For many South Africans, Januworry means scrutinising every rand - including what gets taken out of your bank account in monthly fees

Image: Freepik

January often brings a sharp focus on spending.

For many South Africans, Januworry means scrutinising every rand - including what gets taken out of your bank account in monthly fees, penalty charges and add-ons that may not deliver real value.

Although dated, research from the Competition Commission of South Africa shows that bank fees rise sharply as account tiers increase, while the practical benefits often do not increase at the same pace for most users.

This finding is also anecdotally backed up by the FinScope Consumer South Africa survey from 2023, which finds that many banked adults rarely use accounts fully or maintain low balances.

What the research says about bank pricing

The Competition Commission’s Banking Market Inquiry between 2017 and 2019 examined retail banking fees and found that many structures are complex, bundled and difficult for consumers to compare.

Bundled accounts, for instance, often result in customers paying for transactions and services they do not fully use.

Meanwhile, FinScope Consumer South Africa 2023 shows that while formal access to banking is now widespread, financial stress remains high.

Many households spend most of their income on essentials, making high banking fees for unused perks particularly burdensome.

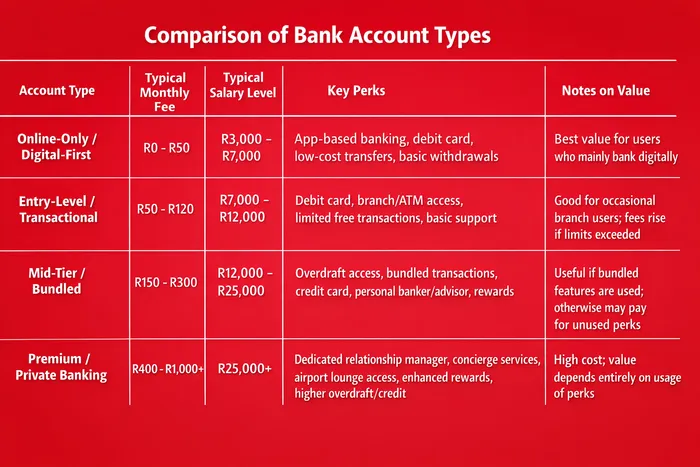

Based on internet research into generic bank account types, here's what you'll pay vs what you get in fees.

Image: ChatGPT

Common bank account types, costs, perks, and salary levels

Online-only or digital-first accounts

Typical monthly cost: R0–R50

Generally includes:

Typical salary level: ~R3,000–R7,000/month

Value reality: Ideal for digital banking users who rarely need branches. Provides core functionality at minimal cost.

Entry-level transactional accounts

Typical monthly cost: R50–R120

Generally includes:

Typical salary level: ~R7,000–R12,000/month

Value reality: Works well for those who occasionally need in-branch services. Costs rise if transaction limits are exceeded.

Mid-tier or bundled accounts

Typical monthly cost: R150–R300

Generally includes:

Typical salary level: ~R12,000–R25,000/month

Value reality: Offers convenience for active users, but many customers pay for bundled services or rewards they may not fully use.

Premium or private banking accounts

Typical monthly cost: R400–R1,000+

Generally includes:

Typical salary level: R25,000+/month

Value reality: Designed for high-income or high-balance clients. Benefits are only worthwhile if perks are actively used, otherwise the monthly fee may outweigh tangible value.

A January reality check

The Competition Commission notes that complex pricing and bundled fees make it difficult for consumers to match costs with actual use, while FinScope data shows many households are financially stretched.

In practical terms, January is an ideal time to ask:

Reviewing account fees alongside insurance, subscriptions, and mobile contracts can reveal easy monthly savings - sometimes enough to make a real difference in a tight budget.

IOL BUSINESS

Related Topics: