Toyota South Africa Motors (TSAM) President and CEO, Andrew Kirby, speaking at TSAM’s 9th State of the Motor Industry address on Thursday.

Image: Thami Masemola/X

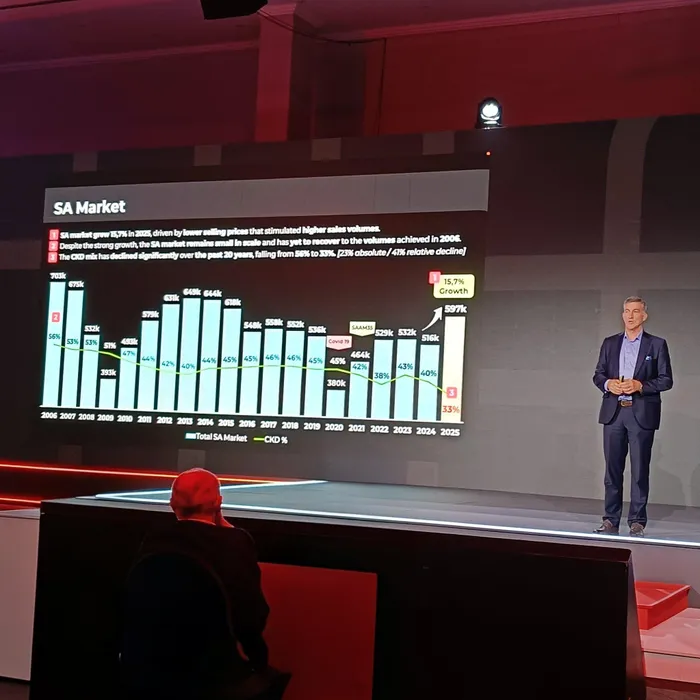

The challenge facing South Africa’s automotive sector is no longer simply about recovery or resilience, but it is about the scale of the market.

That was the central message from Toyota South Africa Motors (TSAM) President and CEO, Andrew Kirby, as he addressed industry stakeholders at the State of the Motor Industry on Thursday, where he delivered a stark assessment of the country’s manufacturing trajectory.

While South Africa's new vehicle market showed encouraging growth last year and finally recovering above 2019 pre-pandemic levels, Kirby cautioned that the underlying structure of the industry is becoming increasingly fragile.

Kirby argued that a domestic market of roughly 600,000 units remains too small to sustainably support a competitive manufacturing base.

"While it's not as high as 2006 and 2007, and certainly not where they were from 2012 to 2016, so it's a fairly pedestrian market. Six hundred thousand is a nice improvement, but it's small," Kirby said.

"We really lack a scale in South Africa and we consider our population size - if we consider the mobility needs, if we consider the quality of our public transport - we should be a lot bigger than this."

Kirby framed his concern not as short-term pessimism, but as a structural reality.

He said only 33% of vehicles sold in South Africa last year were manufactured locally — a steep decline from levels exceeding 50% in earlier decades. The gradient of that decline, Kirby warned, suggests the mix could deteriorate further in 2026 if left unaddressed.

For Kirby, scale underpins the entire manufacturing ecosystem, from supplier networks to investment decisions.

Without sufficient domestic volumes, he said manufacturers struggle to justify localisation of components, which in turn erodes competitiveness in export markets.

"We need a healthy domestic market and a diversified export market. We cannot rely on one market and assume volumes will remain the same," he said.

Kirby explained that South Africa’s production base has grown increasingly dependent on exports, with nearly 70% of locally manufactured vehicles shipped abroad.

"Only 33% of all our vehicles sold in South Africa were locally manufactured," Kirby said. "We're now at a point though where 68% of all the vehicles manufactured in South Africa are exported and only 198,000 are sold in South Africa."

Yet, he said those exports are heavily concentrated in the United Kingdom and European Union, markets that are currently undergoing rapid regulatory shifts tied to emissions and new energy vehicle mandates.

Kirby warned that regulatory changes in those regions could significantly reduce South Africa’s export volumes within the next five years, placing further pressure on an already constrained domestic market.

"We need a healthy domestic market. We need a diversified export market in order for us to sustain and grow our production base in South Africa. We cannot simply say that's fine, we won't sell anything in South Africa. We'll just import and we'll export everything to Europe,"" Kirby said.

"The UK has a zero emission vehicle mandate where you have to sell a certain number or ratio of zero emission vehicles every yea. That becomes more and more stringent in Europe. They have an average emission ratio, and if you don't achieve that you get penalized."

Scale, in this context, becomes a matter of industrial survival.

Kirby suggested that South Africa should aim for locally produced vehicles to account for roughly 40% to 50% of domestic sales, a level that would help rebuild the scale necessary to sustain jobs, supplier investments, and industrial capability.

Encouragingly, Kirby expressed confidence that the market has room to grow.

"I'm very confident that the South African market should and could exceed 700,000 vehicles sales. I'm very confident that the South African production could and should exceed 720,000 production," Kirby said.

"If we made the right small changes in the right way, creating the right investor confidence, we have the potential to increase vehicles sold to the domestic market by 20%, vehicles exported by 20%, and that would generate R21 billion in manufacturing value addition to the South African economy and generate 14 500 direct jobs."

BUSINESS REPORT