Data from Lightstone shows that during the year to November 2025, national house price inflation (HPI) averaged 3.2%, with regional growth ranging from 7.4% in the Western Cape to +.5% in KwaZulu-Natal and 1.9% in Gauteng. “Together, these indicators point to a market steadily regaining momentum, with improving buyer confidence and more broad-based regional activity shaping a cautiously optimistic outlook for 2026,

Image: Ooba

South Africa's house price sales growth this year is likely to feature a story of green shoots and more of the two-speed trend, but there is reason to be cautiously optimistic, said Renier Kriek, MD of home loan provider Sentinel Homes.

"While we likely won't have a property boom, we're seeing encouraging signs of recovery. The year will likely see a continuation of the two-speed market we have experienced in SA for the past decade or so, with coastal areas and semigration destinations showing robustness, while house markets lag in inland areas and localities with perceived poor service delivery," he said.

Rhys Dyer, the CEO of Ooba Group, a home loan origination and mortgage group, said trends such as a return to offices, which is boosting some suburban house markets, may signal a meaningful evolution in South Africa's homebuying landscape.

Data from Lightstone showed that in the past year, national house price inflation (HPI) averaged 3.2%, with regional growth ranging from 7.4% in the Western Cape to 2.5% in KwaZulu-Natal and 1.9% in Gauteng.

Image: Karen Sandison | Independent Newspapers

"With earning potential steadily rising, buying confidence strengthening and stronger lending conditions remaining, the outlook for the property market in 2026 is positive," said Dyer. However, a real upswing in the market will require broader employment and vastly improved service delivery, said Kriek.

Data from Lightstone showed that in the past year, national house price inflation (HPI) averaged 3.2%, with regional growth ranging from 7.4% in the Western Cape to 2.5% in KwaZulu-Natal and 1.9% in Gauteng.

Lightstone data shows that between January and October of the previous year, residential property transaction values rose 12.5% year-on-year to R276 billion, while the number of sales were largely unchanged. There were fewer first-time buyers, with these making up 37% of all transactions, down from 40% in the same period a year previously, and they paid significantly less, on average, at R1.05m versus R1.9m in the same period before.

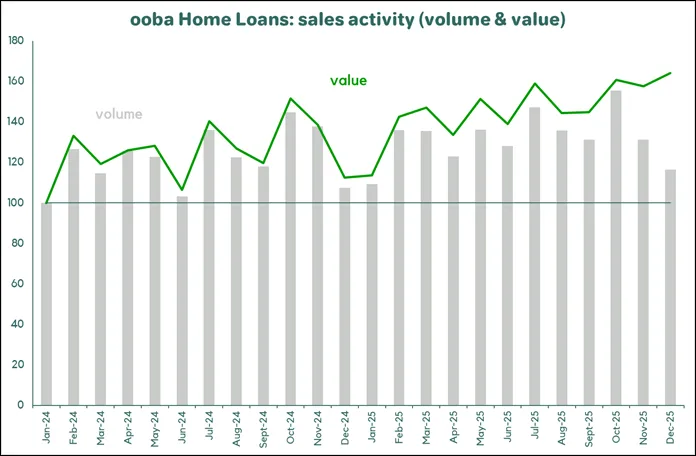

Ooba Home Loans reported that applications by first-time homebuyers amounted to 46.3% in the fourth quarter of last year, up from 43.3% in mid-year. Year-on-year growth in application volumes came to 9%, with a 17% surge in value.

Positive factors for the market this year include that government reforms are starting to bear fruit and business and consumer confidence in the economy is improving. In addition, the SA Reserve Bank had reduced interest rates by a cumulative 1.50% since September last year, and two further cuts were predicted this year, further benefiting the property market, Kriek said.

However, banks may need to increase the minimum capital they hold in terms of the Prudential Authority's implementation of the "output floor" requirement of Basel 4 (global banking regulatory reforms). "This will impact the cost of funding for banks, and therefore the rates that they can charge on, for instance, home loans," said Kriek.

This regulatory change might prove a significant headwind for the property market in the near term. In addition, GDP growth and economic expectations were still muted, even if more positive than before, he said.

"As rates ease, don't expect to see major price spikes; it's initially going to be better conversion and affordability, and higher transaction volumes, followed by gradual price firming," said Kriek.

Increased competition between home loan providers would likely mean higher approval rates, while growth would be concentrated in areas where services, lifestyle and stock availability meet demand.

Dyer said that in 2026, activity in more affordable metros would increase, given the long period of slow or negative price growth, accelerating activity in regions such as Gauteng and KwaZulu-Natal. Demand for eco-sustainable houses was increasing.

"Data shows that demand from high-net-worth buyers to secure estates and established suburbs in Johannesburg is growing, while coastal developments in Durban are attracting both local and international investors," said Dyer. He said coastal and lifestyle property prices were likely to stay relatively high, while inland markets likely to be driven by value for money.

Kriek said stock constraints remain significant. As a result of perceived low affordability and stock, there had been calls from some for demand-side measures, like rent control or regulation of short-term letting and Airbnb.These cries would likely have some success in 2026, he said.

BUSINESS REPORT