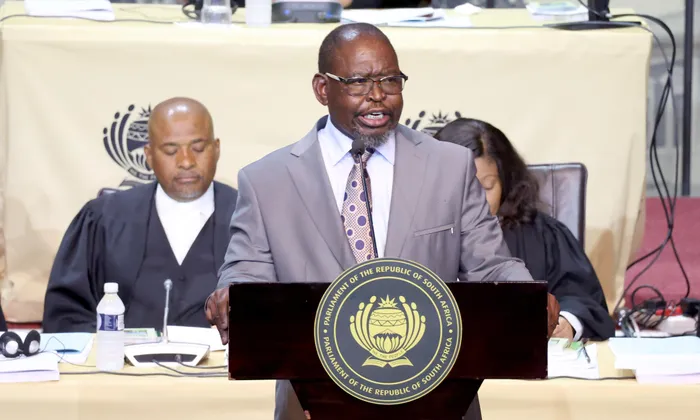

Godongwana plans reviews of ghost workers, exec remuneration to enhance the fiscus

FINANCE

Finance Minister Enoch Godongwana said there were new reviews that Treasury planned to conduct, including an audit of ghost workers in the public service, an infrastructure conditional grant review, and a review of the remuneration of executives and board members of public entities

Image: Phando Jikelo / GCIS

Finance Minister Enoch Godongwana has set forth a strategic vision for the National Treasury aimed at achieving sustainable public finances, including wide-ranging spending reviews, while enhancing the effectiveness of revenue collection.

The department's budget for the medium term stands at R91.835 billion, reflecting an average growth rate of 6.2% from 2024/25 to 2027/28.

The largest portion of this budget of R45.760 billion (49.8%) is earmarked for transfers to the South African Revenue Service (Sars).

This allocation marks an R8bn increase over the 2024 Estimate of Expenditure, highlighting the government’s commitment to bolster Sars' operational and capital projects, which are pivotal in recovering the country’s revenue streams.

"Part of this increase is to improve effectiveness in revenue collection by enhancing theirability to collect debt through better systems, increasing staff capacity and modernising theirprocesses to establish e-invoicing for VAT, instant payment systems and upgrades ofcustoms infrastructure," Godongwana said.

The National Treasury’s core function, as articulated by officials, centres on achieving sustainable public finances through robust controls. The Annual Performance Plan for 2025/26 presents a clear path to advancing key outcomes such as job creation, poverty alleviation, and broader financial inclusion.

Godongwana said efforts to enhance spending efficiency were now more critical than ever.

Since 2013, 276 spending reviews have been conducted, with the Treasury committed to implementing recommendations arising from these assessments.

A thorough review of public employment and labour market activation programmes has recommended rationalising 37 initiatives across 16 governmental departments.

"I will be going to Cabinet to get commitment from colleagues to implement the outstanding recommendations arising out of these spending reviews," Godongwana said.

"This includes our review of government spending on the numerous public employment and labour market activation programmes across government, which has recommended the rationalisation of the 37 programmes across 16 departments."

Beyond this, Godongwana said there were new reviews that Treasury planned to conduct, including an audit of ghost workers in the public service, an infrastructure conditional grant review, and a review of the remuneration of executives and board members of public entities.

To restore fiscal sustainability, Godongwana said Treasury was focused on achieving a growing primary surplus, ensuring that the public debt-to-GDP ratio stabilises and curbing reliance on borrowing.

Through a growing primary surplus, the public debt-to-GDP ratio will stabilise over time and ensure that the government does not rely on additional borrowing to cover its non-interest expenses," he said.

He said plans were underway to implement additional fiscal measures as public comments on recent technical papers were reviewed.

Treasury is also addressing critical issues surrounding disaster risk financing.

In light of climate change-induced disasters that have recently impacted regions like Eastern Cape and KwaZulu-Natal, Godongwana said the government is prepared to implement the National Disaster Risk Financing Strategy—an initiative aimed at proactive budgeting and responsive fiscal planning.

Ongoing reforms in the financial sector aim to foster greater inclusivity and consumer protection. The draft Conduct of Financial Institutions (COFI) Bill seeks to consolidate existing laws into a cohesive framework that enhances regulatory oversight, ensuring fair treatment for financial consumers.

In a concerted effort to strengthen South Africa's position against illicit financial activities, a General Laws Anti-Money Laundering and Combating Terrorism Financing Bill is nearing finalisation. This legislation is a critical step towards fortifying the country’s response to financial crimes.

Sars' persistent investigations have already yielded R4.8bn in tax recovery, while collaborative efforts with professional bodies ensure consequence management for those implicated in wrongdoing.

The interventions detailed are part of a broader strategy to achieve fiscal stability and foster sustainable economic growth through transparent governance and robust public finance management.

Godongwana said Treasury remained committed to collaborating with various stakeholders, including Cabinet members, civil society, and financial institutions, to implement these ambitious plans.

"They represent the department’s efforts in achieving sustainable public finance, advocating coherent economic policy, ensuring sound financial controls and management of public finances and increased public infrastructure investment," he said.

BUSINESS REPORT