Global property prices have mostly surged over the past five years.

Image: Matt Kisiday

Property prices in many parts of South Africa are now outpacing inflation, following years of sluggish growth, and experts are now expecting a more resilient upturn in the market.

As IOL reported earlier this week, First National Bank’s most recent House Price Index shows that annual house price growth has accelerated to 4.5%, which is the fastest pace since 2022.

But how does South Africa’s property market growth compare with other countries?

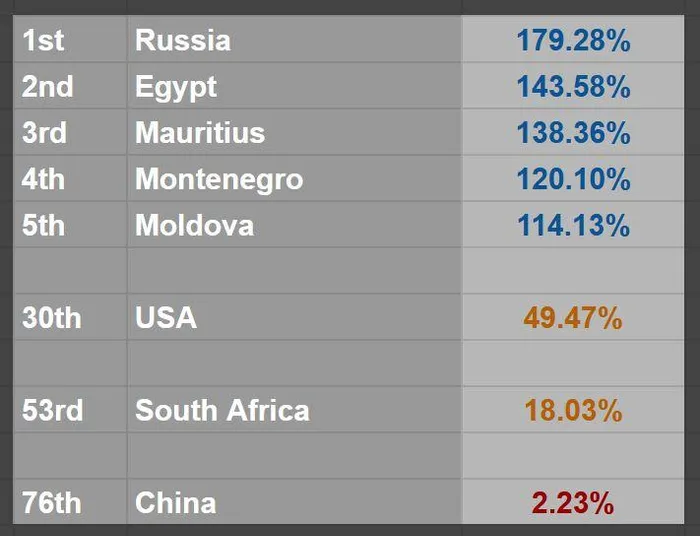

The latest Global House Price Index released by Global Property Guide shows South Africa’s growth was fairly robust over the past year, but comparatively sluggish over a five-year period.

The top performing property market over the past 12 months was Moldova, with a nominal annual growth rate of 34.16%. It was followed by Pakistan (29.22%), North Macedonia (25.10%) and Mauritius (23.82%). Moldova’s property surge has been attributed to improved credit conditions and an influx of refugees amid a shortfall in supply. Pakistan’s strong underlying demand is being driven by a rapidly growing urban population, according to Global Property Guide.

The worst performers were Macau (-10.37%), China (-3.10%), Qatar (-2.23%), and Cambodia (-2.07%). In Macau, housing demand remains below pre-pandemic levels, while China’s market is being hampered by various structural challenges, including unsold inventory, high prices and employment uncertainty created by ongoing trade tensions with the US.

Over the past year, South Africa’s property market ranked 45th among the 80 countries surveyed in the Global Index. This is an improvement over the five-year trajectory, in which the country’s property market grew by a nominal 18.03%, to rank 53rd among the 80 countries.

House price growth over five years. Data: Global Property Guide

Image: Jason Woosey

Leading the growth index over the five years were Russia (179.28%), Egypt (143.58%), Mauritius (138.36%), Montenegro (120.10%) and Moldova (114.13%).

Russia’s property market has been buoyed by government-backed subsidised mortgages, which were recently scaled back, while sanctions have also played a surprising role, as wealthy investors have been forced to invest locally rather than overseas.

Among other major economies, the US recorded property price growth of 49.47% over the past five years, and Japan 54.69%, while the United Kingdom saw a more modest growth of 23.68% and China recorded just 2.23%.

SA property market poised for further growth

While a more positive economic trajectory has fuelled the recent growth in the property market, South Africa’s recent credit ratings upgrade, the first in two decades, is expected to further strengthen investor confidence in the sector and unlock opportunities, property developers predict.

This upgrade by S&P Global Ratings adds to the positive momentum created by South Africa’s removal from the FATF Grey List, as well as the positive fiscal outlook that was outlined by Finance Minister Enoch Godongwana in last week’s Medium-Term Budget Policy Statement.

“The environment for property investment is the strongest it has been in years,” said Barto van der Merwe, managing director of Renishaw Property Developments.

He explained that stabilising inflation, improved fuel costs, and rising business confidence were all contributing to renewed activity across the property sector:

“A ratings upgrade typically lowers borrowing costs, increasing foreign investment interest while supporting long-term development planning. These are all positive signals for the property market,” Van der Merwe concluded.

BUSINESS REPORT