Amidst rising living costs, South Africans are brewing resilience in their morning rituals. Explore the profound trends defining coffee consumption in the country and why this beloved beverage remains a fixture in daily life.

Image: Supplied.

As dawn breaks over South Africa, the aroma of freshly brewed coffee fills countless homes, a staple for nearly half of the nation’s adult population despite ongoing inflationary pressures.

A year after scrutinising the coffee landscape, it’s time to delve back into how coffee enthusiasts across demographics react to the lingering price hikes, notably as inflation fluctuates.

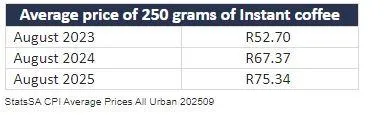

According to new insights from Eighty20, the leading consumer strategy firm in South Africa, coffee preferences have surfaced as both resilient and evolving. Although coffee prices have continued to rise sharply, the latest statistics revealing a staggering 22.3% surge in instant coffee prices year-on-year in August 2024, consumption figures remain robust.

This increase placed instant coffee alongside eggs as one of the few items in South Africa’s grocery basket experiencing inflation above 20%.

Despite the economic pressures, data from the Market Research Foundation (MRF) indicates that an impressive 22.7 million South Africans, almost half of all adults, indulge in some form of coffee daily.

With year-on-year growth reaching nearly 8%, the coffee trend here unmistakably resonates with global patterns, where worldwide consumption is projected to hit a record 10.16 million tonnes by 2026.

Interestingly, consumer behaviour seems to transcend price barriers.

The average price for 250 grams of instant coffee has witnessed a compound annual growth rate of 12.65% over the last three years.

Yet, half of the adult population starts their day with a cup of coffee, highlighting an unwavering affection for this beloved beverage.

Amidst rising living costs, South Africans are brewing resilience in their morning rituals.

Image: StatsSA

Instant coffee reigns supreme in South Africa, with leading brand Ricoffy captivating a loyal base, outpacing the next five competitors combined, as pointed out by Andrew Fulton, Director at Eighty20.

This dominance stands in stark contrast to coffee pod consumption, which, while popular among younger, wealthier consumers, remains marginally consistent, accounting for just 30% adoption among ground coffee drinkers.

While ground coffee is often seen as a product reserved for higher-income households, it’s intriguing to observe how consumption styles are adapting.

Ground coffee drinkers relish about 1.8 cups daily, compared to 1.7 cups consumed on average by instant coffee drinkers, with the upper echelons of the income spectrum (SEM 10 and LSM 10 consumers) exceeding two cups per day.

The introduction of innovative products, such as canned coffee and convenient coffee sachets, further illustrates the industry’s evolution.

Leigh Wentzel, co-founder of Cedar Coffee Roasters, highlighted this snackable trend, particularly appealing to adventurous coffee lovers such as campers and hikers.

Furthermore, coffee shops like Bootlegger are pioneering ready-to-drink cold brews in response to the growing demand for on-the-go consumption amongst younger generations.

This unique intersection of tradition and innovation is also reflected in coffee pod consumption, which has plateaued in recent years, drawing in consumers who enjoy both ground beans and coffee pods.

However, the coffee pod segment primarily attracts an affluent demographic that tends to indulge in nearly three pods daily, underlining a premium coffee culture.

In a country facing significant economic fluctuation, it’s worth noting that coffee still accounts for fewer than 1% of average annual household spending in South Africa, similar to patterns observed in the EU and USA.

Nevertheless, the demographic divide remains stark as nearly a quarter of all ground coffee consumption is attributed to the small, affluent group of about 700,000 individuals earning above R10,000 per month.

Fulton said, “Coffee is not just a beverage; it signifies a cultural lifestyle choice that continues to thrive even in tough economic climates.”

With over 10 million tonnes produced annually globally and 2.25 billion cups consumed daily, South Africa’s enduring coffee love story is a testament to its cherished status as a global commodity.

BUSINESS REPORT