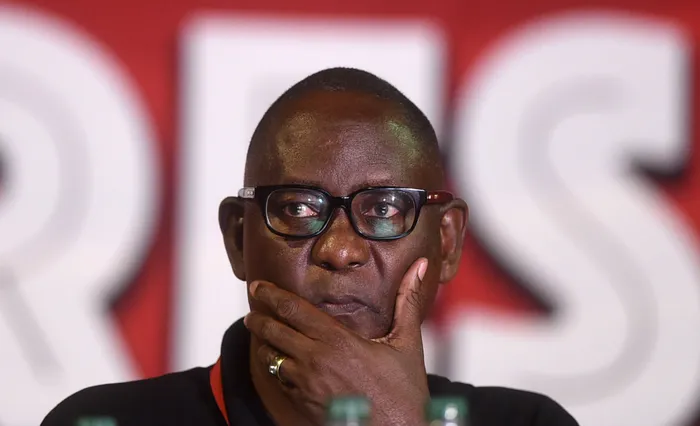

Saftu general secretary Zwelinzima Vavi prevented the foreclosure of his primary residence by Standard Bank.

Image: Itumeleng English / Independent Media

Sources close to South African Federation of Trade Unions (Saftu) General Secretary Zwelinzima Vavi have alleged that ANC politicians are targeting him through Standard Bank.

The allegations stem from the bank's failed attempt to foreclose on Vavi's Sandton home, despite him consistently paying off arrears on his home loan.

According to insiders, Vavi's vocal criticism of the ANC, particularly regarding corruption and policy direction, has made him a target.

"Vavi has been too critical of the ANC in recent years and was outspoken about President Cyril Ramaphosa's Phala Phala scandal... He has also been critical of the corruption that has been taking place within the ANC in recent years, making him a target," a source revealed.

The High Court in Johannesburg, last week, ruled in favour of Vavi, dismissing Standard Bank's bid to foreclose on his home.

Judge Stuart Wilson slammed the bank for its "disproportionate" attempt, stating that Vavi had shown "an apparently perfect adherence" to paying his monthly installments.

The judge also criticised the bank for demanding over R160,000 in legal costs, almost double the outstanding arrears.

Vavi's history with the ANC and Cosatu has been marked by controversy and criticism. He was previously fired from Cosatu due to escalating tensions and disagreements with the federation's leadership.

His criticism of the ANC's corruption and policy direction further strained his relationship with the party.

ANC spokesperson Mahlengi Bhengu did not respond to questions sent to her.

Cosatu's spokesperson Matthew Parks said the Federation was aware of the matter but were not buying into claims that there was a political controversy around the issue.

"We don't buy the story that he (Vavi) was targeted politically...no political party owns a bank or can influenece a bank.

"We obviously sympathise with him...also the judge was scathing towards Standard Bank in his ruling. We always say that there should be a better way to resolve these issues, other than going to court," Parks said.

The Vavi case is not an isolated incident. Standard Bank has faced criticism for handling mortgage arrears and foreclosure proceedings.

A R60-billion class-action lawsuit against major South African banks, including Standard Bank, highlights systemic issues with how banks handle mortgage arrears.

Advocate Douglas Shaw, leading the lawsuit, alleges that banks frequently proceed with sales even when foreclosure is not a last resort, and often impose excessive legal costs.

"We often see banks act in a manner we consider irresponsible. You cannot trust them to do what most people would see as 'the right thing',” Shaw said.

In another case the bank was again accused of using underhanded tactics to short change its clients, claiming that a couple had defaulted in their bond repayments after they were allegedly overcharged by the bank.

Shamilla Pather and her husband Roman, of Pinetown, said at the time that they were overcharged by the bank which, they say, has also prolonged court processes intended to resolve the matter.

They accused the bank of expecting her and her husband to pay R600,000 or more over a 10-year period in lieu of one month of arrears of R8,800.

In another case in 2023, a couple Patrick and Polin Anthony from Gauteng, defaulted on their mortgage payments for their home in Forest Hill, Gauteng.

However, Standard Bank debited an amount of R124,047,34 from Anthony’s family bank account allegedly after increasing the interest rate from prime -1% to prime +1% from August 1, 2009.

This allegedly resulted in an overpayment of R135,301,30, according to financial investigator Emerald van Zyl, who said the overpayment was revealed by an independent actuary as he accused the bank of having allegedly increased the prime rate through internal policy.

Standard Bank did not respond to the claims that political interference had led to banking action against Vavi, but responded to other questions.

The bank’s spokesperson Ron Derby said the bank wished to clarify that on 12 June 2025, Vavi’s matter was postponed, and no final court order was granted dismissing the bank’s application.

“Regarding this matter, the home loan account has been in arrears since 2015. Over the years, the bank has extended multiple opportunities to the homeowner to get the account up to date. Legal proceedings were only initiated in 2022, after all other avenues to resolve the matter amicably had been exhausted…Legal action is never our first course of action — it is a measure of last resort.

“With regards to the matter of Mark Rowan and Shamilla Pather, Standard Bank has engaged directly with the clients to discuss an amicable resolution. Any resolution arrived at is subject to confidentiality agreements and therefore the details cannot be made publicly available.

"We are committed to supporting our clients through financial challenges and strongly encourage clients to engage with us at the earliest signs of financial distress. Early engagement enables us to work collaboratively to find solutions that are sustainable and mutually beneficial,” Derby said.

mashudu.sadike@inl.co.za

Related Topics: