Rand in favour as dollar drops on back of Trump’s policies

South Africa’s local currency is hanging on below R18 to the dollar on the back of a weaker US dollar – a position US President Donald Trump seems to favour.

Image: File

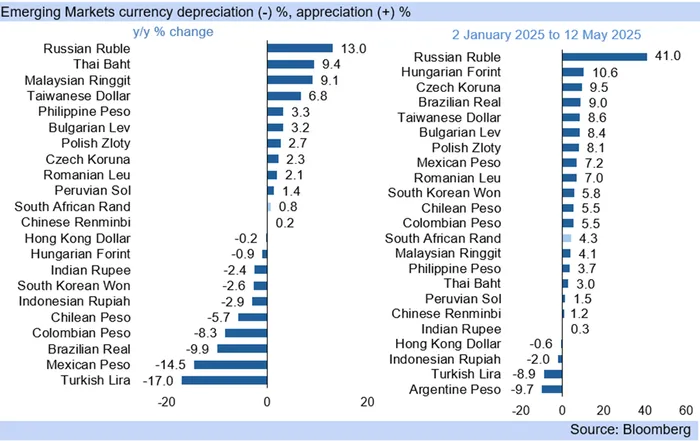

South Africa’s local currency is hanging on below R18 to the dollar on the back of a weaker US dollar – a position US President Donald Trump seems to favour. However, even as investors turn to riskier assets, the rand is only in ninth place in the Bloomberg emerging market currency basket ranker.

The currency opened at R17.89 on Tuesday morning, more or less on par with where it has been over the past about two weeks. By mid-morning, it was at R17.93.

Investec chief economist, Annabel Bishop, said in a note that this was because the US dollar’s weakness was a major support. “The greenback has dropped sharply from recent highs, on concerns over US tariffs and the US President seen to favour US dollar weakness,” she said.

EM currency depreciation on 27 May

Image: Bloombery

Bishop noted that Trump apparently wants a weaker dollar for trade support. Recently, that country’s President has been negotiating trade tariffs with several major markets, including South Africa, after shocking the world and US markets with high and unexpected import duties on April 2 – his so-called “liberation day”.

Trump later backtracked some of these taxes, dropping them to 10% for 90 days as of April 3, bringing a sigh of relief to markets.

However, the rand’s strength against the dollar is not reflected in other forex trades, noted Bishop and it has not gained as much as some other currencies, including those of the Philippines, Thailand, and Malaysia.

Bishop also pointed out that the rand has weakened against the euro and against the UK pound. “The rand has not strengthened on its own, but reflects US dollar weakness,” she said.

Andre Cilliers, currency strategist at TreasuryONE, seems to disagree, stating that the rand is the “star performer amongst emerging market and risk-sensitive currencies”.

Bianca Botes, director at Citadel Global added that the rand is “taking its cues from the global landscape and the South African Reserve Bank interest rate decision, which will be released later this week”.

IOL