In the second quarter, the index rebounded somewhat, although confidence remains below the more positive readings recorded during the second half of 2024

Image: Karen Sandison/Independent Media

First National Bank and the Bureau for Economic Research’s latest Consumer Confidence Index shows that families with an income of between R5,000 and R20,000 are more confident than those on either side of them.

In the second quarter, the index rebounded somewhat, although confidence remains below the more positive readings recorded during the second half of 2024, FNB said in a statement on Thursday.

This, said FNB chief economist, Mamello Matikinca-Ngwenya, is the result of several of adverse shocks that knocked consumer sentiment during the first quarter of 2025, including the initial proposed VAT increase in the first budget, the fallout between the ANC and the DA about the National Budget, brief return to Stage 6 load-shedding as well as “US President Donald Trump’s alarming import tariff proposals”.

Consumer Confidence Per Income Group_BER_FNB

Image: Supplied/Nicola Mawson

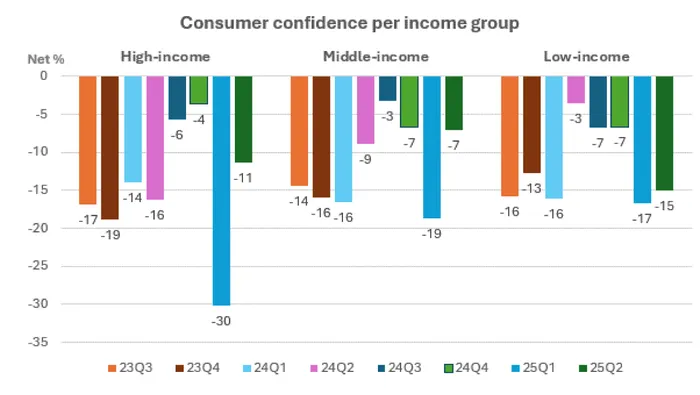

Improved sentiment is not uniform across all income groups, ranked from middle-, high, and then low-income consumers in terms of how much more confident they were than a year ago.

For homes with an income of more than R20,000 a month (high-income), confidence may be up, but remains below the feelings of happiness in the second half of last year. For homes with an income of between R5,000 and R20,000 (middle) – confidence was the same as how they felt at the end of last year, while low-income earners still bear the brunt of a bad socio-economic environment.

“Middle-income confidence is currently significantly higher compared to high- and low-income confidence, said Matikinca-Ngwenya. Additional two-pot pension fund withdrawals at the start of the new financial year in March and another 25-basis point cut in the prime interest rate at the end of May are supporting highly indebted middle-income households in particular,” she said.

Matikinca-Ngwenya noted that “low-income earners are less likely to have pension funds, while the R30,000 annual cap on two-pot withdrawals implies that these withdrawals will deliver a relatively smaller boost to the disposable income of high-income households compared to that of middle-income households.”

Lower fuel prices and the increased availability of more affordable new vehicles are also benefitting middle-income households, said Matikinca-Ngwenya.

Those living in households earning less than R5 000 a month were hard hit by a lack of access to the formal credit sector, higher food inflation, as well as higher unemployment. Statistics South Africa’s latest unemployment figures showed that 90 000 people lost their jobs in March.

Food inflation increased from 1.5% year-on-year in January to 4.4% in May and is projected to tick up further, which will disproportionately affect low-income households, said Matikinca-Ngwenya.

“The devastating floods that swept through the Eastern Cape, as well as the alarming increase in the unemployment rate during the first quarter, may also be weighing down the confidence levels of less affluent consumers,” she said.

IOL

Related Topics: