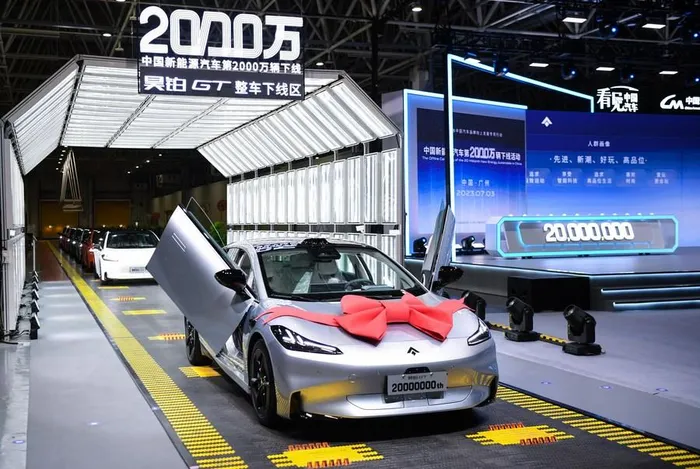

This photo taken on shows China's 20 millionth new energy vehicle (NEV) produced by GAC Aion New Energy Automobile Co., Ltd. in Guangzhou, south China's Guangdong Province.

Image: Xinhua

NextStar Energy (NSE), a joint venture between South Korea’s LG Energy Solution Ltd (LGES) and Stellantis, has completed construction of its C$5bn ($3.5bn) electric vehicle (EV) battery plant in Windsor, Ontario; marking a milestone for North America’s EV manufacturing landscape. The company has secured an occupancy permit, enabling production to commence later this year.

According to NSE CEO Danies Lee, the achievement reflects a “shared vision and strong collaboration” among all partners, including LG Energy Solution, Stellantis, Alberici-Barton Malow, and various levels of government. The Windsor facility, the first of its kind in Canada, will supply lithium-ion battery cells and modules to meet a significant portion of Stellantis’s North American demand.

Construction began in 2022, with government subsidy agreements finalised the following year. By 2024, NSE had already started module assembly operations. The 4.23 million ft² plant boasts a production capacity of up to 49.5 gigawatt hours annually and incorporates processes for electrode manufacturing, cell formation, and module assembly.

Currently employing more than 950 full-time workers, NSE plans to create around 2,500 local jobs. The site features 11 buildings, two primary manufacturing units and nine auxiliary structures including a recycling center and safety testing lab. Although minor construction remains in non-operational areas, the plant is fully approved for production.

Windsor’s mayor, Drew Dilkens, said the investment has positioned the city as a hub for electrification, with the project serving as a foundation for future industrial and economic growth across Windsor and Essex County.

While Western countries celebrate new investments like Windsor’s, China continues to dominate the EV battery market through cost efficiency and rapid technological evolution. In 2024, lithium-ion battery pack prices dropped by 20%, the steepest fall since 2017, largely due to intense competition among Chinese manufacturers and declining critical mineral prices.

Lithium prices alone plunged by nearly 20%, returning to 2015 levels despite global demand being six times higher. This sharp decline was driven by an oversupply of critical minerals, forcing smaller mining firms out of the market and consolidating production among major players. Although the surplus is expected to persist for several years, sustained low prices could deter future investments, potentially leading to shortages of lithium and nickel by 2030.

China’s dominance in refining and processing these materials further compounds global market risks, as supply chains remain highly concentrated both geographically and by ownership. If shortages emerge, lithium prices could rise sharply, benefiting miners but pressuring EV and battery producers, as well as consumers.

Recycling could help offset future supply constraints, yet limited feedstock means its impact on primary mineral demand will remain modest until at least the mid-2030s. Meanwhile, technological advances such as sodium-ion batteries and direct lithium extraction are expected to mitigate future volatility and reduce dependency on traditional supply chains.

As China deepens its hold on the global battery value chain, Western economies are responding by localising production and vertically integrating operations. Projects like NextStar Energy exemplify this shift, linking upstream mineral sourcing, cell manufacturing, and end-product assembly.

By investing in advanced technologies and fostering strategic partnerships, these new facilities aim not only to meet domestic EV demand but also to reduce exposure to price swings in critical minerals dominated by China. However, until mineral recycling and alternative chemistries mature, Chinese manufacturers are likely to maintain a decisive competitive edge in cost, scale, and market influence.

Written By:

*Cole Jackson

Lead Associate at BRICS+ Consulting Group

Chinese & Middle Eastern Specialist

** MORE ARTICLES ON OUR WEBSITE https://bricscg.com/

** Follow https://x.com/brics_daily on X/Twitter for daily BRICS+ updates

Related Topics: