Why Banxso's R2bn fine broke records

Banxso fined R2 billion from FSCA for serious financial misconduct.

Image: File

Tuesday’s record fine against Banxso sends a clear signal that the Financial Sector Conduct Authority (FSCA) is clamping down on companies it believes have defrauded unsuspecting and ill-informed ordinary people.

The R2 billion penalty against Banxso and its directors eclipses the R1.5 billion headline fine in the Steinhoff matter and reflects not just the scale of alleged misconduct, but the nature of the victims: thousands of retail investors, including pensioners, who lost ordinary savings rather than sophisticated shareholdings.

Court documents suggest more than 7,000 investors may have been affected, with at least 130 losing R133.3 million.

The FSCA’s investigation found that Banxso misappropriated client funds, misled clients with false information, and consistently failed to act in their best interests.

Unlike Steinhoff, where cooperation with regulators led to a dramatically reduced final penalty of R53 million, reports indicate Banxso continued operating illegally even after regulatory warnings and resisted remedial action.

In addition, Steinhoff misled shareholders investing in a multi-listed company, while the FSCA found that Banxso misappropriated retail client funds and failed to act in retail investors’ best interests. The regulator has referred the matter to the South African Police Service, though specific charges have not yet been disclosed.

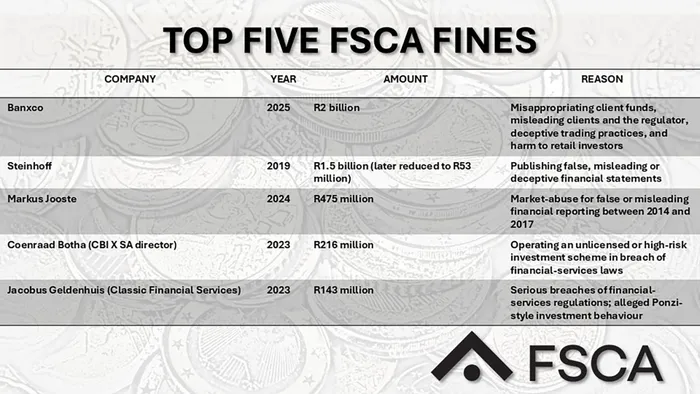

Top FSCA fines by value.

Image: Nicola Mawson | IOL

Company assets in limbo following provisional liquidation

Following a lengthy written judgment, Banxso was provisionally liquidated with a liquidator appointed. The company’s assets now remain in limbo pending a final ruling. Investors can register claims but cannot currently access any funds.

However, Banxso has indicated it will appeal this order, according to a blog post on Moonstone’s website. Moonstone quoted a Banxso statement saying: “We will do everything necessary to secure a just and equitable outcome and prevent the dissipation of client funds.”

This indicated that it aims to ensure that assets are not sold below market value, funds are not distributed to preferred creditors improperly, and accounts are not frozen inappropriately during liquidation.

Considering legal options

Afrimarkets, the company associated with Banxso through common directorships and key persons – and viewed as one entity by the FSCA – has also indicated it is considering its options regarding the regulator’s punishment.

In a statement, Afrimarkets said: “Our primary focus remains on our clients and ensuring their interests are protected throughout this process.”

The statement added that stakeholders “wish to emphasise that our clients are at the heart of everything we do. We are exploring all available legal options to ensure a just outcome that favourably protects client interests.”

Banxso affiliate Afrimarkets is considering its options

Image: File | IOL Archives

Afrimarkets acknowledged that the news may cause concern and stated that “we want to assure our clients that we are working diligently to navigate this matter responsibly”.

The company explained it is “engaging with legal and regulatory advisers to thoroughly assess every avenue available under the Financial Sector Regulation Act.

"The company remains committed to transparency and will provide further updates as soon as we are able to share more information.”

FSCA investigation uncovers multiple violations

The FSCA’s investigation found multiple regulatory breaches at Banxso, including misappropriation of client funds, providing misleading information, and promising unrealistic returns.

The regulator determined that the company consistently failed to act in clients’ best interests, putting their financial well-being at risk.

Banxso’s conduct violated multiple key regulations, including the Financial Sector Regulation Act, the Financial Advisory and Intermediary Services Act, and the General Code of Conduct for Authorised Financial Services Providers.

The FSCA described these violations as representing a serious breach of trust within the financial services sector.

Beyond the headline R2 billion penalty, the FSCA also imposed a R16 million fine for other contraventions, including providing false or misleading information to both clients and the regulator, and co-mingling client funds with business funds.

In setting the penalties, the FSCA considered both the financial gain the company and its directors derived from their misconduct and the wider impact on clients and the integrity of the sector.

Individual directors received fines ranging from R5 million to R20 million and were barred from the industry for periods between 10 and 30 years.

Given the seriousness of the findings, the FSCA has referred the matter to the South African Police Service, providing full evidence from its investigation.

Former Steinhoff CEO Markus Jooste.

Image: Armand Hough | Independent Newspapers

How Banxso’s penalty compares to Steinhoff

Steinhoff’s 2019 penalty of R1.5 billion – imposed after publicly released financial statements covering 2014 through 2017 were found to be false, misleading or deceptive – is considerably smaller than Banxso’s punishment.

One factor may be that Banxso dealt directly with public money, whereas Steinhoff misled shareholders investing in the then multi-listed company.

Another significant difference is that Banxso did not attempt to mitigate the penalty.

This lack of cooperation – combined with the scale of client harm and the misappropriation of funds – contributed to the FSCA imposing the record-breaking R2 billion fine.

This contrasts sharply with the Steinhoff matter, in which the FSCA reduced its headline R1.5 billion fine to R53 million after considering several mitigating factors.

The regulator noted that much of the misconduct was carried out by former executives, that the company was in a precarious financial position, and that current management had cooperated fully with the investigation.

This cooperation and the historical nature of the wrongdoing were key factors in determining a lower penalty while still holding the company accountable.

Steinhoff executives faced additional consequences

Steinhoff and its executives faced additional penalties beyond the company fine.

Former CEO Markus Jooste, who died in March 2024 reportedly from a self-inflicted gunshot wound, faced a separate R475 million penalty for his role in knowingly issuing misleading reports.

The latest available information indicates the FSCA is still attempting to secure this money from his estate.

Dirk Schreiber, the former European CFO, cooperated with regulators and avoided FSCA penalties, though he was later convicted of fraud in Germany.

Former finance executive Ben la Grange pleaded guilty to a fraud charge in South Africa and received a partially suspended jail sentence.

Other senior executives, including Iwan Schelbert and Hein Odendaal, were arrested in 2025 on charges of fraud and racketeering and released on bail pending trial.

Stéhan Grobler, formerly head of treasury, was also arrested and granted bail.

IOL BUSINESS

Related Topics: