Finding value in South Africa’s property market once meant stretching beyond major metros or compromising on space. Today, with interest rates easing and demand patterns shifting, R1 million can still unlock meaningful investment opportunities.

Image: Karen Sandison | Independent Newspapers

Finding value in South Africa’s property market once meant stretching beyond major metros or compromising on space. Today, with interest rates easing and demand patterns shifting, R1 million can still unlock meaningful investment opportunities.

“When investing in this price bracket, you need to know where to look and how to structure your purchase for maximum returns,” says Grant Smee, CEO of Only Realty Property Group.

The African Investor reports that two-thirds of residential transactions still occur below R900,000, with most sub-R1 million stock located in Gauteng, KwaZulu-Natal, and Cape Town’s northern suburbs. For buy-to-rent units in this range, Smee says rental yields of 8% to 12% are achievable, especially in high-demand metros and university hubs.

“For first-time investors in the R1 million sector, the key is getting onto the property ladder rather than focusing on buying your dream home. You want a property that works financially, delivers real return and doesn’t drown you in levies, special charges or inflated rates," he says.

According to Smee, entry-level opportunities in this price bracket still exist across South Africa, including smaller centres in the Eastern Cape, Free State, and Limpopo. But the strongest rental and appreciation play remains in the major urban markets, particularly fringe suburbs just outside traditional high-value zones.

In Gauteng, Johannesburg and Tshwane continue to offer a wide range of stock under R1 million, from sectional title apartments in Ferndale, Northwold and Witpoortjie, to townhouses in Ekurhuleni.

Ooba Home Loans places typical one-bedroom prices between R800,000 and R1.2 million. Smee emphasises that access matters more than postcode prestige: “Young people are moving further from job centres but still prioritise fast access to work hubs. That means areas linked to the Gautrain or major arterials are consistent performers.”

In the Western Cape, luxury dominates headlines, but affordability is real north of the CBD. “Suburbs like Parklands, Bellville, and Goodwood offer one-bedroom and studio apartments between R900,000 and R1.2 million, often with rental yields of 6 to 8%,” says Smee.

He believes shifting lifestyle preferences will push value further from the traditional core: “There’s a new energy in revitalising areas… We anticipate these markets maturing over the next five to ten years.”

Smee says KwaZulu-Natal is also showing renewed promise. Durban’s coastal recovery and urban regeneration are spurring investor confidence. Apartments from R650,000 remain available in Durban Central and South Beach, with strong student and young professional demand. For coastal properties with a higher price tag, there’s also holiday letting potential. “There is a massive upgrade starting along Durban beachfront, which bodes well for local property investors,” Smee notes.

Beyond location, investors must match the right property type to tenant demand and financial strategy. Multi-tenanted spaces are gaining traction, he says.

“There’s a massive opportunity in shared living and young professional communities with a real opportunity for independent investors to get into this space,” says Smee.

University nodes remain resilient. “Stable demand underpins returns in student areas. Areas with major institutions continue to outperform national averages, so it’s well worth considering co-buying in university nodes,” he says.

Sectional title units also remain popular, but Smee cautions buyers to check levy management carefully: “Rate hikes, poor trustee decisions, and bad managing agents erode returns. Become hands-on and consider serving as a trustee, as this is the best defence against mismanagement. Buying in a new development could be a good move, but you must ensure the developers come with experience and reputational backing.”

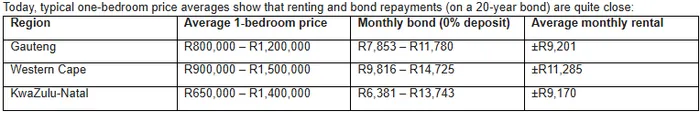

The debate between renting and owning continues to weigh on first-time buyers. Smee acknowledges the dilemma: “Household budgets have been under pressure for years, making renting feel like the safer call. But, the gap between renting and owning is narrowing.” Following a 125 basis point interest rate drop since late 2024, ooba Home Loans indicates that a R1 million bond now costs about R587 less per month, or more than R140,000 saved over 20 years. Smee stresses that the decision must be realistic: “If a property is cash-flow negative, can you absorb that without falling behind? At the same time, you don’t build wealth renting forever; eventually, you need an asset that works for you.”

Ownership does come with upfront costs. On a R1 million purchase with a 100% bond, estimated fees include bond registration of R34,258 and transfer costs of R28,221. Owners also take responsibility for rates, levies, and maintenance, which tenants typically avoid. However, the long-term financial benefit remains substantial. Capital appreciation averages 4% to 10% annually, depending on the segment, and no transfer duty applies under R1.1 million, he says.

Typical one-bedroom prices

Image: Supplied

“If you’re paying rental, that’s almost equivalent to a bond… it could be time to buy. This way, you’d be building an asset that continues to appreciate in value.

“In property, there are risks, also great opportunities,” continues Smee. “Start small, buy smart, and reinvest profit. For most people, one properly vetted purchase below R1 million is the first step toward a portfolio, not the finish line," says Smee.

PERSONAL FINANCE