China/US tariff truce extended – but too soon to make assumptions

ECONOMY

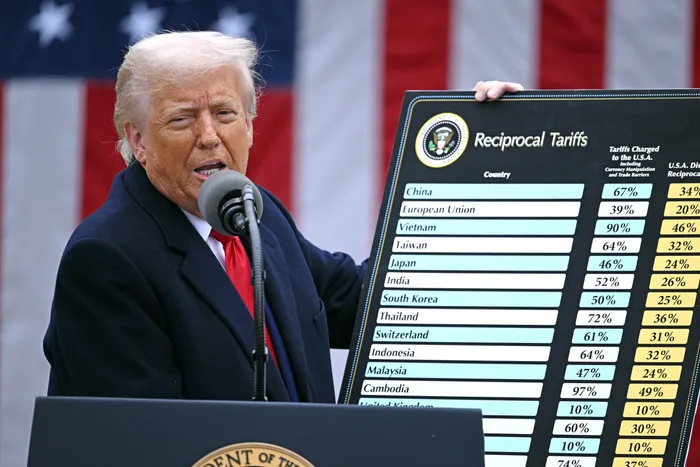

President Donald Trump holds a chart on reciprocal tariffs during an event titled ‘Make America Wealthy Again’, at the White House in Washington, DC.

Image: Brendan Smialowski/AFP

As we get closer to understanding the ultimate US tariff rate, asset prices will jostle with the potential impact on growth and inflation.

Risk assets rallied for another month in July as investors shrugged off tariff woes and focused instead on renewed growth optimism. Markets anticipated a growth recovery because the high tariff rates from April’s ‘Liberation Day’ were walked back, but as potential tariff rates rise again, markets are betting that deals will continue to be done.

All eyes on the big three

So far this has been a wise bet, as Trump announced trade deals with Vietnam, Indonesia and the Philippines at the start of July, with more sizeable wins announced with Japan, Europe and South Korea towards the end of the month.

With the UK already done, and the recent announcement of a trade truce between the US and China for another 90 days (until 10 November), eyes will turn back to the United States’ other large trading partners. Mexico and Canada are currently fighting with Trump, causing the tariff rate, particularly on Canada, to change almost daily.

For now, the markets are pleased with the US/China tariff extension, but this is by no means certain, and no deal has been signed. The China trade deal is the most likely to flare up again, which will have the greatest impact on total US tariffs.

Until we know more about these three largest trading partners, it’s too soon to calculate the final effective US tariff rate. Based on current receipts, the US is receiving a tariff rate of around 8-10%; however, based on current deals, this will rise to 17%, all else equal, which is above our economics team’s assumption of 12%. This will adjust the growth and inflation trajectory for the US in a more stagflationary direction.

This is causing the US Federal Reserve (Fed) to remain on hold. The decision to leave rates intact in late July was again a split decision (2 dissenters who favoured cuts). Federal Reserve Chair Powell emphasised that inflation is still above target, tariffs will likely increase inflation and that the labour market, while softening, remains solid and that monetary policy is only mildly restrictive. Powell also admitted that rates would be lower without the tariffs.

While Trump is looking to make trade deals, he is perhaps forgetting the deal he made with the American voter to bring inflation down.

Our 5-5-5 inflation rule of thumb

While tariffs are inflationary, they are also a consumption tax. This means they will negatively impact US consumption growth.

Early evidence suggests the impact from tariffs is being shared across the exporter, importer and the consumer, thus limiting the impact on the price level.

However, we have not yet seen the full impact of the higher 17% (and potentially higher again) tariff rate currently being negotiated.

At 15%, we believe 5% will be eaten by the exporter’s margins, 5% by the importer’s margins and the remaining 5% by the consumer through higher prices (call it our spin on Bessent’s 3-3-3 growth plan – our 5-5-5 inflation rule of thumb). If tariff rates move beyond 15%, we do not believe the corporates will absorb the extra increase in price, and this will then flow through directly to the consumer through higher inflation.

Fed Governor Waller’s argument to cut is premised on the notion that inflation won’t be as bad as expected, but the economy is already slowing.

He points to signs of labour market stress and that the establishment survey is overestimating employment growth, which we also think is a risk. This risk materialised on 1 August as the non-farm payrolls report saw May and June payrolls revised down by 258,000. These revisions flip the payroll narrative, showing deterioration rather than strength.

We think the US economy is slowing, but recession risk is low. Growth in household expenditure in the first half was weak, and manufacturing PMIs point to continued weakness. If the US cuts rates, this should help the economy recover. However, the impact on inflation and growth still rests on which tariff rate we settle on.

For now, the good news is that US corporates continue to defy expectations, with 80% beating expectations with an earnings surprise of 8.4% (as of 1 August).

Forward guidance is more positive in the second quarter, with over half the companies mentioning they will pass on tariffs through price increases. While this is good for profits, it may be bad for inflation and the economy if we settle on a rate higher than what is currently being decided.

Sebastian Mullins, Head of Multi-Asset and Fixed Income, Schroders Australia