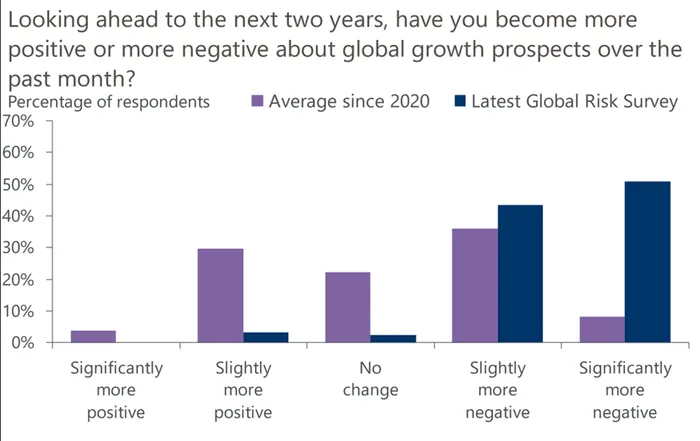

Almost all businesses surveyed have become more negative about growth prospects

Image: Supplied

According to the survey responses—gathered from clients including some of the world’s largest companies employing nearly six million people and generating around $2 trillion in turnover—nearly half of all businesses were significantly more negative about global growth prospects for the next two years.

Jamie Thompson, head of macro scenario at Oxford Economics Africa, said this sentiment represented the highest level of pessimism recorded since the survey's inception five years ago.

"In addition, more than two-fifths have become slightly more negative over the past month. Only a handful of businesses report a more positive or unchanged outlook, in contrast with previous surveys," Thompson said.

The current survey painted a stark picture: approximately 80% of businesses perceive downside risks to the global growth forecast. A concerning one-third of respondents believe these risks are heavily weighted toward the downside, reflecting an acute sense of vulnerability among global enterprises.

The divergence between responses to the first and second waves of the survey indicateed a reactive business community, especially following the forecast downgrade witnessed in mid-April.

Respondents' expectations for global GDP growth have now fallen to a mean of 1.6% for 2025, down 0.4 percentage points from March and 0.7 percentage points from January.

Businesses have also grown wary of prospects for 2026, reducing their mean expectation to 1.8%, a decline of 0.3 percentage points since earlier this year.

Fears regarding the US economy have surged sharply, with fewer than a quarter of businesses believing it will continue to outperform other G7 nations—an astonishing drop from over 80% just a few months earlier. The likelihood of a US recession over the next year has been rated at 48%, a stark increase from previous estimates following last year's elections.

Notably, three-quarters of businesses now cite the risk of a global trade war, spurred mainly by escalating tariffs, as the top economic threat over the next two years. This represented a significant jump of 22 percentage points within just three months, echoing long-standing worries about trade relationships and economic stability.

In parallel, fears surrounding deglobalisation have also intensified, with 60% of businesses identifying it as the principal risk over the next five years, a substantial increase from 35% in January. Conversely, concerns previously directed at geopolitical tensions in regions like the Middle East have waned, reflecting shifting priorities in the face of trade-related uncertainties.

Inflation expectations show an upward trend, with the average projected rate now sitting at 3.1%, 0.3 percentage points above the baseline, but still lower than the peak seen in 2022. As economic risks materialise, businesses are increasingly cautious, underscoring the frailty of the current economic climate.

Looking to the future, geopolitical tensions and protectionist policies are referenced by over half of the respondents as key global economic risks. However, surprisingly, the long-term impact of technological innovations like artificial intelligence remains largely underestimated, with fewer than 10% of businesses viewing it as a leading concern.

Despite the challenges, some optimism persists, with over 40% of respondents identifying the avoidance of a global trade war as a significant opportunity for economic recovery. Other potential upsides noted included a boost in European growth, possibly driven by increased defence expenditure and stabilisation in the Russia-Ukraine conflict.

BUSINESS REPORT