South Africans are feeling more in control of their money - even in a tough economy

Employed South Africans are showing renewed financial optimism, with three-quarters expecting improvements in their personal finances within six months, marking the highest confidence level since the COVID-19 pandemic.

Image: Unsplash

Employed South Africans are demonstrating renewed financial optimism and resilience amid persistent economic challenges, according to the latest Old Mutual Savings & Investment Monitor (OMSIM) report released this month.

The 2025 OMSIM study, which surveys working South Africans earning at least R8,000 monthly, reveals that three quarters of respondents expect their personal finances to improve within six months, the highest confidence level recorded since the COVID-19 pandemic began. Younger workers, especially those from Gen Z, are even more hopeful, with nearly nine out of 10 anticipating better financial conditions ahead.

However, gross domestic product is mediocre at best, with the first quarter’s figure at 0.1%, while the International Monetary Fund expects the full year to be 1% year-on-year, a figure that may be undermined by US President Donald Trump’s trade tariffs.

Income growth is, however, on the rise, with almost half of participants earning more than they did a year ago, Old Mutual found. Many are embracing "poly-jobbing," or earning from multiple income sources, with more than half reporting this practice and three out of four young people engaging in it. Nearly half of respondents own or co-own a business, highlighting a strong entrepreneurial spirit, it said.

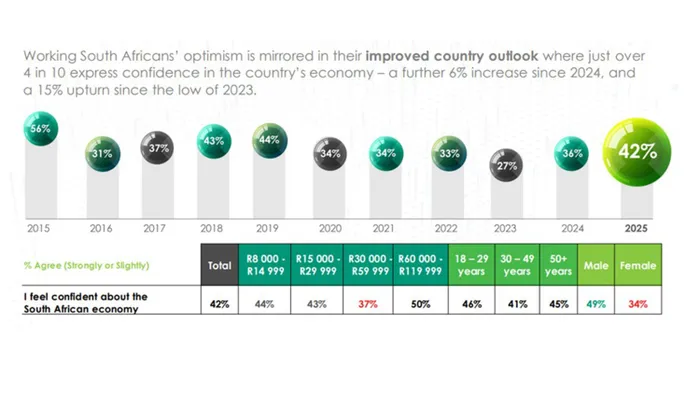

Working South Africans’ optimism is mirrored in their improved country outlook, says Old Mutual.

Image: Old Mutual

However, debt remains a concern. While more than half have managed to reduce their debt levels over the past year, and about one in three have renegotiated repayment terms with creditors, widespread gambling is troubling, the report noted. More than half of working South Africans reported gambling, with close to two out of five doing so in an attempt to cover expenses or repay debt - signaling financial vulnerability in some sectors, said Old Mutual.

Meanwhile, data from DebtBusters and Statistics South Africa continue to show pressure on consumers.

Use of personal loans remains widespread, with the vast majority of debt counselling applicants holding such loans amid rising living costs for essentials like electricity and fuel.

Old Mutual found that short-term savings habits remain robust, with households typically putting aside more than one-fifth of their income, often through trusted informal savings groups like stokvels. Although almost all agree on the importance of saving for retirement, fewer than one in three prioritise it, pointing to a gap in long-term financial planning.

The report reflects a cautious but clear shift from crisis management to proactive financial strategies, the company said. Old Mutual’s Vuyokazi Mabude notes, “the results show that while life is still difficult for many, working South Africans are making tangible progress. There is a notable rise in income, confidence, and an entrepreneurial spirit, particularly among the youth. People are taking control of their finances, seeking out additional income sources, managing debt more intentionally, and placing greater importance on saving.”

As South Africa navigates a complex economic recovery, OMSIM’s findings suggest many are taking control of their financial futures, combining resilience with cautious optimism.

IOL

Related Topics: