South Africa’s richest are spending nearly half their income on debt

South Africa’s top earners are said to be under growing financial pressure, with new data showing they spend nearly half of their income on debt repayments.

Image: Karen Sandison / Independent Newspapers

South Africa’s top earners are said to be under growing financial pressure, with new data showing they spend nearly half of their income on debt repayments.

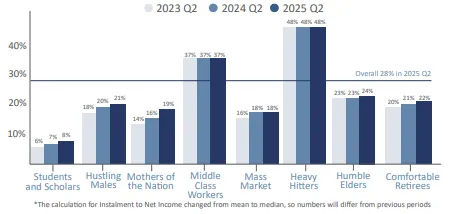

According to the latest Credit Stress Report from analytics firm Eighty20, the country’s highest-income credit users, known as “Heavy Hitters”, are allocating 48% of their net monthly income towards servicing debt, the highest burden across all consumer segments.

The report tracks consumer credit behaviour across income groups, using data from credit bureau XDS and other economic indicators to paint a detailed picture of financial stress among South Africans.

"The overall instalment to net income ratio for all credit-active South Africans was 28% in 2025 Q2," the report noted

"This means that between a quarter and a third of net income is spent on servicing debt. This burden is highest for the Heavy Hitters, with 48% of monthly income going to instalment," it added.

According to the report, Heavy Hitters, despite being a relatively small portion of the population, hold 65% of the country’s total outstanding debt, amounting to R1.7 trillion. The report also noted that home loans dominate this segment’s credit profile, with a balance of R1 trillion, up 1.1% quarter-on-quarter (QoQ).

South Africa’s top earners are said to be under growing financial pressure, with new data showing they spend nearly half of their income on debt repayments.

Image: Eighty20

"Total overdue balances on home loans rose to R11.8 billion, a 4.6% QoQ increase. This contributed to the 3.3% QoQ rise in total overdue balances for the segment.”

The report also highlighted growing debt pressure among middle-class workers, who spend 37% of their monthly income on debt repayments.

This group, comprising around 3.6 million people, took out 1.1 million in new loans during the quarter, a 12% increase, with the majority being unsecured credit.

"The Middle Class at 37%. The Mass Market pays 19% of their income towards debt, while Comfortable Retirees now spend 22% of monthly income on servicing debt, up from 20% in 2023".

Meanwhile, the Mass Market segment pays 19% of its income toward debt. This group saw around 340,000 new-to-credit individuals, who collectively took out over 400,000 loans, more than half of which were retail.

Comfortable Retirees, despite their age and smaller borrowing base, are now spending 22% of their income on debt repayments up from 20% a year ago.

IOL Business

mthobisi.nozulela@iol.co.za

Get your news on the go, click here to join the IOL News WhatsApp channel

Related Topics: