"We've had to build a dam just to ensure we have water security," says Toyota SA Motors

Toyota South Africa Motors (TSAM) President and CEO, Andrew Kirby, speaking at TSAM’s 9th State of the Motor Industry address on Thursday.

Image: Thami Masemola/X

Toyota South Africa Motors (TSAM) President and CEO, Andrew Kirby, has laid bare the mounting cost and infrastructure pressures facing the automotive manufacturer, revealing that the company was compelled to build its own dam to secure water supply and protect production at its Prospecton plant in KwaZulu-Natal.

Speaking candidly about the prevailing operating environment, Kirby on Thursday said while load shedding has eased significantly, other structural costs have continued to escalate, eroding South Africa’s competitiveness as a manufacturing hub.

"We do have challenges. Over the last few years, we've seen a lot of input costs for manufacturing increase. This is not just particular to the auto sector but for many of the industrial sectors. And we need to be fairly aware, not complain, but this is this is the facts," Kirby said.

"Energy costs have gone up. We've made big progress with load shedding, but what we have seen is significant increases in energy costs."

Kirby also noted that labour costs have also climbed at rates above inflation, narrowing what was once a substantial cost advantage over Asian manufacturing markets.

"We used to have a significant competitive advantage to some of the other, especially Asian markets. That's dissipated," he said.

However, one of the most striking examples of infrastructure strain has been water security.

“At our plant in Toyota, we’ve had to build a dam just to ensure we have water security and don’t lose any production efficiencies or continuity,” Kirby said. “And that is a serious concern for us.”

The investment underscores the extent to which manufacturers are being forced to shoulder the burden of infrastructure shortcomings, particularly as a result of municipal inefficiencies, to safeguard operations.

For an automotive plant that relies heavily on stable water supply for production processes such as painting and assembly, interruptions can result in costly downtime and supply chain disruptions.

Beyond water and energy, Kirby said logistics remains another major hurdle, particularly rail inefficiencies.

"We've seen very good improvement from port operations but it's going to take a little time before we see rail cost start to come down and those efficiencies help," Kirby said.

"We transport a lot of high-value goods, both parts, components, service parts, and vehicles, inside the country, in Africa and exporting, so logistics becomes a really key competitive element for us."

Despite these challenges, Kirby emphasised that TSMA was not “complaining” but rather stating the realities facing the sector. He argued that the focus must now shift to strengthening South Africa’s automotive competitiveness and outlined three key priorities.

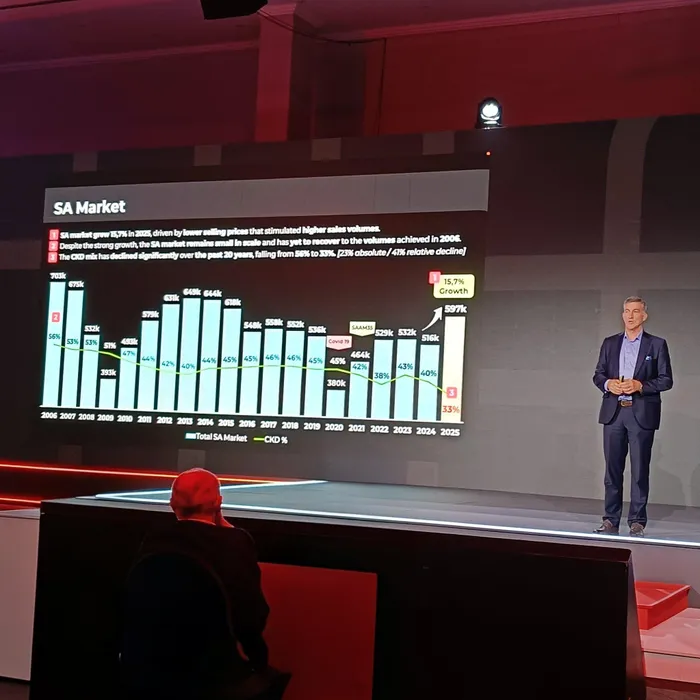

First, Kirby called for improving the competitiveness of completely knocked down (CKD) manufacturing in South Africa.

While the country’s automotive development policies have historically been “foresighted and well thought through,” Kirby said the global landscape has changed and policy must adapt.

He said between 40% and 50% of vehicles sold locally should be manufactured in South Africa to maintain a healthy balance between imports and local production.

“Frankly the country can’t afford to become just an import replacement market,” Kirby said, warning of the significant foreign-exchange impact of excessive imports.

Second, Kirby called for faster transition to new energy vehicles (NEVs), supported by smart and fiscally responsible government interventions. With production volumes still relatively low, he said targeted support is needed both for manufacturers and consumers, as price premiums remain high.

Third, he cautioned that South Africa must carefully manage its export markets, particularly as competition intensifies in Europe and the UK.

BUSINESS REPORT