South Africa is ramping up tourism growth with a focus on better air access, targeted marketing and safer travel.

Image: Ron | IOL

South Africa is just 33 000 visitors shy of its pre-Covid peak after attracting 5.85 million international tourists in the first seven months of 2025 – a 14% jump on last year – but a new BDO analysis says the apparent comeback hides worrying trends.

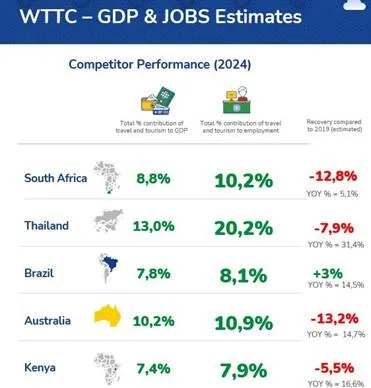

Government, quoting World Travel and Tourism Council figures, said earlier this year that the industry now contributes 8.8% to gross domestic product and supports 1.68 million jobs.

"It is encouraging to see that despite economic uncertainties in various parts of the world, the global tourism sector is growing. It is even more encouraging that our country follows the same trend and trajectory," Minister of Tourism, Patricia de Lille said earlier this year.

Yet, BDO advisory partner Lee-Anne Bac cautioned “this apparent success masks deeper structural challenges that demand immediate attention”.

While global tourism bounced back to 2019 levels in 2024 with growth of more than 12%, South Africa managed just 5.1% growth, leaving it 13% behind its own 2019 arrivals.

These are far ahead of South Africa’s 10.3 million visitors.

A snapshot of South Africa's performance in the tourism market relative to other countries.

Image: World Travel and Tourism Council

The biggest red flag is overseas tourism, where high-spending travellers deliver the biggest economic boost.

Only 1.3m overseas visitors arrived in the first seven months, tracking 10% below 2019.

BDO estimates the 183 000 “lost” overseas visitors cost South Africa about R4.3 billion in foreign spending over seven months, and R13.3bn in 2024.

Chinese arrivals of 23 600 represent just 44% of 2019 levels despite a new Trusted Tour Operator Scheme.

India sits 27% behind 2019 with a 9% drop year on year.

France is at 79% of 2019 levels, Germany at 87%, and the USA shows only 3% growth despite being the largest source market.

Africa is the bright spot.

Regional arrivals climbed to 4.55 million in the first seven months – 118 000 more than 2019 – with Ghana doubling its 2019 numbers in 2024 after a visa waiver and Kenya beating 2019 arrivals by 58%.

Cape Town International Airport shows what’s possible, exceeding 2019 overseas arrivals by 21%, while OR Tambo remains 21% behind.

BDO is calling for urgent action, including a bold Brand South Africa campaign, an air-access development fund, and a crackdown on crime and urban decay that continue to deter visitors.

However, government has already indicated that South Africa is ramping up tourism growth with a focus on better air access, targeted marketing and safer travel, government said in February.

A key step was Cabinet’s December 2024 approval of the Route Development Marketing Strategy, which will restore key routes, expand airline partnerships and improve direct links to major global cities.

Targeted campaigns in China, India and the Americas are showcasing unique South African experiences, while new digital and AI tools aim to personalise and streamline trip planning, government said.

The government also noted that the sector is also driving sustainable and cultural tourism by promoting eco-friendly and heritage attractions.

To boost traveller confidence, government and industry partners are strengthening safety and security measures, working with law enforcement to protect visitors and local communities.

IOL Business

Related Topics: