In a world of negativity, here’s the real story for SMEs

SME

Beneath the noise, the truth is this: South Africa’s conditions for small business growth in 2025 are stronger than they’ve been in years.

Image: File.

As a business rooted in the South African SME ecosystem, we’ve never shied away from highlighting the risks and challenges that confront our market. Like many others, we’ve raised concerns about political volatility, power insecurity and infrastructure decay.

But in an age dominated by attention-grabbing headlines and short-term pessimism, it’s equally important, if not more so, to spotlight the real progress being made. Because beneath the noise, the truth is this: South Africa’s conditions for small business growth in 2025 are stronger than they’ve been in years.

Why our small businesses are set to thrive

South Africa’s small and medium-sized enterprises (SMEs) are the backbone of the economy, contributing over 50% to employment and 34% to GDP.

In 2025, despite global and local challenges, the conditions for SME success have never been better. From renewed political stability and accelerating digital transformation to infrastructure reform and currency-linked global opportunities, we are entering a golden window for SME growth.

Stable politics, strong institutions

The May 2024 elections ushered in a Government of National Unity (GNU), led by the ANC and DA. This peaceful transition – rare not only in emerging markets but in global markets more broadly – was admirable, restoring investor confidence and accelerating long-overdue structural reforms.

The recent ruling reversing the VAT increase reinforced the strength of our democracy, while Operation Vulindlela continues to deliver real progress on logistics, energy and regulation.

For entrepreneurs and investors alike, this represents greater predictability, policy cohesion and reduced systemic risk.

Energy stability: from risk to reliability

Load-shedding, long the bane of business productivity, is no longer the defining narrative.

By October 2024, we had enjoyed over 200 consecutive days without power cuts and, barring a few sporadic days, this has continued into 2025.

The country’s energy availability factor rose from 55.3% to 63.2%, driven by Eskom’s operational turnaround and rapid private-sector renewable energy deployment.

While load-shedding remains a threat and should not be an accepted norm, it’s important to highlight that energy constraints are not limited to South Africa; rolling blackouts occur regularly in the USA too, from California to New York, so it’s important to bear in mind that the grass isn’t always greener across the pond.

Deregulated generation and grid reform are transforming power from a constraint to an opportunity for growth, including driving job creation in the renewables sector. Time and again, SME owners and South Africans in general find opportunity in adversity.

Resilience as a strategic advantage

South African SMEs are among the most battle-tested globally. Having weathered COVID-19 (without government bailouts as we saw in many developed countries), macroeconomic headwinds, high inflation, high interest rates and power instability, they’ve emerged agile, digital and adaptive.

The digital economy – expected to reach 20% of GDP in 2025 – is fueling rapid expansion in fintech, e-commerce and agri-tech.

This strategic resilience is now a core competitive advantage.

Sentiment turns positive

The macroeconomic outlook is also improving.

The RMB/BER Business Confidence Index hit a five-year high in Q4 2024, while consumer confidence rebounded to pre-pandemic levels.

General consensus appears to be that inflation is forecast to ease to 3.9% in 2025, and this suggests that interest rates will follow suit. As domestic demand recovers, SMEs that invest now stand to gain market share and avoid late-cycle competitive pressures.

Infrastructure investment: unlocking trade and growth

For the first time in years, South Africa is executing on its infrastructure vision.

The GNU has prioritised logistics reform, aiming to boost port throughput, modernising rail and unblocking road corridors.

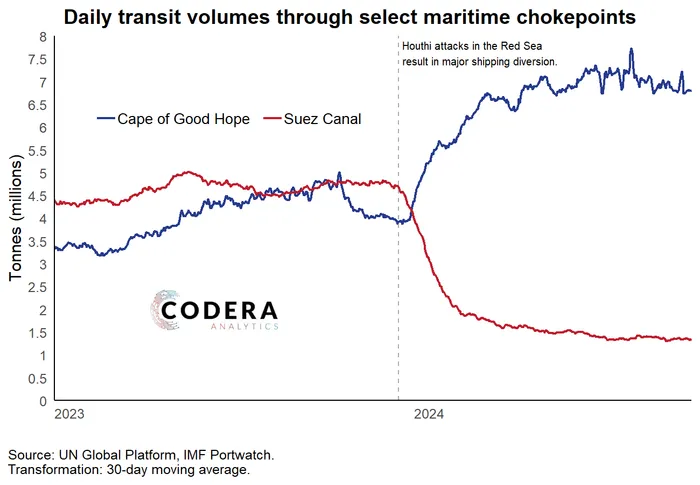

Graph one.

Image: Codera Analytics, 2024

Geographically, South Africa has been well-positioned to manage increased trade and container flows following attacks on ships in the Red Sea as global shipping routes pivoted via the Cape of Good Hope.

These logistics improvements will also lower costs and improve market access for SMEs across manufacturing, agriculture and retail.

Africa-Facing, globally connected

With a population of over 60 million and a rising middle class, South Africa offers a compelling domestic market.

Yet its real strength lies in being a gateway to Africa. Through the African Continental Free Trade Area (AfCFTA), SMEs can access over 1.3 billion consumers.

Sectors like processed foods, textiles, software and professional services are already scaling across borders, supported by fintech platforms and improving connectivity via 5G and sub-sea fibre projects like Google’s Equiano cable (which connects Cape Town with Portugal).

Rand leverage: global business, local cost base

A weak rand has created a structural advantage for exporters, tourism operators and remote service providers.

SMEs offering goods or services to international markets – from boutique wine to app development – are capitalising on foreign currency inflows while keeping operating costs in rands.

The rise of returning professionals and location-independent global teams makes it easier than ever to build globally-facing businesses from our shores. For financial services, digital agencies and BPOs, this is a winning formula.

Tailwinds strengthening the SME ecosystem:

- Youth-Led Innovation: With over two-thirds of the population under 35, entrepreneurship is digitally native and innovation-driven.

- Fintech Integration: From payments to credit, local platforms like Lula are removing friction and improving access to capital.

- Skilled Talent Pool: Cost-effective professionals across IT, design, marketing and engineering enable scalable service models.

- Remote Work Infrastructure: South African SMEs are tapping global clients without relocating.

- Investor Appetite: In a low growth global environment, private equity and venture capital are increasingly focused on South African tech, climate and SME growth sectors.

- Regulatory Reform: BizPortal, SARS automation and reduced red tape improve time to trade.

- Continental Reach: Fintech-enabled trade tools and growing demand from across Africa support scalable growth.

A Defining Window for Growth

South Africa’s SME sector is no longer a story of untapped potential – it’s an engine of resilience, innovation and opportunity.

Structural reform, macro stability and a favourable currency environment are aligning to give entrepreneurs a unique moment to scale.

Whether serving customers in Cape Town or California, the pathway to growth has never been clearer.

As President Ramaphosa aptly said in his SONA 2025 address: “We are steadily removing obstacles to meaningful growth.”

For founders, funders and enablers of small business – now is the time to act.

BUSINESS REPORT

Visit: www.businessreport.co.za