Retirement saving: Where does it go wrong?

File Image: IOL

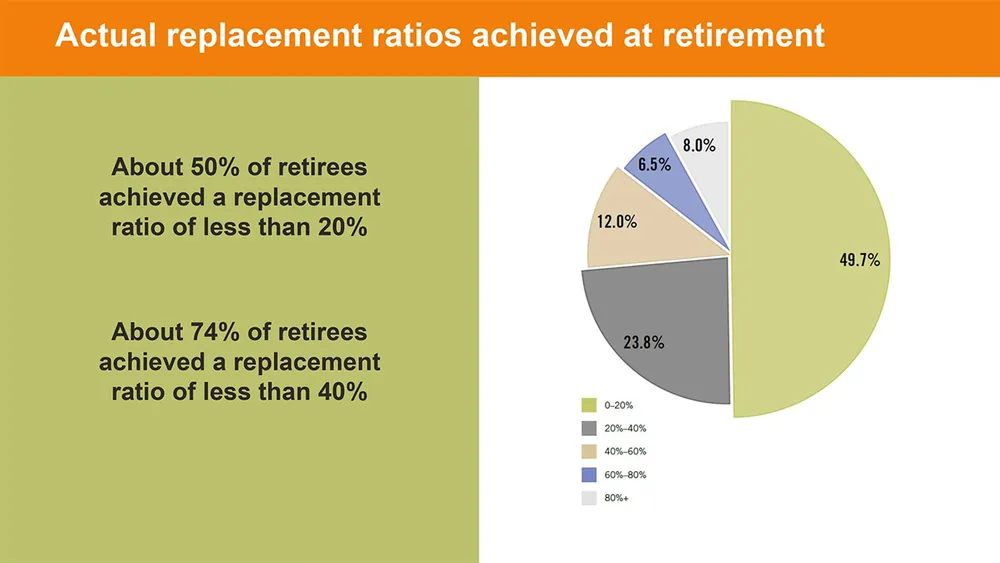

South Africans appear to be as bad as ever when it comes to saving for their retirement: about half (49.7%) of retirement fund members are retiring with a pension of less than one-fifth of their pre-retirement salary and only 6% have saved enough to retire with 75% or more of what they earned when they were working.

This is according to the most recent annual retirement survey (for 2019) by one of the country’s biggest retirement fund administrators, Alexander Forbes. With more than a million members in the funds it administers and its umbrella funds, the Alexander Forbes Member Watch has the biggest data sample of all retirement fund surveys in South Africa.

Retirement funds use what is known as your “replacement ratio” when calculating whether or not you are on track to have saved enough for retirement. This is the pension you will be able to afford as a proportion of your pensionable salary (your salary on which your pension deductions are based, which excludes additional income such as bonuses and allowances).

For example, if your pensionable salary just before you retire is R20 000 a month and if your savings can provide you with a sustainable pension of R4 000 a month, your replacement ratio is 20%.

The industry works on the assumption that most people can retire comfortably – essentially retaining their pre-retirement lifestyle – on a replacement ratio of 75% (R15 000 a month in the above example). This, according to the survey, equates to having accumulated savings of at least 12 times your gross annual salary by the time you stop working at age 65, but this figure does depend on your personal circumstances.

What the Member Watch survey shows – and, unfortunately, has continued to show each year – is that the vast majority of South Africans have saved nowhere nearly enough by the time they retire to be able to live comfortably off their savings.

(As a caveat, the survey takes into account only what members have saved in their retirement funds; it doesn’t include other savings or investments.)

The 2019 survey shows that contribution rates have remained relatively stable over the past few years, with employees contributing an average of 5% of salary and employers contributing 9.2%, resulting in an overall average contribution of 14.2%. But not all of this goes towards savings: if you subtract costs and group insurance contributions, the average member saves 12.3% of his or her salary each month.

The survey shows that even if you were diligent and saved 12.3% of your salary for 40 years – from starting work at age 25 to retiring at age 65 – you would, given certain return assumptions, reach a replacement ratio of only about 55%. You would need to save 17%, or almost an extra 5% of your salary, from day one, to reach 75%.

Making the situation far worse is the fact that most people do not accumulate savings over their full working life. They wake up to the importance of saving for retirement only later in life, typically only after they have held a few different jobs, and, more often than not, cashed out their savings each time.

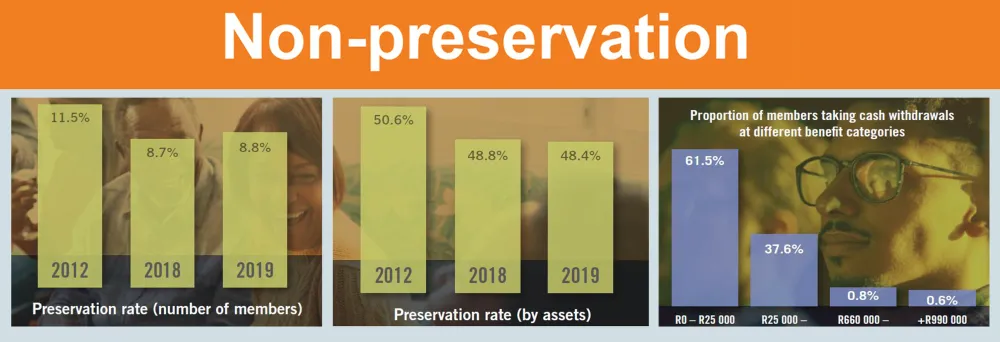

According to the survey, preservation rates – the rate at which members preserve their savings rather than cashing them in when they change jobs – are shockingly low. Only 8.8% of members preserve their savings (down from 11.5% in 2012) when they change jobs. Preservation rates are lowest at younger ages and when members have smaller amounts saved (see above).

This goes contrary to the government’s efforts to encourage South Africans to save for retirement, through tax breaks (as well as heavy taxes on pre-retirement withdrawals) and through the new retirement fund default regulations under the Pension Funds Act, with which retirement funds had to comply by March 2019. The default regulations require, among other things, that preservation is the default option when you change jobs (you must actively opt out), and that you are made aware of the dangers of cashing in your savings through retirement benefits counselling, which retirement funds must provide.

In a recent webinar presentation on the Member Watch survey, Vickie Lange, head of best practice at Alexander Forbes, said there were things both retirement funds and members could do to ensure better outcomes (see below). When asked by Personal Finance why the default regulations did not appear to be having an effect, she said it was probably too early to tell.

Lange emphasised the importance of communication. She said: “The results highlight how important it is for members to have access to communication, retirement benefits counselling and advice to make informed decisions over their lifetime to improve their long-term financial well-being. This has become even more important following the implications of Covid-19 on retirement fund members.”

WHAT CAN BE DONE TO IMPROVE OUTCOMES?

Lange said retirement funds can:

- Proactively engage with members at crucial points in the savings journey.

- Provide individualised solutions that better match your personal circumstances.

But there are also many things that you, as a member, can do. Lange had the following tips:

- Establish your financial goals early in life.

- Plan on how to meet your goals – develop a healthy savings habit.

- Discuss solutions with a financial adviser when it matters. “Life events, such as starting a career, are important triggers,” Lange said.

- Stay committed to achieving your goals. “Even when life throws you a curve ball, get back on track – don’t be derailed for the long term.”

- Start building resilience early in life – develop the ability to bounce back from adversity.

- Don’t accumulate high levels of debt, particularly bad debt, which is debt used to buy consumables or things that decline in value.

- “Ask yourself the tough questions to get your financial priorities in order,” Lange said, “so that the things that really matter to you are taken care of, and if you can’t, then ask for help.”

MEMBER WATCH QUICK FIGURES

- Age of members ranged from 17 to 73

- Median age of members: 37

- 54% of members were men, 46% women

- Average member contribution: 5%

- Average employer contribution: 9.2%

- Average costs plus group risk cover: 3.3%

- Average actual replacement ratio: 26.2%

- Average projected replacement ratio: 40.5%

- Preservation rate: 8.8% of members leaving a fund

To view the Alexander Forbes 2019 Member Watch summary Click Here.

PERSONAL FINANCE

Related Topics: