Run on Numbers: SA Reserve Bank’s Financial Stability Review: Idiosyncratic factors amplify risks

The SA Reserve Bank building in SA. Picture: Phill Magakoe

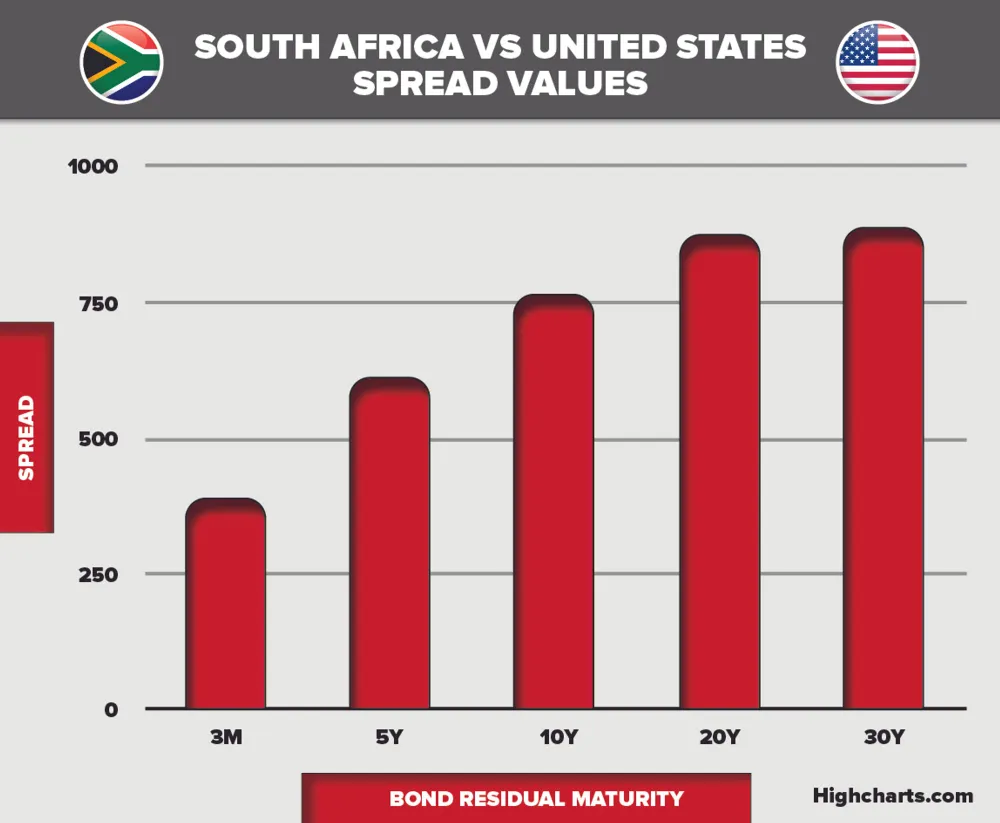

The Bond premium (Spread values) between the bonds of the two currencies are as depicted above for the various maturity terms. The market is King and if the above is the spread each individual investor must make their own decision. I for what it may be worth, will back the rand as an investor/trader.

A quick Google search will tell you that a bond’s yield relative to the yield of its benchmark is called a spread. The spread is used both as a pricing mechanism and as a relative value comparison between bonds. For example, a trader might say that a certain corporate bond is trading at a spread of 75 basis points above the 10-year Treasury.

In the Financial Stability Review presented recently, the Governor of the SA Reserve Bank made mention of the Government's Sovereign Debt relative to GDP. For South Africa, this number is between 70% and 80%. The USA is currently negotiating with the members of the representatives of the House of to raise the US debt ceiling which is currently at 130% of GDP.

I must admit as an ex-bond trader on the JSE Bond Exchange I am itching to call the end of the US Dollar Bull run of the last four decades. The world order can no longer tolerate the abuse of the US dollar. The rumble in the jungle is growing every day for a new BRICS currency. Yes, we all know we need huge liquidity which we do not have at present. But trust me the wheel is turning slowly at first but it will increase.

The Reserve Banks, Financial Stability Forum Media lock-up presentation at the end of May, was presented by Dr Herco Steyn and others. Steyn is the Lead Macro-prudential Specialist at the Bank. I was pleasantly surprised by the honesty and objective, transparent, professional and comprehensive assessment of the financial and systemic risks that our country is faced with.

“’Financial stability’ refers to a financial system that exudes and inspires confidence through its resilience to systemic risks and shocks, and its ongoing ability to efficiently intermediate funds. Financial stability is therefore not an end but is an important precondition for sustainable economic growth.”

- According to the South African Reserve Bank (SARB), systemic risk has increased in both domestic and global financial markets. The collapse of international regional banks, due to funding and liquidity pressures, has heightened vulnerabilities in the global setting. Fortunately, global banking sector turmoil has caused little to no interruptions in the domestic financial system so far. Idiosyncratic factors, such as the energy crisis, the worsening performance of the logistics network and the high government debt burden are driving local financial stability risks.

- The domestic financial cycle remained in an upward phase on the back of a continued recovery in private sector credit extension, equity prices and house prices in the fourth quarter of 2022. A rise in non-payments has accompanied the increase in private sector credit extension in light of deteriorating economic conditions which is a risk for the banking sector. The SARB will be revising the countercyclical capital buffer requirement because keeping it at 0% deems it ineffective as a countercyclical tool. The insurance sector was assessed to be in a relatively good condition but there is a rise in uninsurable risks.

- Since November 2022, the SA government bond yield steepened significantly on the back of domestic concerns. This increases the risk of a sharp repricing in government debt. Grey-listing is assessed to have longer-term implications if SA remains on the list for longer than 24 months. Insufficient and unreliable electricity supply is assessed to be the most severe (high likelihood) over the near term while the level of the financial sector’s preparedness for climate change risk is on the other end of the spectrum (low likelihood and a medium- to longer-term risk).

- Two new risks have been added to the Risk and Vulnerability Matrix, namely “capital outflows and declining market depth and liquidity” and “secondary sanctions amid heightened geopolitical fragmentation”. Higher financial stability risks can reduce business and consumer confidence, which can translate into lower investment and spending, and ultimately dampen economic growth prospects. Heightened financial stability risks can also raise risk aversion among investors and discourage capital flows.

- In addition, financial stability risks can cause lenders to become more cautious about extending loans which will make accessing credit by businesses and consumers more challenging. This will limit their ability to invest, expand or make large purchases. Ultimately, higher financial stability risks complicate monetary policy decision-making as authorities are forced to balance the potential for market disruptions with having to encourage investment and stimulate spending.

According to Momentum Investments, given the expectation of rates remaining higher for longer, the persistent load-shedding (possibility of stage eight in winter), logistics inefficiencies and deteriorating government finances, the current pressures on financial stability are unlikely to dissipate over the near term.

I cannot agree with every conclusion and will address my humble opinion in a follow-up article. But this presentation was a fresh breath of air compared to the comments we had to endure from other politicians about what was loaded onto and off Lady R and various other comments on political or economical issues we are faced with.

Kruger is an independent analyst.

PERSONAL FINANCE