High inflation and unemployment pressure South African households – will relief come later in 2025?

The SARB's restrictive monetary policy has been the main reason for the consistent decline in the per person average disposable income of South African households in real terms.

Image: Nadine Hutton | Bloomberg

South African households continue to feel the squeeze from high inflation, stagnant real wages, and rising unemployment, leaving many struggling to make ends meet.

The Altron FinTech Household Resilience Index (AFHRI) for the first quarter shows that, while there has been modest improvement over the past year, households remain vulnerable.

The index rose 2.5% year-on-year but fell 4.2% compared to the last quarter of 2024, landing at 111.4.

The prime lending rate finished the first quarter at 11% after a third 25 basis point repo cut in January.

Yet the real prime rate – prime minus inflation – remains 118% higher than early 2020 and 177% higher than in the first quarter of 2014.

Over the longer term, households have barely kept pace with the economy. Since the AFHRI began in 2014, the index has grown at an average annual rate of 1%, slightly ahead of GDP, but the last three quarters show households lagging behind the broader economy.

According to economist Dr Roelof Botha, who compiles the index for Altron FinTech, the restrictive monetary policy of the South African Reserve Bank’s Monetary Policy Committee has been the main reason for the consistent decline in the average disposable income for each South African in real terms, with a sharper drop since these policies began affecting key macroeconomic indicators.

One of the more encouraging features of the latest AFHRI is the stability that has crept in over the past four quarters.

The index smooths out seasonal swings, including the retail spending surge that boosts economic activity during the fourth quarter.

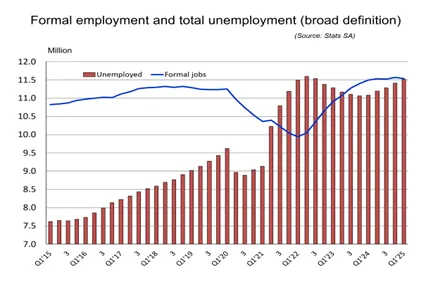

The consistent and sharp increase in total unemployment in South Africa (including discouraged work-seekers) is alarming, says the Altron Fintech Household Resilience Index.

Image: Altron

Still, drops in formal employment and real wages, combined with high lending rates, held the index back in the first quarter.

Unemployment remains a pressing concern.

Total unemployed, including discouraged workers, now sits just above 11.5 million – equal to the number of formally employed South Africans. In 2015, formal employment exceeded unemployment by 3.2 million.

Johan Gellatly, MD of Altron FinTech, said the first-quarter results reflect the tough reality for South African consumers.

Gellatly said, “while we’ve seen modest annual growth in the index, the quarter-on-quarter decline of 4.2% underscores the volatility facing households, and their financial vulnerability in this high-rate environment”.

Looking ahead, Gellatly said SARB must foster a more growth-friendly environment, with the May rate cut offering some hope for the AFHRI in the second quarter.

Gellatly added that more aggressive easing is needed to restore household stability, boost investment, and encourage the consumer spending that drives the economy.

IOL Business