G20 Parliamentary Speakers’ Summit examine the impact of debt on low-income countries

Chairperson of the Financial and Fiscal Commission, Dr Patience Nombeko Mbava, began by explaining that debt sustainability involves two dimensions.

Image: Parliament of South Africa/GCIS

Officials at the G20 Parliamentary Speakers’ Summit (P20) used their first session on Thursday to examine the issue of debt sustainability, with several officials highlighting a call for a change in how low-income countries are allowed to manage their debt.

Heads of Delegations delivered statements on the second working session of the summit, “Ensuring debt sustainability for low-income countries”.

The session discussed how debt sustainability is critical for the long-term stability and development of countries, and that Parliaments must play a proactive role in shaping transparent, fair, and growth-oriented debt policies that protect public service and social investments.

Chairperson of the Financial and Fiscal Commission, Dr Patience Nombeko Mbava, began by explaining that debt sustainability involves two dimensions, solvency (a government’s ability to meet debt obligations) and sustainability (which considers future debt dynamics), and that legislatures are responsible for ensuring debt sustainability through revenue oversight.

“(This includes) tax, borrowing, expenditure, where spending choices, guarantees, and liabilities must be weighed against the fiscal capacity of the state, which central banks must maintain independence, and financial stability.

“Most importantly, the existence of independent fiscal institutions, such as the Financial and Fiscal Commission of South Africa, and other similar institutions globally, serves to strengthen fiscal oversight with Parliament, safeguard fiscal prudence, and uphold the constitutional values of fiscal transparency.

“It ensures that critical financial and fiscal matters are thoroughly researched, examined and presented to parliament as evidence for legislative oversight,” Mbava said.

She added that the country has a robust legislative pre-script governing public debt, but that shortcomings lie in oversight of the fiscal framework and its execution.

“Legislation, while necessary, is not sufficient to guarantee debt sustainability. Without effective and ongoing legislative oversight of fiscal execution, including enforcement of constitutional provisions, scrutiny of contingent liabilities, and transparent reporting of borrowing and guarantees, the fiscal position can deteriorate rapidly.”

Mbava said that for many middle and low-income countries, debt levels have climbed, and much of their deterioration is attributed to overly optimistic forecasts of economic growth and revenue mobilisation, “which created fiscal frameworks based on unattainable assumptions”.

“Reckless borrowing practices… further undermine fiscal integrity. Weak fiscal and policy execution compounded the problem, reducing returns on borrowed funds, and increasing contingent liabilities to state and state-owned enterprises, bailors and cost-overrides.”

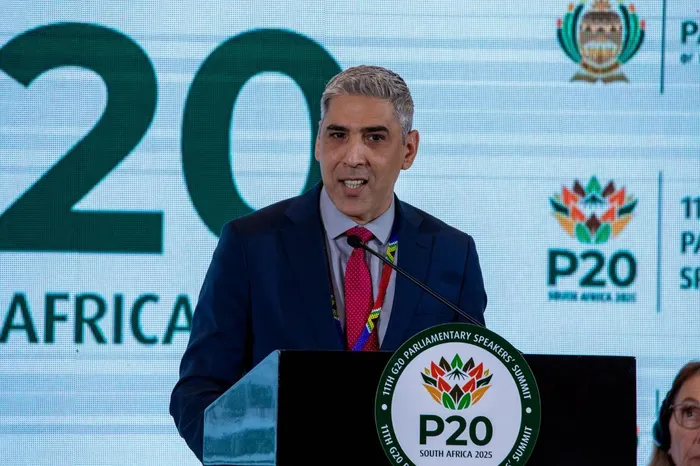

Deputy Speaker of the Federation Council of the Federal Assembly of the Russian Federation Konstantin Kosachev.

Image: Parliament of South Africa/GCIS

Deputy Speaker of the Federation Council of the Federal Assembly of the Russian Federation Konstantin Kosachev said that ballooning global debt is increasingly undermining the sustainability of the global financial sector.

“It already exceeds 92% of most countries’ GDP. Countries of the Global South suffer the most of these debt burdens. They’re forced to spend a significant portion of their budget revenues on interest payments instead of financing healthcare, education, and development projects.

“According to the United Nations, development financing currently suffers from a 4 trillion dollar deficit, and more than 60% of the poorest countries are not able to generate economic growth on their own.

“The unbalanced nature of landing an investment can be largely attributed to the imbalances in landing an investment resulting from the West's neocolonial policies, which, taking advantage of its dominant position in global finances, easily refinances its debt at relatively low rates,” Kosachev said.

“At the same time, debt restructuring is an uphill battle for developing countries.”

Kosachev said that efforts to resolve developing countries’ debt issues should be based on the principles of “non-discrimination, and equal access created to multilateral financial institutions”.

Senator from the Council of Algeria, Mohamed Amroune, said the debt for low-income countries is a crucial issue.

Image: Parliament of South Africa/GCIS

Senator from the Council of Algeria, Mohamed Amroune, said the debt for low-income countries is a crucial issue.

“In Africa, we are still looking for an order that takes into account the ability of low-income countries to pay off their debt. We need a new order that is based on participation, not on exclusion.

“We are looking for a new order, in which everyone has a place and space, in order to build towards peace. We have a huge responsibility, because debt for low-income countries is closely linked to the threats that we undergo at the moment across the world - when we talk about illegal migration, terrorism, or any other form of threats.

“Very often, the causes are the lack of development in these countries, and therefore, we think that low-income countries have heard enough of our promises, but nothing has been done in practice.

“There is a shared responsibility amongst all of us… We all need to place pressure on decision-makers to come into line with the decisions taken and the promises made, whether it relates to debt relief or eradication. Poor countries, or low-income countries, need to be able to honour their financial obligations.”

theolin.tembo@inl.co.za

Related Topics: