SA Reserve Bank cuts interest rates: What it means for consumers

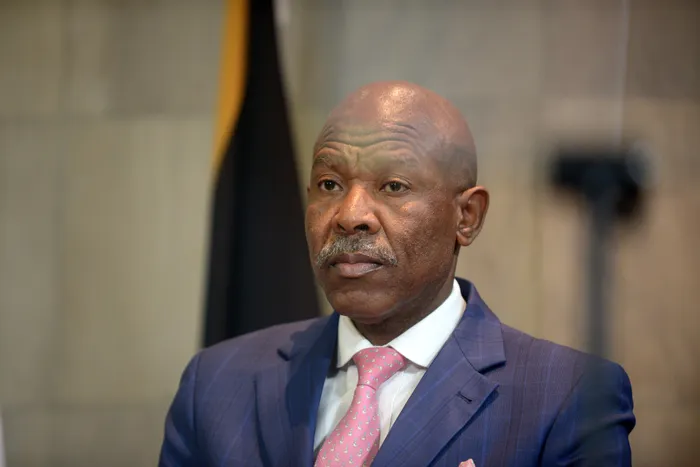

South African Reserve Bank Governor Lesetja Kganyago.

Image: Thobile Mathonsi / Independent media.

South African consumers cheered as the South African Reserve Bank (Sarb) cut the interest rate this past week, however, a wider view shows that the relief could be undone by other costs increasing.

Sarb Governor Governor Lesetja Kganyago decreased the repurchase rate for the country by 25 basis points (BPS), dropping the repo rate from 7.50% to 7.25%, effectively taking the prime lending rate to the country to 10.75%, from 11%.

Hayley Parry, Money Coach and Facilitator at 1Life's Truth About Money told Business Report that the cut could not have come at a better time.

Parry said, "What that means is that, for anyone paying back any debt, it means that you are going to be able to save on your debt repayment. For example, for every million Rand you have in a home loan for instance you are now going to be paying R515 less per month at this new interest rate, thanks to the reduction in the interest rate."

"It could not come at a better time because there has been a lot of pressure on South African consumers, with increasing electricity prices kicking in. This is great news for anyone who has been feeling the pinch and been struggling to make ends meet. Hopefully, this is going to provide a little bit of breathing room. If you happen to have any money leftover thanks to this reduction in the interest rate, my advice as always is to make sure you put aside extra cash into your emergency fund because you never know when that may come in handy," Parry added.

Tando Ngibe, a senior manager at Budget Insurance said, “This move offers some relief to consumers, particularly those managing debt, as it slightly reduces the cost of borrowing on home loans, personal loans, and credit facilities. This modest cut should be seen as a chance to reinforce, not relax, responsible financial habits. We urge consumers to use any savings from lower repayments to prioritise essential expenses, reduce high-interest debt, and build emergency funds. While the rate cut may support economic activity, it’s important to remain cautious. Inflation risks still persist, and returns on savings may decline. Consumers should continue to budget carefully in order to remain financially resilient in these uncertain times.”

Consumers still drowning in debt

Meanwhile, Neil Roets, CEO of Debt Rescue gave a more scathing view on the Sarb's rate cuts.

Roets said that the announcement of the 25BPS cut, may be good news for economists but will not shield South Africans from the burden of the fuel and sin tax levies introduced by Finance Minister Enoch Godongwana within his Budget 3.0 projection.

Roets said, "Increased taxing of the workforce is not the answer, the fuel-tax levy and raising sin taxes even higher, will put further financial strain on households, driving them to new depths of despair. This, at a time when they are buckling under the weight of multiple unsustainable inflation-related living costs. The reality is that the Finance minister’s decision to impose new tax measures will hurt lower-income families most, as they will bear a proportionally higher burden, thus forcing them to make impossible lifestyle choices with the little disposable income they have left."

"The reality is that the slow pace of the country’s repo rate reductions is perpetuating the debt trap that millions of ordinary South Africans find themselves in, leaving millions with no option but to survive on credit. This scenario has been escalating since the prolonged tightening cycle began towards the end of 2021, when the Monetary Policy Committee raised the repo rate by a cumulative 4.75% between November 2021 and May 2023, taking it from 3.50% to 8.25%, the highest level since 2014. Sadly, this means more and more South Africans are relying on their credit and store cards to put food on the table and keep the lights on," Roets further said.

"The likelihood is that they will default on debt and fall into an even deeper trap, as the cost of credit rises due to existing debt. This is most evident with big purchases like home and car loans. South Africans need real financial relief. This is a glaring red flag that should be at the top of the list of concerns of the authorities," Roets said.

BUSINESS REPORT

Visit: www.businessreport.co.za