SARS aims for R20 billion through strategic revenue enhancement initiatives

SARS has taken valuable lessons from the 2024/25 debt-collection drive.

Image: Ziphozonke Lushaba / Independent Newspapers

The South African Revenue Service (SARS) is determined to tackle the pressing financial challenges facing the nation, affirming its commitment to serve with integrity and efficiency.

As a critical entity in collecting revenues that fund essential public services, SARS has announced an ambitious goal of raising a minimum of R20 billion in revenue through strategic enhancements and technical innovations.

With valuable lessons learned from the 2024/25 debt-collection drive still fresh, SARS is refining its operations to ensure that its revised revenue estimates are met this year.

Paramount among these efforts is the use of advanced data analytics and artificial intelligence, tools that are revolutionising how the agency detects tax compliance risks and combats tax evasion.

By integrating expansive third-party data sources such as banking and payroll information, SARS is automating tax assessments and more accurately identifying underreported income.

This sophisticated approach aims not only to strengthen compliance rates but also to close the persistent tax gap that has long plagued the South African economy.

Furthermore, SARS is intensifying its fight against the illicit economy, particularly in sectors that generate significant revenue, such as tobacco, alcohol, and fuel. Through enhanced enforcement measures targeting smuggling, counterfeit goods, and black-market transactions, SARS seeks to recover substantial revenue losses while simultaneously deterring future non-compliance in the informal economy.

Another critical initiative involves broadening the tax base. SARS is systematically identifying and registering individuals and businesses that have previously operated outside the formal tax system. By focusing on hard-to-tax sectors—specifically small enterprises and self-employed individuals—SARS is actively mobilising increased revenue and lessening reliance on a narrow tax base.

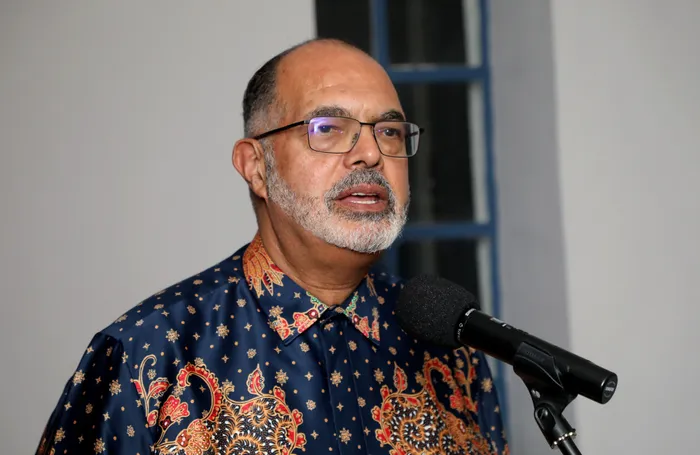

SARS Commissioner Edward Kieswetter

Image: Timothy Bernard / Independent Newspapers

In a recent statement, SARS Commissioner Edward Kieswetter emphasised the transformative role the agency plays in funding approximately 90% of government expenditure, highlighting its importance for social services such as old age pensions and health care.

“The increased revised revenue estimate means that SARS must do more to realise a better life for all South Africans,” he stated, underscoring the responsibility SARS embraces with humility in transparent governance.

Commissioner Kieswetter also expressed his gratitude to compliant taxpayers and traders.

“My sincere gratitude goes to the compliant taxpayers and traders, who have continuously played their part in building our country."

He acknowledged the dedication of SARS employees, affirming that their efforts contribute significantly to the establishment of a capable state.

“The tax revenue you collect is the lifeblood that enables government to build a capable State. I salute you!” he concluded.

IOL

Related Topics: