Swipe surge: Why South Africans are suddenly leaning on their credit cards

New credit card limits have been slashed by nearly a fifth compared to last year.

Image: Simphiwe Mbokazi | Independent Media

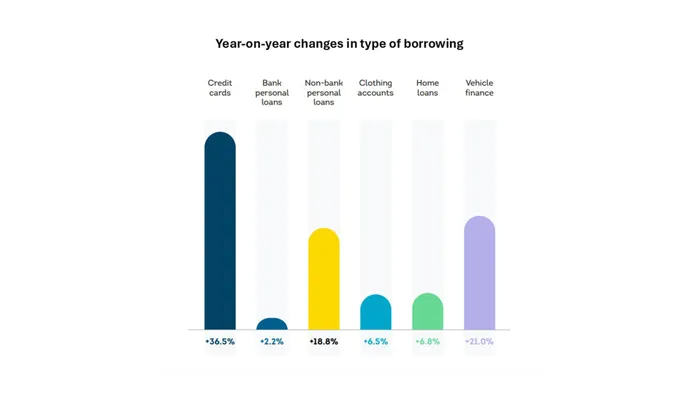

South Africans are seemingly splashing out on credit, with credit card originations surging more than a third in the second quarter as interest rate relief finally gives consumers room to breathe.

Yet, there are other indications that many South Africans are drowning in debt.

TransUnion's latest Industry Insights Report, released on Tuesday, reveals that Millennials are responsible for nearly half of all new credit cards issued in the second quarter of 2025.

Ayesha Hatea, director of research and consulting at TransUnion South Africa, believes that the “latest credit card trends reflect strategic credit use and disciplined repayment behaviour among a financially stretched borrower base”.

However, DebtBusters’ 2025 Money Stress Tracker showed that, for people feeling financially stressed, short-term concerns continue to dominate, with the top two being running out of money before the end of the month and struggling to pay off monthly debt.

Positively, Hatea noted that the “combination of rising origination volumes and shrinking new credit lines suggests that lenders are working to balance growth with prudent risk management”.

Gen Z and Millennials combined grabbed almost two-thirds of new vehicle loans.

Image: TransUnion

She added that “lenders may need to refine their segmentation strategies, enhance early warning systems, and tailor credit line management to sustain portfolio health while supporting customers’ financial needs”.

Gen Z and Millennials combined grabbed almost two-thirds of new vehicle loans as they set their eyes on new (or new to them) cars, TransUnion’s research showed.

It also noted that first-time home buyers – mostly younger consumers – secured just over half of all home loans, the highest proportion in over five years.

However, lenders are quietly pulling back the reins, TransUnion’s data showed.

New credit card limits have been slashed by nearly a fifth compared to last year, even as banks chase growth by lending to riskier borrowers.

The repayment reality check

With borrowing on the increase, TransUnion's data reveals mixed payback trends.

Credit card account delinquencies improved, but home loan defaults went up, suggesting many are struggling to keep up even as market conditions improve.

Vehicle finance showed delinquency rates declining.

DebtBusters' Money-Stress Tracker survey, conducted in May and June with over 27,000 respondents, showed that seven out of ten South Africans are losing sleep over money – and it's taking its toll.

Among those experiencing financial stress, 91% say it affects their home life, while 73% report impacts on both their work life and their health.

Women bear the heaviest burden, experiencing significantly higher stress levels than men across every measure.

Debt payments hurt

At the same time, paying off debt is eating into take-home pay. Nearly two-thirds of consumers are spending 30% or more of their take-home pay on debt repayments.

Almost half are spending over 40% while, those aged 45 and older, three in five are trapped in debt spirals.

In a cruel twist, those earning more than R20,000 monthly are among the most stressed, often qualifying for – and recklessly taking on – more credit than they can realistically afford.

This comes as the PayInc Net Salary Index increased marginally in August 2025 to a level of R21 222, 0.2% up on July’s level and 2.0% higher than a year ago.

“The upward trend evident in net salaries during 2024 spilled over to 2025, with the average nominal net salary in the first eight months of 2025 up by 4.6% compared to the corresponding period in 2024,” it said.

IOL Business