Editor's Note: Debanking in South Africa: The risk of financial exclusion based on reputational damage

US bank de-banking US regulators are taking steps to prevent unfair discrimination by the banks.

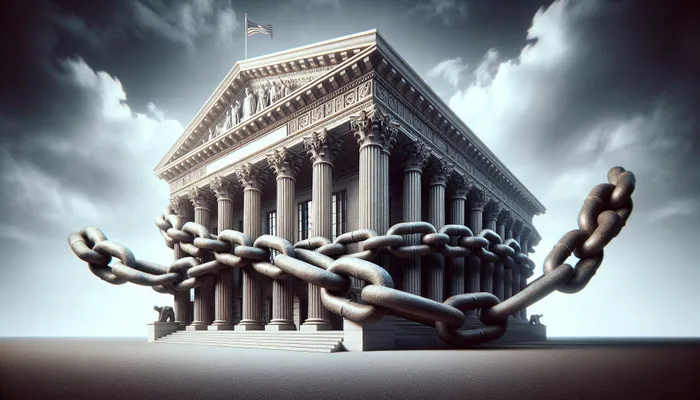

Image: RON AI

Thousands of bank accounts are being closed in South Africa on the basis of reputational risk despite legislative changes in the United States that seek to stop this.

Reputational risk as a metric is a slippery slope. Banks do so on the basis of negative media press.

Banks use data platforms LexisNexis, World Online and World-Check that aggregates news from media outlets. The problem is that these articles that flag reputational risk lack any forensic or legal basis.

Banks don't have to verify if the perceived reputational risk carries weight and on the basis of the negative articles they can debank you whether the news is true or not.

The irony is that the banks themselves, such as Standard Bank and Nedbank, are also flagged by the Zondo Commission for wrongdoings, which by their metrics would make them subject to reputational risk.

In February, Parliament hauled the FSCA over the coals about the lax manner in which they were treating the unilateral and arbitrary closure of bank accounts. Parliamentary standing committee on finance chairperson, Joe Maswanganyi, said transformation within the financial sector is not merely an option but a constitutional and economic imperative.

However, despite the Parliamentary hearing, debanking is still very much in force in South Africa.

What is debanking?

Debanking refers to the practice of financial institutions closing or refusing to open bank accounts for individuals, companies, or political groups due to concerns over reputational risk. Banks and financial institutions claim that they make these decisions to protect their image, avoid association with controversial figures, or comply with legal or regulatory pressures. However, the practice has become highly contentious, as it often involves political or ideological motives, especially when it targets individuals with unpopular views or dissenting political stances.

In recent years, "debanking" has become a controversial issue, particularly when it involves politically active individuals or groups being cut off from banking services due to their views or affiliations. This practice has sparked widespread debate, with critics arguing that it infringes on freedom of expression and creates a chilling effect on political discourse. The debate has gained even more attention in light of recent developments involving high-profile figures like Nigel Farage in the UK and political actions in the United States, including a new executive order from President Donald Trump. As debanking increasingly becomes a tool for managing reputational risk, it raises important questions about the intersection of politics, economics, and individual rights.

While financial institutions have always had the right to refuse service to certain customers, the increased politicization of banking services has raised concerns about the potential misuse of this power to suppress certain political ideologies. The most famous example of this growing trend is the recent case of Nigel Farage, the British politician, whose accounts were closed by several major UK banks. This incident set off a firestorm of criticism from both supporters of Farage and advocates of free speech, who argued that debanking was a form of political censorship.

Nigel Farage and the Debanking Debate

Nigel Farage, the former leader of the UK Independence Party (UKIP) and prominent Brexit supporter, found himself at the center of the debanking debate in 2023 when it was revealed that several British banks had closed his personal and business accounts. Farage claimed that he was targeted for his political views, particularly his role in promoting the Brexit referendum and his outspoken criticism of the European Union. The controversy escalated when it was reported that other prominent figures with controversial or conservative political stances had also been deplatformed by financial institutions.

Farage has settled his debanking dispute with NatWest Group, nearly two years after the closure of his accounts sparked a chain of events culminating in the resignation of the lender's chief executive. Sky News revealed that Farage and NatWest agreed to resolve their row, with the bank thought to have agreed to pay him an unspecified sum in damages.

Trump’s Executive Order on Debanking

In the United States, the issue of debanking has gained further prominence with an executive order issued by President Donald Trump. Trump’s order seeks to protect individuals and businesses from being targeted by financial institutions based on their political views. In particular, Trump’s order addresses concerns over "political discrimination" by banks and credit card companies, especially in light of the growing trend of deplatforming conservative voices in various sectors.

The executive order comes in response to reports of financial institutions cutting ties with political figures or organisations that are perceived to hold right-wing or conservative views. In some cases, banks and financial services providers have been accused of closing accounts or denying services to individuals based on their association with certain political movements or political figures.

While Trump’s order focuses primarily on protecting individuals from political discrimination, it also highlights the broader issue of whether financial institutions should be allowed to exercise such significant control over people’s economic lives. Many critics of debanking argue that it represents an erosion of individual freedoms, as financial institutions increasingly assume the role of gatekeepers, determining who can access financial services based on their political leanings. This shift, critics say, could pave the way for financial exclusion based on ideological purity tests, further polarising society.

State of debanking

Ultimately, the current state of debanking in South Africa - driven by reputational risk metrics, media bias, and a lack of regulatory oversight - calls for a rethink of how banks and financial institutions are allowed to operate. While protecting a bank’s reputation is important, it should not come at the cost of undermining basic human rights. As the international discourse around debanking continues to evolve, it is imperative for South Africa to establish clearer regulatory frameworks that protect citizens from arbitrary financial exclusion, ensuring that banking decisions are based on clear, verifiable criteria and not on perceptions or unverified media reports.

If South Africa’s financial sector is to remain inclusive and democratic, it must strike a balance between protecting institutional reputations and safeguarding the rights of individuals to freely express themselves and engage in economic activity, regardless of their political or social views.

Philippa Larkin, is the executive edior of Business Report.

Image: Supplied

Philippa Larkin is the editor of Business Report.

BUSINESS REPORT