Debt review ruling may go to ConCourt

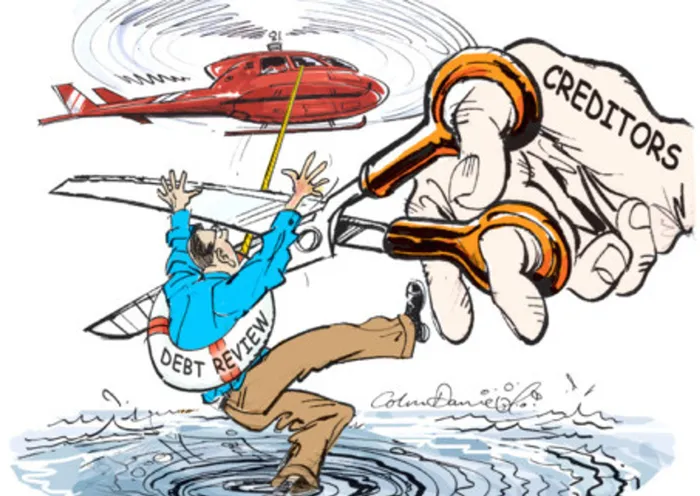

Illustration: Colin Daniel Illustration: Colin Daniel

The National Credit Regulator (NCR) is considering approaching the Constitutional Court because it says that a recent ruling by the Supreme Court of Appeal renders the debt counselling process null and void.

Advocate Jan Augustyn, the manager of investigations and enforcement at the NCR, says that, in the case of Sally Ann Collett versus First National Bank (FNB), the Supreme Court of Appeal ruled that credit providers can end the debt review process at any stage after 60 days have lapsed from the date on which the consumer applied for debt review and where the consumer is in default, irrespective of whether a debt counsellor has lodged the consumer’s application for a debt re-arrangement with a magistrate’s court.

Augustyn says the judgment brings an end to the conflicting judgments about exactly when credit providers can end the debt review process and take legal action against borrowers.

According to the ruling, a credit provider may end the debt review process only if you have defaulted on your repayments.

At the end of May, about 251 350 consumers had applied for debt review. Of these, 110 000 had started debt counselling.

According to the NCR, about 70 percent of consumers undergoing debt counselling make regular payments to their creditors.

The NCR had intervened as amicus curiae (a friend of the court) in the Supreme Court appeal case. It argued that credit providers cannot end a debt review if the consumer’s application for a debt re-arrangement has been lodged with a magistrate’s court.

The Supreme Court of Appeal further ruled that where a consumer is under debt review but is not in default in respect of his or her obligations towards a credit provider, credit providers do not have the right to end the debt review and take further legal action against the consumer in terms of the credit agreement – they must first await the hearing for a debt re-arrangement in a magistrate’s court.

The Supreme Court determined that the right of credit providers to end a debt review and enforce a credit agreement is balanced by the fact that, during proceedings to enforce the credit agreement, a consumer may request, in either the magistrates court or the High Court, a resumption of the debt review, and a debt judgment may not be granted. During such an application, the magistrate’s court or High Court will look at whether the creditor participated in good faith in the debt review proceedings. If it is found that this was not the case, the resumption of the debt review may be ordered.

“The effect of the Supreme Court judgment is that consumers currently under debt review and those who intend to apply to go under debt review are not afforded the necessary protection against further enforcement steps by their credit providers and may well be at risk of losing their properties,” Augustyn says.

“The NCR is of the understanding that Collett will shortly apply to the Constitutional Court to have her matter heard there. We believe that there are constitutional issues with this ruling, and the NCR will either join as amicus curiae or, if Collett does not take her case to the Constitutional Court, possibly as a party in that court,” he says.

Michael Jordaan, the chief executive of FNB, says the bank welcomes the ruling. However, FNB will terminate a debt review only after the bank has exhausted all other avenues to rehabilitate a loan, in compliance with the National Credit Act.

* The National Credit Regulator can help you with disputes that involve debt counselling.

Sharecall: 0860 627 627

Telephone: 011 554 2600

Fax: 011 554 2860

Post: PO Box 209, Halfway House, 1685

Email: info@ncr.org.za or complaints@ncr.org.za

Website: www.ncr.org.za