The Congress of South African Trade Unions (Cosatu) remains cautious following the adoption of Budget 3.0 on Wednesday while economists welcome the budget being passed.

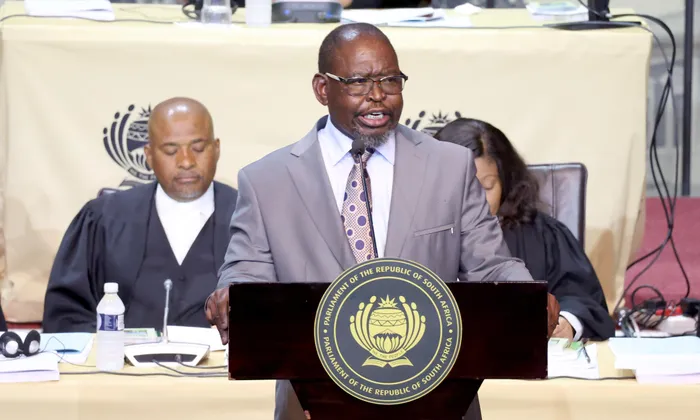

Image: Phando Jikelo / GCIS

The Congress of South African Trade Unions (Cosatu) has adopted a cautious stance following the recent passage of Budget 3.0, even as economists have largely welcomed the budget's provisions.

On Wednesday, the budget, which outlines fiscal frameworks and revenue proposals for the 2025/26 financial year, was adopted by Parliament, marking a critical moment for South Africa’s economic management amid fiscal challenges.

While Cosatu acknowledged certain important allocations, including the government's decision to retract a proposed VAT increase, which the union believed would have placed undue pressure on workers grappling with rising living costs, concerns linger over whether the budget will provide the economic stimulation required during this precarious time.

“Cosatu cannot support tax hikes upon the working class and the poor, who are already highly indebted,” said the union federation in their official response.

Cosatu said it was particularly distressed that Personal Income Tax brackets had not been adjusted for inflation for two consecutive years, putting workers who are marginally above the tax threshold at risk of higher tax burdens with annual increases in income.

Despite these concerns, the union federation praised the R4 billion investment in the South African Revenue Service’s (SARS) tax and customs compliance efforts, lauding the agency’s proven capacity to enhance revenue collection.

It also supported the allocation of R7.5bn for improved tax compliance, a measure which is aimed at the recovery of the R800 billion owed in taxes.

“It is critical that SARS be given every possible support to achieve these tax compliance targets,” Cosatu emphasised.

Furthermore, Cosatu highlighted the government’s recognition that excessive reductions in public service funding are detrimental to the economy.

The 5.4% increase in expenditure over the Medium-Term Expenditure Framework (MTEF) is viewed as a step towards repairing damage caused by previous austerity measures, especially in frontline services like education and healthcare.

In addition to addressing higher tax burdens, Cosatu expressed disappointment regarding the absence of further relief measures for the impoverished, particularly the eight million recipients of the Social Relief of Distress Grant, and a lack of robust support for small, medium, and micro enterprises (SMMEs).

Waldo Krugell, economics professor at North-West University, stated the importance of the budget is that it is not only an ANC budget but a Government of National Unity Budget.

“In the Medium Term Budget Policy Statement (MTBPS) in November, it was basically a tax and spend budget. Budget 3.0 is similar. There is a lot less spending and not a lot of tax increases except the increase in the General Fuel Levy. Coalition politics has brought sensibility to the budget,” Krugell said.

“However, we hope in the future that the governing coalition will make policy in the budget without issues. We can't keep having a situation where the Budget is opposed by every opposition party and we have to wait for consensus.”

Professor Bonke Dumisa, an independent economic analyst, said that Budget 3.0 being adopted will create less financial and/or economic uncertainties.

“This reduces opportunities for those politicians who have been recklessly using the budget disputes as a platform for local government elections campaigning,” he said.

Efficient Group chief economist Dawie Roodt said that the adoption of the fiscal framework was no surprise.

“We hope that we won’t have similar issues in future budget speeches,” Roodt said.

BUSINESS REPORT