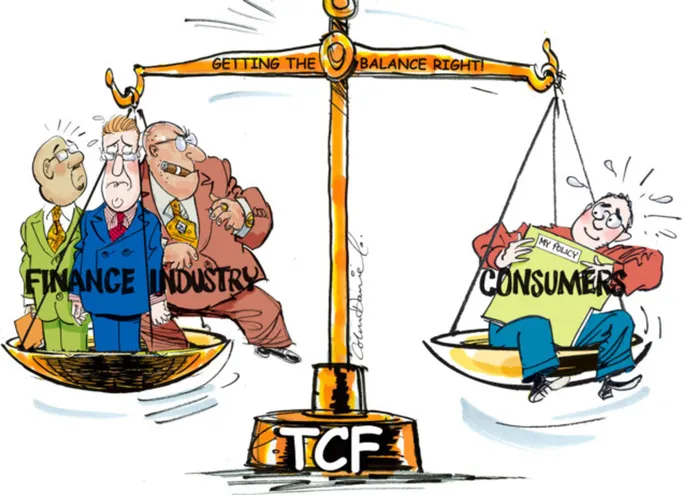

TCF to give customers more weight

Illustration: Colin Daniel Illustration: Colin Daniel

The Treating Customers Fairly (TCF) campaign, initiated by the Financial Services Board (FSB), seeks to improve the levels of fairness in the way financial services companies conduct their business with you, the client, Gerhardt Meyer, the executive head of advice and development solutions at acsis and chairman of the Financial Planning Institute of Southern Africa, says.

At his presentation for the acsis/Personal Finance Financial Planning Club, Meyer talked about TCF and what you need to look at to determine whether you are being treated fairly.

Meyer was elected to the TCF steering committee to represent the FPI shortly after the seminars.

Last year, the FSB published a proposal titled “Treating Customers Fairly”, which requires financial services companies to ensure that you are treated fairly at all stages of interaction, including the product development, marketing, advice, point-of-sale and after-sale stages. Once the legislation is in place, the FSB will be able to take action against companies that are found to be treating you unfairly.

TCF will complement other consumer protection legislation, including the Consumer Protection Act, the National Credit Act and the Protection of Personal Information Bill.

“Government has been quite firm that TCF is not a compliance project and should not be seen as a once-off event within a company,” Meyer says.

He says companies will, under the TCF regime, have to provide ongoing objective evidence that they are treating you fairly. This will require them to monitor an measure their performance in delivering the six fairness outcomes (listed under “How TCF should help you”, below).

“Companies are expected not only to have this information in place but must also show that they have analysed the information they have gathered to identify TCF risks and areas for improvement, and have acted upon these findings to enhance your customer experience,” Meyer says.

At the national Budget presentation earlier this year, Finance Minister Pravin Gordhan and the National Treasury released a document titled “A safer financial sector to serve South Africa better”. The treasury identified four key pillars to ensure that South Africa’s financial sector is safer for you: financial stability; consumer protection and market conduct; expanding access through financial inclusion; and combating financial crime.

“The thinking behind this document was, among other things, to strengthen South Africa’s financial sector to ensure that local insurers and banks do not collapse, as happened in the United States several years ago, and to ensure stronger market conduct regulation,” Meyer says.

“Government is working towards the legislative implementation of TCF by January 2014. A regulatory framework steering committee, which includes people from the financial services industry, is already operational and had its first meeting this month in Johannesburg,” Meyer says.

He says that until such time as TCF becomes a reality in our law, the question that remains is how we can measure the level of fairness in the treatment that we receive.

Fairness is defined by the Concise Oxford English Dictionary as “treating people equally – just or appropriate in the circumstances”. According to dictionary.com, fairness is “being free from bias, dishonesty or injustice”.

“But the question is, how do you, in the absence of TCF, measure whether your treatment has been fair or not?” Meyer says.

Financial advisers are currently governed by the Financial Advisory and Intermediary Services (FAIS) Act, which was introduced in 2004. The FAIS Act is mainly rules-based and sets out clearly how a financial planner should conduct himself or herself within the confines of those specific rules.

Meyer says he favours the more principle-based approach of TCF, with less of a focus on products. He highlighted an important principle in the current FAIS legislation – that “a provider must at all times render financial services honestly, fairly, with due skill, care and diligence, and in the interests of clients and the integrity of the financial services industry”.

Meyer says the late Charles Pillai, the former financial advice ombud, often quoted this principle in his determinations. “This principle serves as a test of whether the financial adviser did the right thing.

“TCF will hopefully go a long way to take the financial services industry regulation from being rules-based to principles-based,” he says.

How TCF should help you

Gerhardt Meyer from acsis says the six desired outcomes of TCF are:

* You must be confident that you are dealing with firms that put the fair treatment of customers at the centre of their culture;

* Financial products and services marketed and sold in the retail market must be designed to meet the needs of identified customer groups, which are targeted accordingly;

* You are given clear information and are kept appropriately informed before, during and after the contract has been signed;

* Where you receive financial advice, the advice is suitable and takes account of your circumstances;

* You are provided with financial products that perform as firms have led you to expect, and the associated service is both of an acceptable standard and what you have been led to expect;

* You do not face unreasonable barriers to changing products, switching providers, submitting claims and making complaints.

What you should look for in a financial adviser

Gerhardt Meyer says you should ascertain the following when you look for a financial adviser:

* Is your adviser a financial planner? A financial planner will analyse your financial needs before trying to sell you any financial products and will provide you with holistic advice based on your financial needs analysis. A product sale is not always necessary and financial planning may, under certain circumstances, exclude the sale of any products. A financial planner also regularly reviews your financial plan. Reviews should take place at least once a year to ensure that your financial plan takes into account any legislative changes such as a change to the threshold for capital gains tax. You should also review your financial plan when you undergo a major life change such as marriage, divorce or the birth of a child.

* Does your adviser have a professional designation? The Certified Financial Planner (CFP) designation, which is recognised internationally, is the highest designation for financial planners in South Africa and around the world. To achieve CFP status, a financial planner must not only obtain a post-graduate qualification in financial planning but must also join the Financial Planning Institute and agree to subscribe to its code of ethics.

* Does your adviser believe in doing the right thing? Note whether or not your adviser believes in what he or she says and takes pride in his or her job.

* Has your adviser kept up with affairs in the financial landscape? Your adviser needs to keep abreast of developments to give you advice that is relevant and up to date;

* Does your adviser take the regulatory environment seriously? Check whether or not your financial adviser is registered in terms of the Financial Advisory and Intermediary Services Act and whether or not he or she has the appropriate insurance indemnity cover. This cover protects your money in the event that something goes wrong.

Financial companies: where you stand

Gerhardt Meyer says there are several sets of legislative rules in South Africa that govern institutions that provide you with financial products.

For example, the policyholder protection rules under the Long Term and Short Term Insurance Acts set out guidelines to ensure to some degree that you are treated fairly when you buy life assurance or short-term insurance policies. And the Medical Schemes Act ensures scheme members are treated fairly – for example, open medical schemes are not allowed to deny you membership, although they can impose waiting periods and/or late-joiner penalties.

Meyer says some of the things you should look out for in a financial company are:

* Does the company have an in-house ombudsman? If it does, your complaints may be resolved quickly and efficiently without your having to take your case to an external ombud or adjudicator.

* Does the company voluntarily subscribe to industry codes? For example, does a life assurance company subscribe to the office of the Long Term Insurance Ombudsman? This is a good indicator of whether a company is committed to treating you fairly. Although companies that do not subscribe to a voluntary ombud automatically fall under the Financial Schemes Ombud and you do still have some protection, the company’s reasons for not belonging to a voluntary ombud scheme can be called |into question.

* Does the company use clear and simple language in documents sent to you? Make sure you understand what your financial contract says and clarify any issues you are not sure about with the product provider or your financial adviser.

* Management of conflicts of interest. Under the Financial Advisory and Intermediary Services Act, financial advisers cannot interact with investment companies in exchange for perverse incentives (such as holidays abroad). A company that treats you fairly will take the regulatory regime seriously and will not offer perverse incentives or be seen to be condoning such behaviour.