income is increasingly tied up in repayment commitments, especially as consumers navigate multiple lenders.

Image: Pixabay

South Africans are borrowing differently today than they were ten years ago, according to the latest DebtBusters Debt Index, which tracks household debt patterns over time.

The data shows an increase in multi-credit relationships, with more consumers holding multiple credit agreements at once.

Vehicle loans, in particular, are stretching over longer terms, giving borrowers more manageable monthly payments but often extending the time they remain in debt. Some loans are as long as eight years in duration.

The overall annual net income ratio appears to have worsened for many income bands; those taking home R35,000 or more have an overall income ratio of 210%, which is the highest level the debt review company has seen.

Middle-income earners generally experience lower levels of debt stress than higher earners, while lower-income groups continue to grapple with shorter-term, higher-interest obligations.

Across the board, unsecured debt has grown, highlighting the need for careful management to avoid financial strain.

Benay Sager, executive head of DebtBusters, pointed to shifting borrowing behaviour.

“We've also seen an expansion in the multi bank relationships, the number of credit agreements, or open trades, as it's known in industry per consumer. When people applied to debt counselling, this used to be around 6.5-7. Now it's up to 8.7 which is a significant increase,” he said.

The index also highlights how income is increasingly tied up in repayment commitments, especially as consumers navigate multiple lenders.

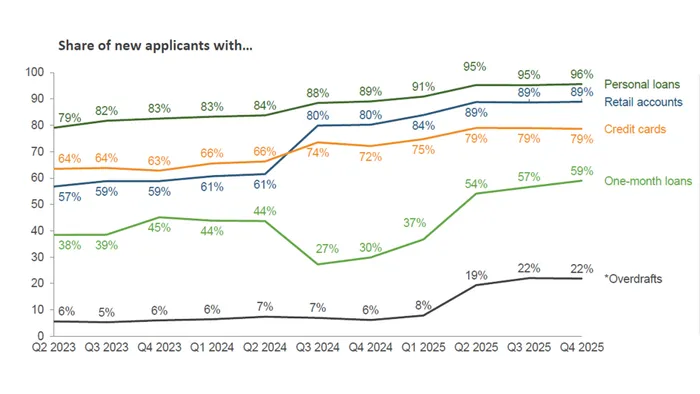

Growth of various types of loans since the second quarter of 2023.

Image: DebtBusters

Over the past decade, factors such as interest rates, economic uncertainty, and the availability of credit products have influenced how South Africans borrow, repay, and prioritise debt.

During the past decade, electricity tariffs have increased by 165%, petrol by 74%, and the compound effect of inflation is 49%.

By contrast, income growth has lagged considerably, said Sager.

“The result is that consumers who applied for debt counselling in Q4 2025 needed 71% of their take-home pay to service their debt – the highest level we’ve seen since 2017,” Sager noted.

Yet, macro data from PayInc’s November 2025 Net Salary Index shows why some households ended 2025 on firmer footing.

While average nominal take-home pay was largely flat month-on-month at R21,414 in November, salaries were up about 4% year-on-year.

A record 96% of these consumers had a personal loan, and 59% a one-month payday loan – another record

Sagar added DebtBusters had seen huge interest from the consumer base to really help them stretch their finances so that they could consider going to a movie. He noted that people were looking for good deals and discounts.

“We're feeling we're feeling that 2026 will be an important year for the South African consumer,” said Sagar.

IOL BUSINESS

Related Topics: