What the oil price says about the Iran crisis

ANALYSIS

In an aerial view, oil storage tanks are seen at the Enterprise Sealy Station on June 19, 2025 in Sealy, Texas. Oil prices have spiked over concerns that the Israel-Iran war could lead to a broader conflict involving the United States.

Image: Getty Images via AFP

The ongoing conflict in the Middle East continues to unsettle markets – but perhaps to a lesser degree than investors feared.

Despite the intervention of the US, markets’ reaction has been contained. Oil prices initially rose, reaching over $81 (R1465) a barrel, but quickly fell back to their range of the previous week. Global conflict often transmits into wider economic and market performance via inflation, and energy prices are a key contributor. This is why, during geopolitical flashpoints, the oil price becomes a point of focus. What factors are influencing oil prices in relation to today’s Middle East crisis?

Oversupply of oil keeps prices under $80 a barrel

The global economy currently enjoys a healthy oil surplus. This helps keep prices in the mid to low $70s, a historically moderate range. Despite the events of recent days, there has not yet been any significant disruption in oil flows from the region.

A risk premium is already priced in

Following the initial exchange of fire between Israel and Iran, the oil price rose as the market responded to potential future disruptions in supply. Our calculations suggest today’s price includes a 20% “risk premium”, already taking into account possible future disruption. With no short-term supply disruption and this additional risk already priced in, the market remains relatively stable for now.

Concerns over the Strait of Hormuz risk may be overstated

How Iran responds is vital. It is frequently reported that one response could include “closing” the Strait of Hormuz, a sea passage critical to global oil transit.

However, the Strait is a comparatively wide channel of international waters and cannot, in practice, be “closed”.

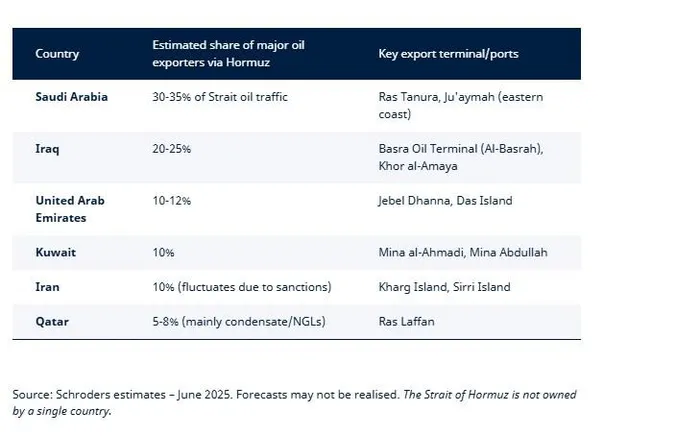

More importantly, while the targeting of shipping remains a theoretical risk, much of the oil passing through the Strait originates from Iran’s neighbours (see table below). Disrupting the Strait of Hormuz would require aggressive action against international shipping, risking further isolation for Iran and the potential to draw other parties into wider conflict due to breaches of international maritime law.

Who sends oil via Strait of Hormuz?

Image: Supplied

Inflationary threat only starts to impact at c$100

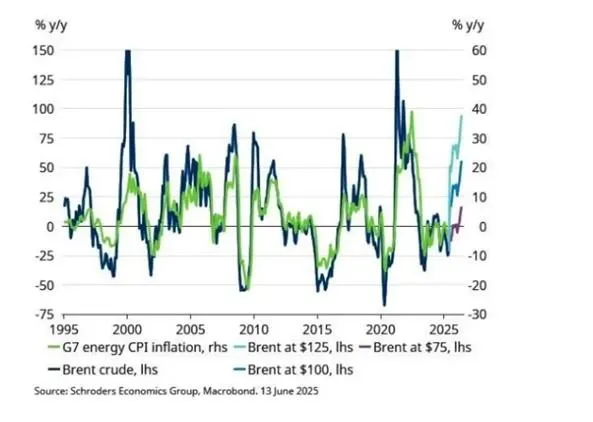

Since Israel’s attack on Iran on 13 June, Brent crude price jumped 10%. If it settles at this level, it implies that G7 energy inflation will be a little over 5% over the next year (see chart below). This is not likely to lead to broader inflation pressure.

Historically, a material inflationary threat typically only emerges when oil prices rise by 50% or more (see chart below). This would require Brent prices to move above $100 per barrel, which would need to happen before we see a pronounced impact on energy inflation rates.

As we have pointed out before, the relationship between oil prices and inflation suggests that every 10% rise in oil prices adds just 0.1% to wider inflation.

Oil prices need to top $100 for energy inflation to rise significantly

Image: Supplied

George Brown is a senior economist and Malcolm Melville, a fund manager, Energy at Schroders.

*** The views expressed here do not necessarily represent those of Independent Media or IOL.

BUSINESS REPORT