Given the rising cost of coffee globally, the July decrease in prices in SA maybe short lived

AGRICULUTURE

Following these events related to Brazil's coffee industry, arabica production is projected to decline by 18.4% year-on-year to 36.5 million bags in 2025, as the harvest is nearing completion in Brazil

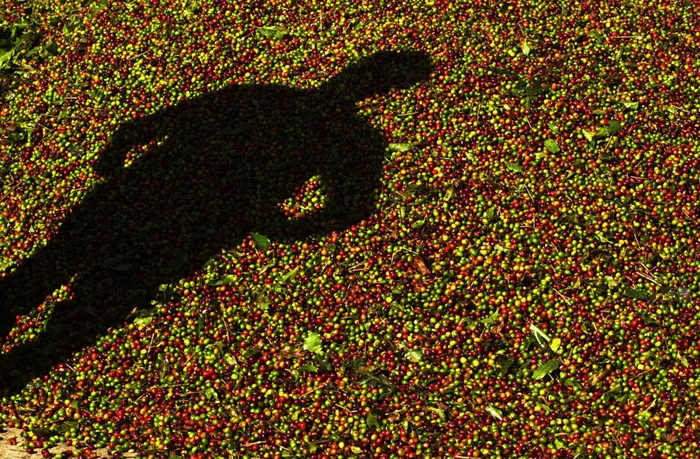

Image: AP File Photo/Dado Galdieri

By Thabile Nkunjana

Many, like myself, thought that more coffee would be available for importing countries globally when the United States put 50% tariffs on Brazil, the world's largest producer and exporter of coffee. In fact, this seemed to be happening in South Africa, where domestic coffee costs are totally reliant on international pricing. In August, Statistics South Africa issued the July consumer price index (CPI) data, which showed a fall in coffee prices.

Instant coffee prices dropped somewhat from June to July, according to Stats SA statistics, bringing the yearly rate down to its lowest point since January 2024. For the second consecutive month, cappuccino sachet prices dropped. However, new data from Brazil, international coffee groups like International Coffee Organization (ICO), and other sources indicates that coffee prices are rising quickly once more due to a number of factors.

First, the coffee that Brazil would typically send to the US is now going to the Chinese market since several coffee exporters that were formerly exporting to the US have inked agreements with China. Additionally, it is reported that the EU, particularly Germany, is purchasing significant amounts of coffee from Brazil. This could result in Brazil's coffee ending up in the United States as Germany re-exports and is currently subject to lower tariffs compared to Brazil.

Second, Brazil, the world's largest coffee exporter and South Africa's top coffee supplier, recently announced a 20% drop in unroasted coffee and 28% drop in green coffee shipments owing to tighter supplies due to unfavorable weather early August. This implies that there would have been a shortage of coffee supplies regardless of the US's tariffs on Brazilian coffee.

Third, there are reports that there is virtually no coffee in central America since US importers are primarily responsible for filling the void created by Brazilian exporters sending their coffee elsewhere due to tariffs imposed on its top coffee supplier, Brazil. The United States was classified as one of the countries that imports the most coffee globally in 2024. Consequently, coffee enthusiasts in the United States are likely to experience price pressure.

As traders booked profits after a nine-day rise that peaked at $3.92 on August 25, arabica coffee futures increased from $2.80 on average in July globally to about $3.82 per pound, according to the trade economics data. A sustained drop in certified stockpiles contributed to the recent spike, which came as US roasters are frantically looking for alternatives after a 50% duty on Brazilian coffee exports was imposed, as was previously noted.

Drought, erratic rainfall, and cold blasts are among the difficult weather conditions that continue to jeopardize crop output in Brazil's coffee-growing regions. According to reports, local production has decreased by 5% to 10%. Producers are pointing out that regular rainfall in September is essential to boosting the prospects for the arabica crop the next year.

Following these events related to Brazil's coffee industry, arabica production is projected to decline by 18.4% year-on-year to 36.5 million bags in 2025, as the harvest is nearing completion in Brazil. One may also argue that there is a global panic buying of coffee, which often causes prices to skyrocket.

As a result of the factors we believed would influence coffee costs in South Africa, there is little likelihood that coffee drinkers there will experience a drop in pricing very soon. All these elements have price implications.

Above all, the global increase in coffee prices will inevitably have a detrimental effect on local prices, therefore price rises from your favorite breweries are most likely imminent. Whether its decreased output due to drought or trade concerns, coffee aficionados like myself must realize that high coffee prices will continue until supply and demand are balanced in the market.

Mr Thabile Nkunjana is a senior economist under the Trade Research Unit at the National Agricultural Marketing Council

Image: LinkedIn

* Thabile Nkunjana is a senior economist under the Trade Research Unit at the National Agricultural Marketing Council.

** He writes on his personal capacity, and does not, necessarily express of IOL or Independent Media.

BUSINESS REPORT