Likely interest rate cut next week brings thousands in savings, but higher rates could follow

Economists agree that the South African Reserve Bank (SARB) will drop interest rates at its meeting next week, with an announcement expected on Thursday at 2pm. However, future cuts could be scuppered if the inflation target is dropped.

Image: Pixabay

Economists agree that the South African Reserve Bank (SARB) will drop interest rates at its meeting next week, with an announcement expected on Thursday at 2pm. However, future cuts could be scuppered if the inflation target is dropped.

The rate at which SARB lends to local banks is currently 7.5%, with banks generally lending at 11% to consumers, unless they are not high risk, in which case borrowers can get a rate that is below prime.

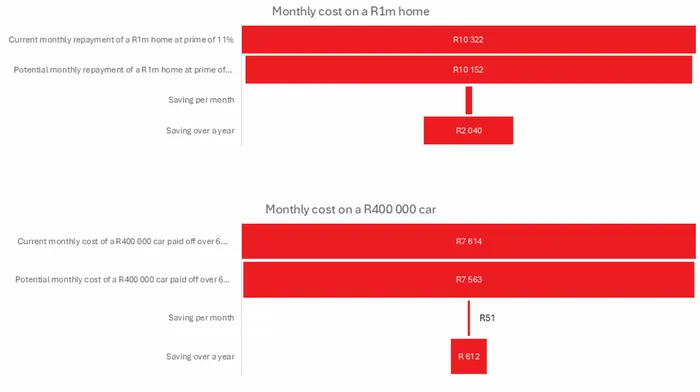

Based on calculations using ooba homeloans’ online tool, a homeowner will save R2 040 over a year if they have a R1 million home they are paying off over the standard 20-year period.

These calculations have been worked out on an interest rate of 11% and then 10.75%, which is in line with others freely available on the internet.

Interest rate effects on home and car repayments.

Image: IOL

Taking the average price of a car in South Africa of R400 000, the annual saving will be R612 – using an Auto Trader calculator with the same prime rate figures as for a home, although the results would be the same with any other calculator that can be found online.

The Bloomberg consensus is for a 0.25 percentage point cut.

Investec chief economist, Annabel Bishop, noted that “lengthy signalling of a lowering of the inflation target, but no announcement, has also led to expectations of an interest rate cut”.

Andre Cilliers, currency strategist at TreasuryONE, said the SARB’s Monetary Policy Committee “is expected to cut rates by 25bps given the recent inflation data and strong recovery in the rand”.

Meanwhile, Old Mutual chief economist, Johann Els, has previously said that he expected an interest rate cut, also of 25 percentage points, next week on the back of a stronger rand. The currency opened at R17.89 on Tuesday morning, a level at which it has been lingering after breaking through R18.

Casey Sprake, economist at Anchor Capital, has previously told IOL that the latest inflation data, of 2.8% as of April, strengthens the case for monetary easing. “We expect SARB to cut the repo rate by 25 basis points at its upcoming MPC meeting on May 29,” she added.

However, a lower “inflation target risks scuppering interest rate cuts this year,” warns Bishop. As a result, she said that “with a change to the inflation target reportedly occurring soon this year, the SARB could choose to cut interest rates this month to avoid the limitation of doing so in the future but then could easily be at risk of needing to reverse the cut.”

Bishop noted that the inflation rate target, currently between 3% and 6%, is likely to be lowered, with the Reserve Bank having said that this is imminent, although the Finance Department is responsible for changing the target.

SARB’s deputy governor, Fundi Tshazibana, is reported to have said, “we are at the point where the technical teams will make recommendations to the minister of finance and the governor of the Reserve Bank,” Bishop said in a note.

Bishop warned of higher inflation in the medium-term, at 4.5%, which will adversely affect people’s spending ability. Higher inflation will translate into interest rates being put up. The South African Reserve Bank has typically done this in moderation, with 0.25 percentage point hikes.

The central bank explained on its website that its monetary policy is also driven by the need to protect the value of the rand. When interest rates are cut, the local currency strengthens because higher interest rates attract foreign investment.

IOL