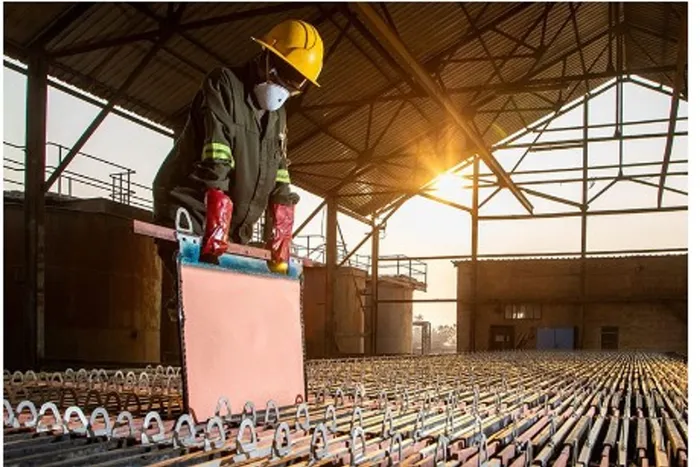

Jubilee Metals, a diversified metals producer with operations in South Africa and Zambia, has received a conditional binding offer from a private mining and metals trading company to acquire the group’s chrome and platinum group metals operations in South Africa

Image: Supplied

Jubilee Metals, a diversified metals producer with operations in South Africa and Zambia, has received a conditional binding offer from a private mining and metals trading company to acquire the group’s chrome and platinum group metals (PGM) operations in South Africa for a consideration of up to $90 million (R1.6 billion).

The shares leapt 4.17% to R1.00 on Thursday morning on the JSE as investors welcomed the news.

The offer allows Jubilee to sharpen its focus on expanding its copper strategy in Zambia while retaining exposure to the PGM market through its Tjate Platinum mining project.

Under the terms of the offer, Jubilee will retain all current rights to the Tjate Platinum mining project offering Jubilee continued exposure to the potential upside of the PGM market, while focusing to further advance the Company’s copper strategy in Zambia.

The total consideration of up to $90m is payable through a combination of cash upfront and deferred cash payments over an approximate three year period.

Jubilee’s board has reviewed the offer and recognises its compelling value proposition. The company is also evaluating its dividend policy to potentially enable future distributions to shareholders. A detailed shareholder circular outlining the transaction will be issued soon.

Absa Corporate and Investment Bank, a division of Absa Bank Limited, has been appointed as the financial advisor for the transaction.

Strategic Focus on Copper in Zambia

The disposal of the chrome and PGM operations allows Jubilee to prioritise its Zambian operations, where the company sees significant growth potential. Strong copper markets support higher earnings potential resulting in higher margins than that of chrome.

It said, "With the anticipated continuing expansion of the world’s growth in electrification generally, renewable power and automotive applications, demand for copper is expected to remain high. Jubilee has demonstrated its ability to successfully recover copper from shallow, transitional reefs.

Recent trials confirm the Roan concentrator’s capability to maintain a ROM feedstock run rate of between 35 000 to 40 000 tonnes per month (tpm) on the transitional reefs equating to 240 (at 35 000 tpm throughput and min Cu grade) to 360tpm of Cu units (at 40 000tpm and targeted Cu grade," Jubilee said.

Jubilee recently continued to expand its near surface mining portfolio with the execution of two further agreements offering the exclusive right to perform its due diligence on these properties with the option to purchase the rights pending the outcome of the due diligence.

Zambia holds additional potential opportunities which Jubilee seeks to secure. Jubilee’s in country operational presence and processing know-how, positions Jubilee well to pursue these opportunities.

Leon Coetzer, the CEO of Jubilee, said, "The Board has reviewed the terms of the offer and feel it is an opportune time to accept a fair value offer for the chrome and PGM operations at a time when the two segments of the company are on markedly divergent paths.

"After years of effort and investment, the South African business has reached a stage of maturity that would require a large capital outlay to achieve any step change in production going forward. On the other hand, in Zambia, the potential capital returns and earnings growth offered from our exciting suite of assets could not be more evident. Execution of Jubilee’s copper strategy has gained significant traction with Roan now fully operational and the near surface mining opportunities, such as Munkoyo and Project G, which offer significant growth opportunities."

Coetzer said the staggered nature of the proposed acquisition consideration, along with funds from the expected sales of non-core assets in Zambia, and project specific funding discussions, align with the group's future capital growth plans in the country.’

BUSINESS REPORT