Invicta Holdings reported stead resilient trading results for the six months to September 30, 2025, with headline earnings per share up by 19% to 285 cents in the six months.

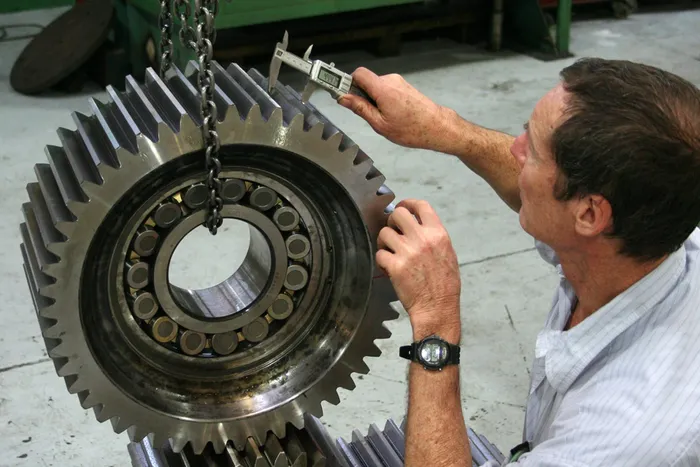

Image: Supplied

Invicta Holdings’ geographic diversification strategy and other initiatives to streamline the business and bed down investments paid off in the six months to September 30, despite the challenges facing South Africa’s industrial sector.

The JSE-listed holding company that distributes engineering components, capital equipment, and related technical services across South Africa, Africa, Europe, and Asia, increased sustainable headline earnings a share by 19% to 285 cents in this period. Cash on hand stood at R931 million.

The group acquired Spaldings in the UK, a distributor of agricultural and ground care components, on September 1, 2025, for about R250m. Invicta also repurchased and cancelled 3.1 million ordinary shares. On May 1, 2025, associate Kian Ann acquired 100% of US-Texas based Safe Harbor – a premium aftermarket parts supplier for various capital equipment.

“We are pleased with our cash generation. The business continues to demonstrate strength in its geographical diversification strategy and initiatives that have supported resilient operations, and delivered value despite challenging trading conditions,” said CEO Stephen Joffe.

He said during the first half, the focus had been on streamlining operations, solidifying investments, and keeping abreast of tariffs and foreign exchange fluctuations.

Revenue increased by 6% to R4.24 billion, with South African operations contributing R3.43bn, the rest of Africa contributing R410m, Europe contributing R404m, and the balance of R2m from other territories.

Extreme volatility in currencies was experienced. Despite declines in mining and manufacturing, Invicta experienced improved activity levels in the local market, which remained at these better levels, said Joffe.

South Africa’s industrial sector, however, remained a challenging environment, with the regulatory landscape doing little to stimulate growth, he said. Supply chain challenges persisted, including port delays. Container prices out of China remained volatile, oscillating between $2 500 and $4 200 for 40ft containers.

"However, we have seen positive movements in the automotive sector in South Africa, and agricultural house brands are expected to grow locally. With the sustained tensions in Eastern Europe, Invicta continually seeks to expand the auto-agri business westward into other European geographies,” Joffe explained.

Replacement Parts for Industrial Equipment (RPI) revenue decreased marginally from R2.46bn to R2.45bn. Operating profit before finance and foreign exchange decreased by 9% to R178m, primarily due to a 6% increase in operating costs.

Replacement Parts for Auto and Agri (RPA) revenue increased by 1% to R420m, primarily due to a 7% rise in local revenue. Offshore revenue fell 2% and contributed 62% of segment revenue.

Plans to leverage group synergies in Poland and the UK were underway. RPA’s operating profit before finance and foreign exchange remained flat at R46m.

In the Capital Equipment and Related Services (CE) segment, there was positive sentiment in the mining sector, albeit from a low base, as there remained a long way to go to return to continuous production levels.

“We are positive that we have come to a more stabilised position in terms of tariffs globally and hope that this will provide the impetus for a global sales improvement,” Joffe stated.

Revenue in CE increased by 25% to R764m, primarily due to growth in the capital equipment market, led by a recovery in the South African mining sector. Operating profit before finance and foreign exchange increased by 36% to R57m, primarily due to the sales increase.

In Replacement Parts and Earthmoving Equipment (RPE), revenue increased by 25% to R366m, bolstered by the acquisition of Spaldings, which contributed 20% of revenue. The operating profit increased by 6% to R75m, with Spaldings contributing 5% thereof.

Kian Ann Group (KAG) contributed R69m to group earnings, compared to R79m in the prior period. The US tariffs, the stabilisation of operations following the relocation of the warehouse from Singapore to China, and currency movements impacted these results.

“Given the uncertainty in the world, we will continue to prioritise cash generation. Having a relatively debt-free business gives us the necessary time to respond to difficult situations and provides the capacity for us to implement our acquisition strategy,” Joffe said.

Invicta’s share price was steady at R38 on the JSE on Monday afternoon.

BUSINESS REPORT