Jubilee Metals Group reports 65% increase in copper production in first quarter

Mining

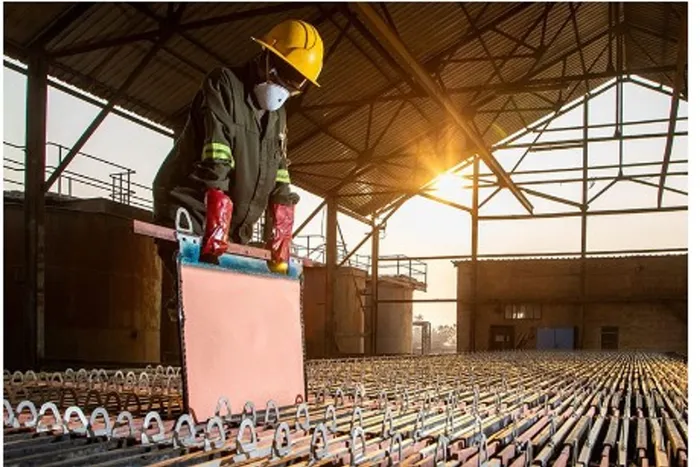

Jubilee's modular concentrator for copper production. Jubilee's CEO Leon Coetzer said the past 12 months had been significant for them as the company became a pure Zambia focused copper producer.

Image: Supp[lied

Jubilee Metals Group, the London and JSE listed mining group, increased copper production by 65% in the first quarter of its financial year to September 30, with no material power outages affecting operations.

The Zambia-focused copper producer said in an operational update on Friday that production was made up largely of copper concentrate produced by Roan for refining at Sable, prior to the commencement of high-grade copper (Cu) ore deliveries from the Molefe mine to Sable during September 2025.

Leon Coetzer, Jubilee's CEO, said it had been a significant 12 months as the company had become a pure Zambia-focused copper producer. Jubilee’s share price fell 2.5% to 65 cents on Friday, a price already well down from R1.13 a year before.

“I am pleased to report positive progress in the first quarter, where we have successfully improved our copper production versus the previous year's comparable period. We have seen firsthand the benefits of our power supply agreement, resulting in no material power outages affecting our operations,” he said in the trading update.

Key growth drivers included that the Roan facility had reached stable production. The Molefe Mine had also commenced operations with the delivery of high-grade ore to the Sable refinery.

Targeted growth deliverables in the second quarter included that Molefe mine increase delivery of high-grade Cu ore from 3 500t per month achieved in October 2025 to 4 500t per month in November 2025.

Targeted growth deliverables for the end of the third quarter included that Molefe mine further increase its high-grade Cu ore deliveries to reach 8 500t per month.

Roan was set to increase copper concentrate deliveries to Sable refinery on the back of a 30% expansion of the filtering capacity to incorporate the fine copper concentrates stockpiled on site, at an approximate rate of 65tpm of copper contained in concentrates.

Targets for the end of the fourth quarter included full quarter operation at Molefe at a capacity of 8 500t per month. The Roan concentrator would target an increased throughput of 40 000t per month from 30 000t per month currently.

Roan’s production for the first quarter increased by 65.5% to 917t. Power supply agreements delivered consistently throughout the period with no material power outages for the quarter allowing Roan to operate more stably.

Molefe mine operations recommenced operations on schedule with high-grade Cu ore deliveries to Sable during September 2025 following the successfully expanded Pit 2.

Post the first quarter, Molefe mine reached its targeted 3 500t per month of high-grade Cu ore on grade delivered to Sable within guidance in October 2025. A targeted joint venture with a potential partner to undertake the resource drilling and review of the Molefe mine, and wider district, was expected to conclude this month.

An independent resource review of the near 240 million ton Large Waste Project was progressing on target, with further infill drilling expected to commence in the third quarter as part of the development of the ore reclamation plan..

The revised copper unit production guidance for the full 2026 financial year is expected to be within the range of 4 500t to 5 100t, depending on the extent of the impact on production during the rainy season (2025 production: 2 211t).

“With both Roan and Sable processing plants now fully operational, and the Molefe open-pit copper mine expanding successfully, our copper business is stabilising ahead of a new phase of growth,” said Coetzer.

He said Jubilee still possesses the optionality to increase throughput through both increased processing of historical tailings material and the introduction of the new Roan front-end, although these will only be considered after the rainy season.

“The focus for the remainder of the 2026 year remains firmly on driving our copper strategy via our Three-Pillar Strategy and ensuring stability in the operations, including key items such as feed rate, yields, and cost control for our operations,” he said.