The dollar’s role allows the US to borrow cheaply by issuing debt instruments like Treasury securities, which are widely held globally, explains the author.

Image: Reuters

With a stroke of his fat koki pen, US President Donald Trump has done more to harm the dollar's reserve status than anything Xi, Putin or anyone else could do. Although its reserve status was an outcome of agreements struck at Bretton-Woods, the dollar has retained that status because it works really well. That is changing. The "exorbitant privilege” of having the world's reserve currency, described by French economist Valéry Giscard d’Estaing, is essential to America's economy.

The dollar’s role allows the US to borrow cheaply by issuing debt instruments like Treasury securities, which are widely held globally. Commodities such as oil, gold and even sugar are priced in dollars, further cementing its centrality in global trade.

But these are all fictions, maintaining their ephemeral existence only because of the sincere belief of the faithful.

In Terry Pratchett's 1992 philosophical treatise on America, Small Gods, Om, the central deity, finds himself reduced to the form of a powerless tortoise because his followers no longer truly believe in him. The faith of his followers has become hollow, rooted in fear, ritual, and dogma rather than genuine devotion. This lack of authentic belief renders Om weak and vulnerable. Sound familiar?

The United States derives its strength from the belief of its citizens and most of the world, in its institutions, such as democracy, justice, and governance. When faith is lost in America, it's difficult to see how America still thrives. Om is eventually caught by an eagle and dropped onto someone's head, so the metaphor only goes so far, but the point remains.

America's strength has been in its institutions which have been severely undermined on Liberation Day. Promises made to other countries were broken. Trade agreements were torn up and just a minute ago, Nato found out that America may only be there on paper, and quite possibly on other side if the borscht hits the fan.

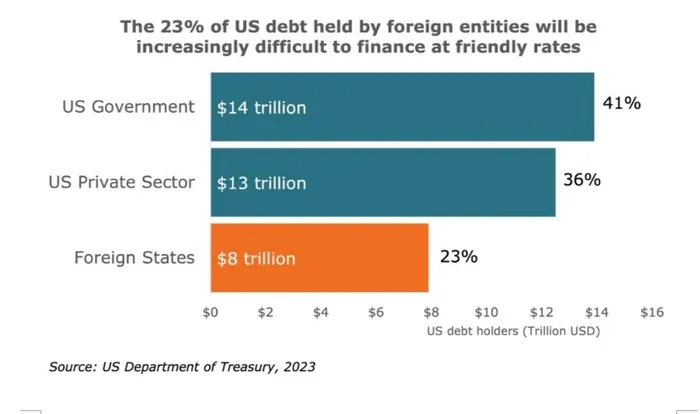

US debt graph.

Image: US Department of Treasury, 2023

America's debt stands at $35 trillion (R630trl), of which $7trl needs to be rolled over this year at interest rates of over 4.5%, compared to 1.3% in 2021. The Congressional Budget Office estimates that the US will pay $1.1trl (17% of revenue) just in interest payments in 2025 (they never repay capital. They just keep adding debt and let inflation eat away at it). In 2023, a very large 23% of US debt was held by foreign states.

Holding Treasuries has generally been a good deal for everyone, but that is rapidly changing. Even the US private sector may begin losing its appetite to hold Treasuries at low prices. And price really is everything when your debt is literally larger than the GDP of every country in the world. The US is worried by this, which is why century bonds are now being proposed. These debt instruments lock in low borrowing costs (in theory) for a century, but whilst appealing to the American government, these may be appalling to big buyers of its debt who have just been hit with reciprocal tariffs. America's greatest export has arguably been its dollar, a product of increasingly dubious value after Liberation Day.

Could America simply self-finance its ever growing debt pile? Yes, but to do that, they need growth and by cutting off the rest of the world, this will be increasingly difficult. Such broad tariffs will inflate costs in the US, lowering the buying power of American consumers, the engine of America's GDP. Trump wants to change America from a nation of consumers to a nation of manufacturers, but its not clear how this will happen and even if it did, it will take far longer for that to happen than it did to impose the tariffs.

Tariff it and they will come is simply nonsense, especially when tomorrow those tariffs can disappear when Tariff Man cuts a new deal.

Trump wants to cut taxes, replacing them with tariffs, but that can never work. When tariffs work best (in the olden days before last week), they moved production onshore, but in doing so the revenue collected from tariffs falls. This is the point. The government's only source of revenue is tax, in all its different flavours. If tax collections drop, which I predict they will if the tax rates are cut, and the high tariffs remain, then borrowings will increase. More borrowings from people who don’t want to lend to you, means even higher rates and so the spiral continues.

Bad times ahead for America and everyone else who suckles on the teat of the American consumer.

Donald MacKay is founder and chief executive of XA Global Trade Advisors.

Image: Supplied

Donald MacKay is founder and chief executive of XA Global Trade Advisors. MacKay has been advising local and foreign companies on global trade issues for more than two decades. X handle: XA_advisors; email: donald@ xagta.com; website: xagta.com.

Book your seat to our free webinar on Tariff Madness on Wednesday, 9 April, here

***The views in this column are independent of IOL and Independent Media.

BUSINESS REPORT

Related Topics: