Explore the growing trend of South Africans marrying later in life, driven by financial stability, personal growth, and changing societal norms.

Image: Tara Winstead

South Africans are putting off getting married until later in life, putting this ceremonial expression of love aside as they are focused on their financial stability, personal growth, and careers. And that’s if they are even getting married at all.

A recently released Statistics South Africa research paper noted that the median age for grooms getting married has moved up from 35 to 38 in about a decade. Over the same period, the data showed, brides were getting married at a median – or middle-of-the-range age of 34 instead of 31.

Statistics South Africa noted that, “in modern times, love and commitment are no longer bound by age but by readiness. Across the globe, the traditional timeline for tying the knot is shifting, and South Africa is no exception.”

Verona Pillay, client value proposition lead at ASI Financial Services, explained that there are many factors that influence when someone gets married – if at all.

Pillay said that love remains central to relationship commitments, although this concept has evolved. “Today’s clients seek emotional connections, shared values, mutual respect, and lifestyle compatibility, and not just passion or family approval,” she said.

Statistics South Africa’s research concurs: “One thing is clear – South Africans are redefining what partnership and commitment mean in modern society.”

What is important, said Pillay, is for couples to “balance their hearts with their heads”. She added that “financial compatibility often strengthens emotional bonds in the long run”.

Yet, getting married later in life provides both financial opportunities and risks, said Pillay.

Advantages:

Challenges:

When getting married later in life, Pillay said couples should also align their retirement age, investment strategies, and estate planning early on. At the same time, she noted, it is important to ensure that beneficiaries nominations for pension investments and life policies have been updated.

Another important aspect Ettienne Bezuidenhout, wealth manager at Alexforbes, raised is the importance of regularly reviewing and updating your will as life circumstances change, such as a marriage, as this is crucial to keeping it relevant.

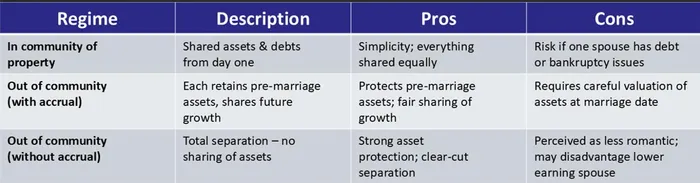

“We encourage clients to discuss cohabitation agreements or pre-nuptial contracts with a lawyer and your financial advisor before the wedding day and not after,” Pillay said.

While people may not go into a marriage expecting to get divorced, the stats show that ending a marriage is becoming more commonplace. Statistics South Africa’s data indicated that there was a 10.1% increase in the number of divorces between 2022 and 2023.

“The trend of rising divorce rates is not new, but 2023 saw one of the highest increases in recent years,” it said.

Statistics South Africa added that its data showed that, in 2023, the most affected demographic was individuals between 40 and 44 years old. “The rising divorce rate may suggest that South Africans are increasingly open to leaving unhappy marriages rather than staying due to social pressures”.

Pillay noted that “later-life divorce often involves more assets, business interests, and retirement savings – making financial settlements complex and emotionally draining”.

Dionne Nagan, legal counsel at Ninety One, said that when couples divorce, dividing assets can become a complex matter, particularly where retirement savings are involved.

Among the aspects Pillay said must be considered are property ownership disputes, the potential of splitting assets such as businesses and retirement savings, as well as perhaps having to pay spousal maintenance – otherwise known as alimony.

Renier Kriek, MD at Sentinel Homes, added that “if you own or intend to buy property for habitation, business or investment, you need to consider the implications before tying the knot”.

The stats agency also noted that marriage is becoming less prevalent: Over the past decade, the number of registered civil marriages has dropped a significant 34.2%. “Marriage, once considered a natural step in adulthood, is becoming less common in South Africa,” the agency said.

Worth noting, as well, said Pillay is that there is no such thing as a common-law marriage in South Africa, well, not legally anyway. “Living together doesn't automatically give you marital rights. However, courts may consider universal partnerships if you can prove shared finances and contributions,” she said.

Yet, with more couples cohabiting rather than marrying, financial planning must adapt, Pillay said. She said, in such circumstances, it’s best to have a cohabitation agreement.

“Do the smart thing and get advice from your attorney on the best way to proceed; a contract may seem unromantic when wedding bells are ringing, but it will protect you both in the long run,” said Kriek. “It’s just the sensible thing to do.”

Types of marriage regimes in SA.

Image: Nicola Mawson

PERSONAL FINANCE