Why you need to keep your statements

File photo: Karen Sandison. File photo: Karen Sandison.

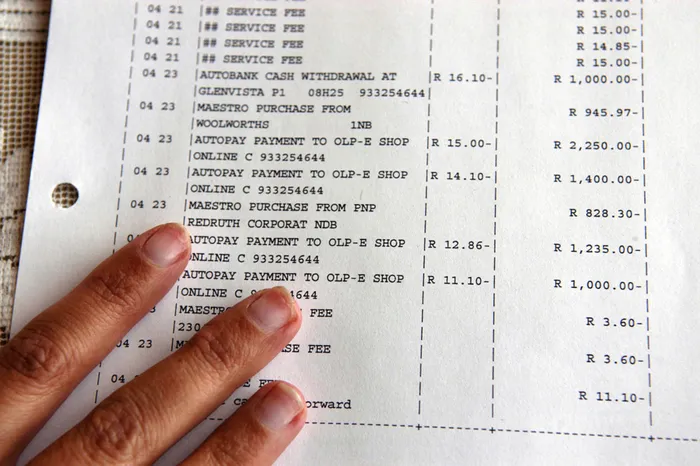

Filing paperwork is not one of life’s fun activities, but having to pay up because you can’t prove you’re in the clear is even less fun.

Bradley Harrod was contacted by attorneys acting for Standard Bank last August, and told he owed the bank R786.

He protested that he’d settled the account in 2011, but the demands continued, and so, worried that the amount would escalate, he gave in to the pressure and paid up.

Later he found his settlement letter and wrote to the bank, requesting a refund. When he didn’t get a response, he contacted Consumer Watch.

I asked Standard Bank how such unjustified legal handovers happened, and a spokesman confirmed that Harrod had paid what he owed the bank in 2011.

“However, the balance on the account did not correctly reflect as zero, but instead reflected an amount of R532.73 still owing.

“This resulted in the account being referred to attorneys for collection.

“Mr Harrod was asked to settle an amount of R786.24, which was the amount outstanding, plus interest.

The error was due to a system fault on the part of Standard Bank, which the attorneys acted on.

“Standard Bank sincerely regrets the error and has apologised to Mr Harrod for the poor customer experience.”

Harrod has also been refunded.

“I was lucky to find my two-year-old letter,” Harrod said.

“I’m sure a lot of people pay up despite not owing the money because they can’t produce written proof that the amount was paid.”

E

rrors happen all the time, so protect yourself by insisting on written proof that you’ve settled and closed an account, or paid a debt, and make sure you will have access to that proof – ideally both hard copy and electronic – should you get a demand for payment a few years later. -Pretoria News