High-earners with RAs face dilemma

Illustration: Colin Daniel Illustration: Colin Daniel

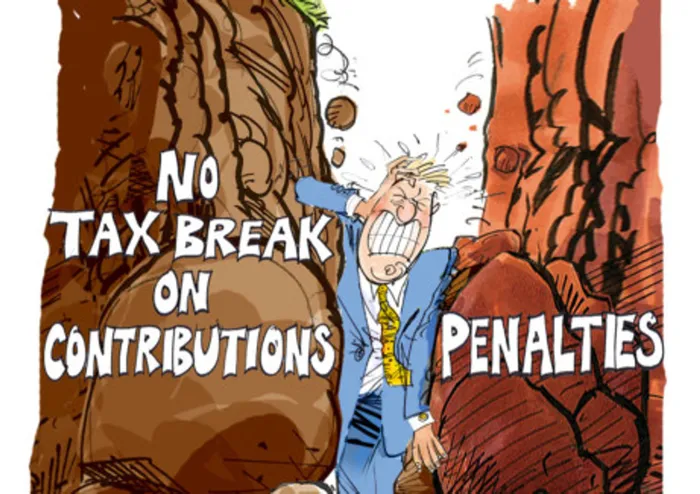

High-earning members of old-generation life assurance retirement annuities (RAs) who want their savings to be as tax-efficient as possible could face a nasty shock next year.

From March 1, there will be a limit on the annual amount you contribute to a retirement fund that you can claim as a tax deduction. However, if you reduce your contributions to an RA to stay within the limit, you could face a penalty for altering your RA contract.

Liberty and Sanlam have announced that they will waive or reduce penalties if contributions to old-generation RAs are reduced, but Old Mutual and Momentum say the penalties will apply despite the change in the law.

In terms of amendments to the Income Tax Act due to take effect next year, you will be able to deduct up to 27.5 percent of the higher of your remuneration or taxable income, to a maximum of R350 000 a year. The only people the limit affects are those earning more than R1.27 million a year.

A number of high-income earners may, as a result, find that they are contributing more than they can claim as a tax deduction and may want to reduce their RA contributions.

Over the term of an RA, a life company recovers from the contributions the expenses, mainly commissions, it incurred at the start of the policy. If you cancel the policy, or alter the amount of your monthly contribution before the policy term expires, the assurer will levy a penalty to recover these expenses.

Currently, you can claim a tax deduction on RA contributions of up to 15 percent of your non-pensionable income (this is income, such as commissions, bonuses and allowances, over and above your pensionable income, which is normally your base salary). You can claim a deduction on pension fund contributions of up to 7.5 percent of your pensionable income. There is no cap on the rand amount that qualifies for a deduction.

From March 1, the tax deduction of 27.5 percent and the R350 000 cap will apply to the contributions that you and your employer make to any retirement fund to which you belong, including an RA.

Rowan Burger, the managing executive of the large corporate segment of financial services company MMI, warns that taxpayers with old-generation life assurance RAs may find that, if they reduce their contributions to avoid exceeding the amount they can claim as a tax deduction, they will trigger “a causal event”, which will entitle the life company to impose a penalty.

The life assurers are adopting different approaches to the penalties in such a situation. Deon Booysen, Liberty’s head of actuarial control, says Liberty will not impose any penalties. Bernie Wessels, a product actuary at Sanlam Individual Life, says Sanlam is investigating RAs with large recurring contributions with a view to reducing the penalties on members who decrease their contributions to R350 000 a year.

But Phillip du Preez, MMI’s chief executive of legacy solutions, says MMI will not waive its “exit fees” on Momentum and Metropolitan RA contracts taken out before 2009.

Braam Naude, the head of Old Mutual income and guaranteed solutions, says Old Mutual will also apply the penalties.

Life companies are entitled to impose a penalty of up to 30 percent of your retirement savings on RAs sold before January 1, 2009, or up to 15 percent, decreasing annually on a sliding scale, on RAs sold after January 1, 2009.

The penalties apply only to traditional life assurance RAs. If you have a unit trust fund RA or a linked-investment services provider RA, you can increase or decrease, or stop paying, your contributions without incurring a penalty.

You can still contribute more than R350 000 a year, but the excess contributions will not qualify for a tax deduction. However, these contributions will earn tax-free investment returns in the fund.

In addition, the excess contributions roll over for tax purposes. So if you contribute less than R350 000 in a particular year, you will be able to claim excess contributions made previously. Or, when you retire, you will be able to add all excess contributions to your tax-free lump sum.

But note that there is a tax disadvantage for excess contributions if you die before your retirement date. Jenny Gordon, the head of legal advice for Alexander Forbes’s retail division, says that this year’s Taxation Laws Amendment Bill, which has been passed by Parliament, provides that, from March 1 this year, contributions to a retirement fund that do not qualify for a tax deduction will be included, for estate duty purposes, in your estate if you die on or after January 1 next year.

Burger says that, before you reduce your contributions, you should consult your financial adviser and take the following into account:

* The potential impact on your retirement plan if you reduce the contributions.

* Whether it may be feasible putting the excess contributions in a tax-free savings account.

* Whether you may be better off making excess contributions to your RA and earning tax-free investment growth, and adding the excess contributions to the lump sum you can take tax-free at retirement. If you face being hit by a penalty, it may be less expensive to make non-tax-deductible contributions than to reduce your contributions.

Burger says he hopes that advisers who earned upfront commissions when they sold the affected products will advise their clients how best to structure their savings arrangements in a tax-efficient way.

“Advisers should not only consider the tax position, but also the client’s overall retirement and savings goals,” he says.

You cannot mature an RA before the age of 55, and when you do, you may withdraw one-third as cash. You must use the balance to buy a pension.

‘ASSURERS SHOULD REMEMBER TCF’

The fact that the Long Term Insurance Act allows life assurance companies to charge “termination fees” if you reduce or stop paying your contributions to a retirement annuity (RA) does not mean they have to impose the fees.

Jonathan Dixon, the deputy executive for insurance at the Financial Services Board, says life companies should keep the principles of Treating Customers Fairly (TCF) in mind when deciding whether it is appropriate to apply penalties.

Dixon says the principles of TCF should apply, in particular, where the contribution changes are influenced by factors beyond the policyholder’s control.

OLD MUTUAL REPLACES PENALTY WITH LOYALTY BONUS

From the end of this year, Old Mutual plans to stop selling recurring-contribution retirement annuities (RAs) where you incur a penalty if you reduce or stop paying your contributions.

The Max Focussed RA, which uses the old penalty system, will be closed to new business at the end of the year.

Its new-generation Max Investments Optimal RA, Old Mutual will, however, penalise you indirectly by fully or partially withdrawing an “investment booster”, which is added to your savings only if you stay invested in the RA for five years, and for each month after that.

Old Mutual says there is no change in the cost structure of the new product, which was launched at the beginning of this year. You will also be liable for a R300 administration fee if you alter your contribution amount.

Cobus Rothman, an investment actuary at Old Mutual, concedes that the “investment booster” is a loyalty bonus.

National Treasury has proposed that products with loyalty bonuses should not be used as default investment options for retirement funds.

Rothman says the “investment booster”, which aims to encourage customers to keep contributing, was launched before National Treasury published its proposals on default investment options.

“When the final regulations for retirement reform have been finalised, we will ensure that all our products are fully compliant with all applicable regulations,” Rothman says.