The impact of macroeconomic policy on employment in South Africa

The South African government has dumped employment as a macroeconomic design on the department of labour, says Pali Lehohla.

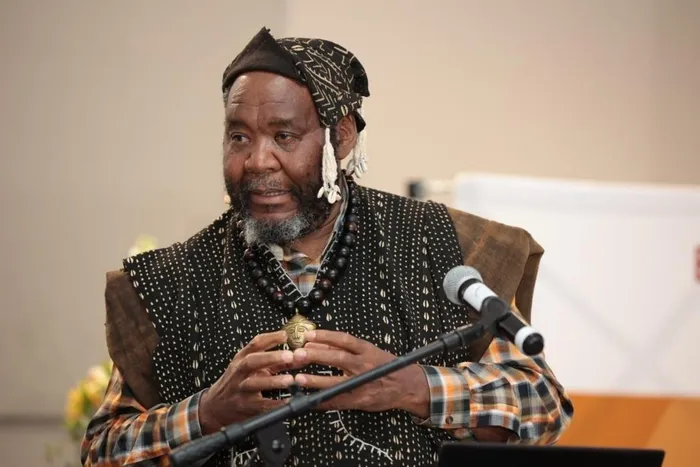

Image: Henk Kruger/Independent Newspapers

The South African government has dumped employment as a macroeconomic design on the department of labour. This is a serious anomaly that removes an essential component of employment, growth and prices from the main economic actors in macroeconomics, which are namely Treasury, Reserve Bank and trade and industry. To relegate employment to the department of labour is to ignore a yet vexed question of the Phillips curve that addresses the relationship between unemployment and inflation. Whilst questions have been raised around this relationship and Vermeulen in 2017 asked “whether the Phillips Curve is dead?” in a title he penned, the question remains a policy debate in which some central banks including South African Reserve Bank have concluded that perhaps unemployment is not their mandate.

As a consequence, and in South Africa specifically, this has been dumped on the department of labour, which intrinsically is marginal to macro-economic policy designs and their attendant tools. We need to bring in Chapter 15 of Volume One of Capital. In this chapter Karl Marx dedicates one hundred and fifty pages on “Machinery and Modern Industry.”

It will be made clearer in this article that Machinery and Modern Industry as explicated by Marx has not received global attention as a fundamental macro-economic feature. It has rather been reduced to innovation – a fascination with smartness in technology, artificial intelligence and autonomous systems, instead of a deep breath taking historical epoch. For this is a fundamental feature of and significant inflection point in the development of productive forces. It is a central macro-economic policy question, which globally has received scant attention as possibly the highest stage and last stage of capitalist accumulation as we know it.

It is a socio-economic stage negated by laws of scarcity that capitalist formations continue to fabricate as they seek survival. The sad part of this period is the production and reproduction of surplus populations – those who are supernumerary to society and the economy in all respects.

This super numerary are asubject of philanthropic receipts and pities of forms. The point is this - information technology is a result of the development of productive forces with its common feature and anticipation of removal of scarcity. Information technology has introduced in the practice of economics the law of abundance. This replaces the law of demand and supply as we know it. This law has a central feature, which is price increases with demand.What information technology has brought about is to remove rivalry in use of economic assets emanating from the development of productive forces. So suddenly non-rival products are on the shelves and they have introduced a different law of demand and supply in economics. The law that says the more demand there higher is the push for lowering prices. The first order deflation should emerge caused by surplus consumer benefit from non-product rivalry that information technology delivers. The second is the contrarian second order deflation driven by low demand because of surplus population created by capital.

Whilst the Phillips Curve provided a phenomenon that ceased economic minds and sparked inflation targeting to tame prices, the central Banks might have basked in the wrong vista. The real vista is non-rivalry in demand of goods and services that are driven by rapid development of productive forces. Inflation expectations and the subsequent inflation targeting as a strategy is but a placebo to which central banks can enjoy their Hawthorne effect.

The secondary effect of basking in the Hawthorne mantra is depressed demand for goods and services because of the low demand for consumption because of high levels of unemployment, the creation of a lumpen class and a sure source of a revolution.

Karl Marx in Chapter 15 of Volume One of Capital sets a very clear context of Artificial Intelligence under a capitalist mode of production and concludes that it will be dwarf like, “Just as the individual machine retains a dwarfish character, so long as it is worked by the power of man alone, and just as no system of machinery could be properly developed before the steam-engine took the place of the earlier motive powers, animals, wind, and even water; so, too, modern industry was crippled in its complete development, so long as its characteristic instrument of production, the machine, owed its existence to personal strength and personal skill, and depended on the muscular development, the keenness of sight, and the cunning of hand, with which the detail workmen in manufactures, and the manual labourers in handicrafts, wielded their dwarfish implements.”

Unfortunately, the central banks attribute lowering inflation to their dexterity of taming it whilst it is the non-rivalry of consumer products from artificial intelligence and autonomous systems that drives deflation and changes the laws of demand and supply. The supply, demand and price levels have changed not by central banks inflation targeting but by rapid development of productive forces. A reversal of this trend may well be on its way through the Trump tariffs and subsequent trade wars.

Dr Pali Lehohla is a Professor of Practice at the University of Johannesburg, among other hats.

Image: Supplied

Dr Pali Lehohla is a Professor of Practice at the University of Johannesburg, aResearch Associate at Oxford University, and a distinguished Alumni of theUniversity of Ghana. He is the former Statistician-General of South Africa.

*** The views expressed here do not necessarily represent those of Independent Media or IOL.

BUSINESS REPORT