Anglo American's slow exit from South Africa: A silent crisis

South Africa remains quiet as Anglo American exits South Africa, says the author.

Image: File

A former employee of the mighty organisation, Statistics South Africa, Sihle Khanyile, now a graduate of Michigan University, with a Masters in complex sampling had lunch with me last week. He is visiting home and is now based at the Saudi Statistics Authority in the Emirates. He reminds me of my advice to him when he left for Michigan.

He was looking for a specific public lecture and noticed many people heading in one direction. He chose not to follow them, but then spotted a Chinese person and asked the person where the lecture he was looking for was being held. The Chinese person replied that he was also going there. The two of them went together — to a place where few others were headed.

An equivalent and relevant story to Anglo American exit is one of rodents that are kept in the depths of the mine. The task of the rats is to know when there is carbon monoxide. Long before human beings know it rodents will start fleeing and workmen must not waste time, they must follow with speed for that hails danger. Anglo American is leaving South Africa by increments.

According to sources, a vote is to be held on the 9th of December to consider departure. The date is far closer than the 12 month horizon that was provided for in the consideration of the decision.

The Public Investment Corporation (PIC) has the largest stake Anglo. The PIC also manages the Government Employees Pension Fund so there are 1.6 million public servants in this endeavour and with I am one of the members as a retiree. So, any decision made by Anglo affects me personally. No doubt therefore I have a personal interest in this matter well beyond a broad consciousness responsibility. So, my unease here is both personal and patriotic. I cannot claim to know much about matters finance, however, I have booked enough to be uncomfortable when there is skin irritation. My skin is itchy. My natural response will therefore be to scratch.

For now, I am reminded of the activist leader by the name of Brian Molefe, now a MKP member of parliament. He was visible during his tenure as the chief executive of PIC. He was an activist of note. I asked ChatGPT what Molefe would have done? ChatGPT did not disappoint, it captured what Brian would have done with clinical precision. It said ChatGPT Brian Molefe, as CEO of the PIC - which manages South Africa’s government employee pensions—was known for activism in investment, especially regarding protecting public funds and influencing corporate behaviour. PIC’s approach under him often involved using its stakes to influence companies’ decisions, rather than passively investing.

If Anglo American, holding 7% of government pension funds via PIC, decided tomove offshore (i.e., shift profits, assets, or headquarters outside South Africa), Molefe’s likely response, based on his activism record, could have included:

1. Engagement and Pressure: PIC under Molefe often engaged directly with company boards. He would probably have pushed Anglo to justify the offshore move, highlighting potential negative effects on South African economic growth, job creation, and tax revenues.

2. Voting Power: With 7%, PIC had significant influence. Molefe could have used shareholder voting rights to oppose or influence the offshore strategy.

3. Public Campaign / Moral Suasion: Molefe sometimes used public statements to pressure companies into decisions aligned with national interest. He may have publicly questioned Anglo’s commitment to South Africa to rally public andshareholder sentiment.

4. Conditional Support / Divestment Threat: He might have threatened to sell PIC’s stake or make support conditional on measures benefiting local stakeholders, such as retaining jobs, paying taxes locally, or investing in South African operations.

5. Policy Lobbying: Molefe could have lobbied government or regulatory bodies todiscourage capital flight or create incentives for keeping the company’soperations domestic.

In short: Molefe likely would have leveraged PIC’s 7% stake to either prevent or modify Anglo’s offshore move, combining direct engagement, shareholderactivism, public pressure, and potential threats to divest, all in line with his track record of protecting South African public investments. None of what Molefe is known to have done during his tenure as CEO of PIC have happened from the CEO or board of PIC.

The Civil Servants, a cool 1.7 million of us who are members of Government Employees Pension Fund, which is managed by the PIC, have been mum. The political head of PIC and its chair has been quiet. The question is whether the five points on which Molefe would be concerned are muted in the current management. A chill down my spine tells me of a numbed nation, which could not care a hoot where it itches even if the Setswana saying of “se le monate se ingoaeloa” holds. This means when you scratch your own wound it is such a good experience. It appears that there is no scratching even by the civil service. But only civil society is the one that is scratching. They have a Molefe in them whilst the civil service the majority shareholder is simply a bunch of “Sleepy Joes.”

My take on why Anglo is leaving is a more grave scenario. Imagine where Anglo was in the 80s when it initiated discussions in Zambia, then to Roben Island andfinally a settlement. My conclusion of reasons Anglo is leaving South Africa whenthe conditions today are far better than in 1993 albeit not at a leadership level,especially when Anglo is a master of scenarios having offered the Mont FleurScenarios to government in 1993, is this: Anglo has concluded that there is an empty shell in South Africa at the leadership level. There is no Lusaka to go to, there is no Roben Island to go to. There is only a cave at the Union the Buildings and it is not worth anybody’s while to go there. This is a scary message. Even if we can hurl Uhambanini at Anglo and say Makahambe khona ngogo the scary messageis has Anglo seen its erstwhile nemesis and like rodents from carbon monoxide Anglo plans to exit.

The reality therefore that South Africa has to wake up to is that Anglo is seeing deep trouble and we have to wake up now. It is not too late for us to save ourselves from ourselves. Therefore even if Anglo were to leave, we owe it to ourselves to stop the carbon monoxide than to continue to inhale it. However, before they “behamba” let us apply to the maximum, the five Molefe principles of Engagement and Pressure; Voting Power; Public Campaign / Moral Suasion; Conditional Support / Divestment Threat and Policy Lobbying.

Dr Pali Lehohla is a Professor of Practice at the University of Johannesburg, among other hats.

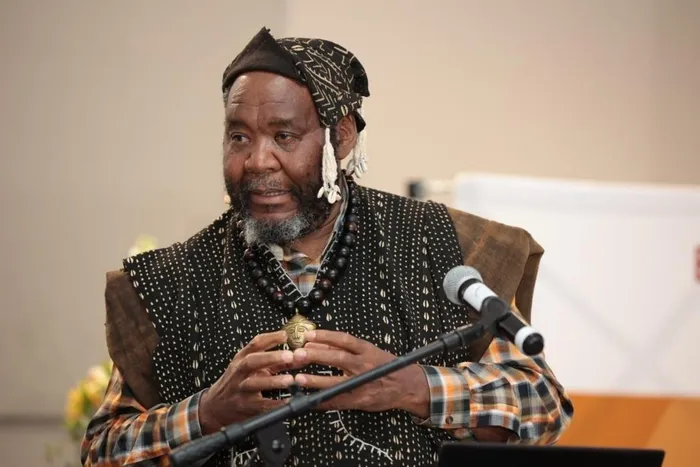

Image: Supplied

Dr Pali Lehohla is a Professor of Practice at the University of Johannesburg, a Research Associate at Oxford University, and a distinguished Alumni of the University of Ghana. He is the former Statistician-General of South Africa.

*** The views expressed here do not necessarily represent those of Independent Media or IOL.

BUSINESS REPORT