The South African Revenue Service dismisses Montana's 'fake Judgment' claims in R55 Million Tax dispute

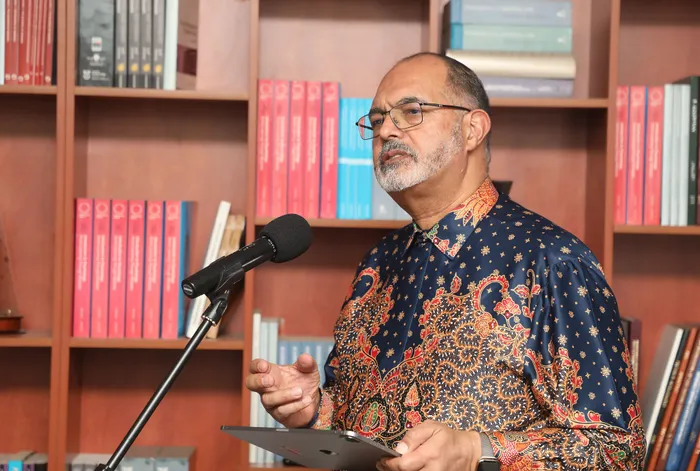

Image: Timothy Bernard / Independent Newspapers

The South African Revenue Service (SARS) has rejected the former Passanger Rail Agency of South Africa (PRASA) CEO Lucky Montana’s explosive claims that officials fabricated a fake court judgment to justify a staggering R55 million tax bill and accused him of spreading falsehoods to distract, delay, and escalate conflict.

On Monday, Montana laid criminal charges against SARS Commissioner Edward Kieswetter and other officials, who he accused of fraudulently doctoring a fake court judgment to justify a tax bill exceeding R55 million.

The hefty sum and related sequestration proceedings initiated by SARS have intensified an already contentious relationship between the ex-Prasa boss and the revenue authority.

In a rebuttal released on Tuesday, SARS condemned Montana's allegations as an attempt “to obfuscate, delay, distract, counter, and create unnecessary drama.”

“Whereas SARS does not engage publicly with taxpayers engaged in dispute processes ordinarily, the false claims must be addressed immediately.”

SARS accused Montana of making assertions, including claims of “maladministration, abuse of power, and a politically motivated witch hunt,” which it said were unfounded and part of a tactic to obstruct the tax collection process.

The entity noted a pattern of some taxpayers leveraging complaints and media narratives to “advance false claims and narratives” and to manipulate public opinion.

“Our recent history is littered with examples of how persons have sought to infiltrate and manipulate the media and other public platforms to achieve all sorts of questionable outcomes,” said SARS.

The revenue service also underscored the role of the National Prosecuting Authority (NPA), noting that it alone holds constitutional authority to decide whether to institute criminal charges.

SARS stated bluntly that no individual or entity - SARS included - can “charge SARS or any of its officials.”

In a pointed warning, SARS declared it is prepared to invoke Section 67(5) of the Tax Administration Act to disclose previously confidential taxpayer information to refute Montana’s allegations.

SARS explained that this move aims to correct the public record should Montana withdraw his claims within 24 hours of notification.

Earlier on Monday, Montana, speaking outside the Brooklyn police station, told IOL that he was being targeted.

“For the past five years, I have been repeatedly engaged with SARS regarding my tax affairs and have been in and out of court dealing with this. Recently, I discovered that SARS claims I owe them over R55 million, including interest and penalties, up from an initial R44 million.”

He further asserted serious concerns about the legitimacy of the court judgment SARS relies upon to justify the tax demands.

“This matter will expose these abuses and ensure accountability. We will see if SARS can explain which judge signed the judgment and on what date and clarify the conflicting case numbers. Until then, I hold them responsible for this fraudulent activity.”

thabo.makwakwa@inl.co.za

IOL Politics

Related Topics: