This year’s Hotel Development Pipeline Report, the definitive study of international hospitality development projects in Africa, reveals record activity.

Image: Rudy and Peter Skitterians/Pixabay

A new report from the W Hospitality Group reveals an unprecedented surge in the hotel development pipeline across Africa, providing a beacon of hope for the continent's tourism and hospitality sectors.

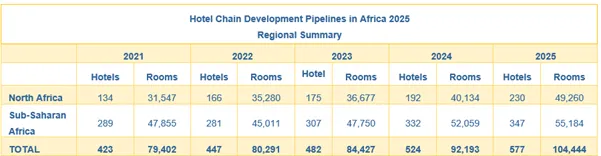

The 2024 Hotel Development Pipeline Report indicates a total of 577 hotels and resorts are under development, offering a staggering 104,444 rooms—an impressive 13.3% increase from the previous year. This significant growth stands in stark contrast to the single-digit increases seen in global hotel pipelines.

The report, compiled with data from 50 international and regional hotel chains, also highlights a remarkable expansion in North Africa, which has experienced a 23% year-on-year increase in hotel development compared to a 6% increase in sub-Saharan Africa.

Africa's hotel development pipeline soars with 577 projects underway

Image: Supplied

Over the past five years, the pipeline has grown at an annualised rate of 12% in North Africa and 4% in sub-Saharan Africa, illustrating a burgeoning interest in hospitality investments across the continent.

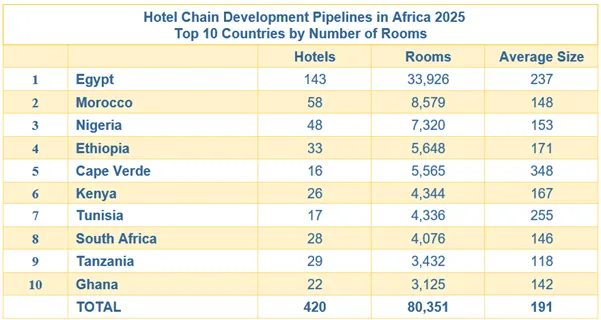

Leading the charge is Egypt, which dominates the hotel market with 143 hotels and 33,926 planned rooms. This astounding figure is almost four times the number of rooms in Morocco, the second-largest player, with 8,579 rooms across 58 hotels.

Countries such as Nigeria (7,320 rooms), Ethiopia (5,648), and South Africa (4,076) are following, but the disparity in numbers illustrates Egypt's robust position in the hospitality sector.

Despite its leading role, Egypt faces challenges, as fewer than 50% of its rooms are currently under construction—significantly less than Morocco's 72%.

International hotel chains have deals signed in 42 of Africa’s 54 countries.

Image: Supplied

Ethiopia boasts the highest ratio of rooms “on site” among the top 10 countries, demonstrating that while the number of planned hotels is impressive, actual progress may vary across different regions.

Disturbingly, many projects in Nigeria and Ghana have stagnated, with construction halted for years, sending ripples of concern about the reliability of the region's development commitments.

Interestingly, the report points to Cairo as the epicentre of the hotel boom, with plans for 17,757 new rooms across over 70 hotels.

This growth starkly contrasts with Sharm El Sheikh, where only 4,231 rooms are planned in fewer than 10 sites. Other notable cities in the development pipeline include Lagos, Addis Ababa, and Casablanca, each vying for a piece of the hospitality pie.

Major international hotel brands are key players in this growth, with Marriott International leading the pack with 165 hotels comprising 29,639 rooms. Following closely are Hilton and Accor, with significant contributions of their own.

Hilton has outpaced Marriott in terms of room additions, while Barceló Hotels & Resorts has made headlines with a remarkable doubling of its pipeline due to booming demand in North Africa.

Emerging trends from the report suggest a positive trajectory for the industry. The actualisation rate—the ratio of actual openings to expected openings—has nearly doubled from 21% in 2023 to 38% in 2024, indicating a recovery from the pandemic's devastating economic impacts.

With over 50% of the planned 104,444 rooms expected to open in the forthcoming years, optimism is resurging in the African hospitality landscape.

Resort developments are rapidly outpacing those in urban settings, a shift that reflects a growing preference for leisure travel. The average size of resort projects now stands at 210 keys compared to 170 for city hotels, with nearly half of last year's openings in resort locations.

Additionally, a trend towards franchising is notable, with almost 19% of new projects embracing this model, a significant increase from less than 10% just three years ago.

At the upcoming FHS Africa conference, senior decision-makers will convene to discuss these burgeoning opportunities.

Matthew Weihs, Managing Director of the Bench, emphasised the significance of these developments, stating, “The growth in hotel development across Africa is a testament to the continent's economic and tourism potential.”

Concluding insights from W Hospitality Group's Trevor Ward underscore the continent's potential, highlighting the 125 new deals signed last year, which amounted to 21,000 rooms.

His observation echoes a promising sentiment for the future of Africa's hospitality industry: development has merely scratched the surface, with cities projected to lead the global landscape in coming decades.

IOL