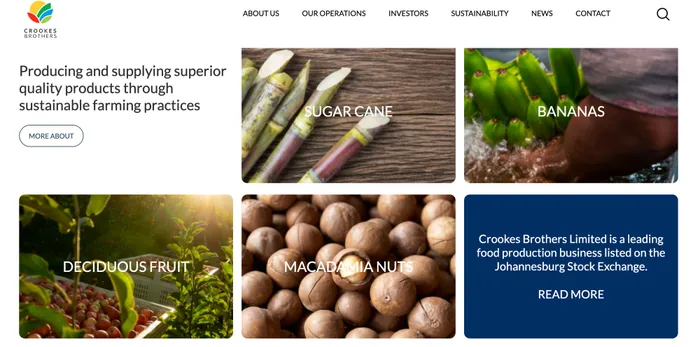

Crookes Brothers' profit slips amid lower crop prices and weather challenges

Agriculture

Crookes Brothers earnings declined in the six months to September 30 primarily due to softer than expected commodity prices across all crops farmed by the group. Extreme weather events further impacted volumes and yields, particularly in the banana and macadamia segments.

Image: Supplied

Crookes Brothers's revenue fell 5% to R492.2 million in the six months to September 30, 2023, while profit fell by 52% to R29.28m mainly due to lower prices for the group's crops.

"Earnings declined primarily due to softer than expected commodity prices across all crops farmed by the group. Extreme weather events further impacted volumes and yields, particularly in the banana and macadamia segments," directors of the JSE-listed group said Friday.

Revenue consequently decreased by 5% to R492.2m. The fair value of biological assets decreased by R81.6m (R68.8m), mainly due to the year-end standing crop of sugar cane and macadamias being harvested and sold at substantially lower prices during the period.

Operating profit after biological assets decreased by 51% to R46.7m. Finance costs reduced to R19.5m (R20.8m), with net interest on bank borrowings decreasing to R7.3m (R7.5m).Headline earnings a share is 44% lower at 126.9 cents (225.5 cents). No interim dividend was declared.

Revenue from sugar cane increased by 1% to R393.6m, driven mainly by a strong performance from the Zambian operation, which benefited from record sugar prices. Irrigation expenses were higher as the Lowveld operations received less rainfall. Combined with above-inflation electricity price increases, overall agricultural costs rose. As a result, operating profit fell by 9% to R116.8m.

Revenue from bananas decreased by 29% to R62.1m. Volumes and bunch masses at Mawecro farm were significantly lower. The October 2022 storm adversely affected plant growth and extended cycle times. The farm was further impacted by a severe hailstorm in late September 2023, resulting in the loss of more than 40 000 plants.

The storm damage was also expected to negatively affect fruit quality, leading to reduced market sales. Carton prices for this interim period were lower due to an oversupplied market. Operating profit decreased to R7.9m from R27.1m.

Revenue from macadamias fell 23% to R20.7m. Volume and quality were lower, with final saleable tons reducing to 700 tons (1,040 tons). A tornado-like storm had a devastating impact on yields. Average prices per ton were slightly lower, due to quality issues from the storm damage to infrastructure and orchards. These lower average prices also resulted in a greater reversal of biological assets on harvested crops and sales, relative to the valuation at March 31, 2025. The operating loss increased by 48% to R39.4m.

Revenue from the property segment fell by 45% to R2.5m. At the Renishaw Hills division, residential sales were lower as the remaining Phase 6 units were sold out. Construction of Phase 7 had commenced. At the Renishaw Coastal Precinct, negotiations were progressing, however no land sales were concluded in the period. The operating loss increased by 45% to R7.2m.

Revenue from "other operations" increased by 56% to R13.2m. Beans sales at the Mawecro farm contributed strongly. Expenses at the Crocworld tourist division were slightly higher with efforts to revitalise it and align it with the Renishaw Coastal Precinct plans. The operating loss improved to R1.9m from the R4.7m operating loss at the same time last year.

"Overall, while certain macroeconomic and market pressures persist, the group remains disciplined, operationally focused, and committed to unlocking value across all segments. Positive structural initiatives are already underway, including the Nicoskamp conversion, operational improvements in Mozambique, and continued progress at Renishaw, which provide a solid foundation for longer-term growth," the directors said.

Visit:www.businessreport.co.za