Gold rush rewards: Krugerrand investors strike it rich after 30 years

A 30-year investment in Kruger Rands is a 50-fold return in 30 years when inflation is included.

Image: IOL Graphics

Gold has surged to record highs, and South Africans who bought Krugerrands 30 years ago have seen extraordinary returns.

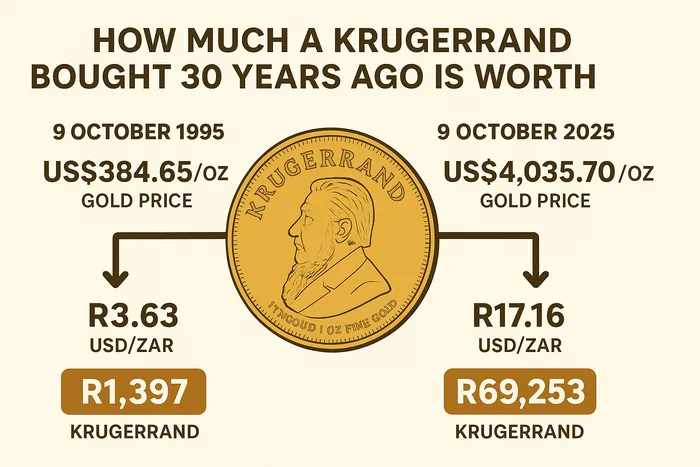

Exactly 30 years ago, gold traded at about $384.65 an ounce. With the rand then averaging R3.63 to the dollar, a 1oz Krugerrand cost roughly R1 397 at the time.

Fast forward to today and gold is trading at a record-breaking $4,035.70 an ounce, with the rand at R17.16 to the dollar.

That puts the same coin’s value at about R69 253 – a 50-fold increase in nominal terms.

When South African inflation is stripped out, the 1995 price in today’s rands would be around R7 137, meaning the Krugerrand’s real value has grown nearly ten-fold over the past three decades.

Goldman Sachs this week raised its gold price target to US$4 900 an ounce by end-2026, citing robust central bank buying and expectations that the US Federal Reserve will maintain an easier policy stance.

If that forecast materialises and the rand holds near current levels, a 1oz Krugerrand could be worth close to R84 000 within the next 14 months.

This would further extend what has already been one of the most remarkable long-term investment stories in South African history.

Taking inflation out of the equation, that same coin will be worth R79 900, not all that much difference when you start talking those numbers.

The comparative price of gold on a 30-year basis, taking inflation into account.

Image: ChatGPT

While gold has always been viewed as a store of value, the numbers highlight just how powerful long-term exposure can be, especially for local investors holding assets linked to the dollar.

The dollar has, meanwhile, depreciated substantially this year, Investec chief economist, Annabel Bishop, has noted.

“The US dollar’s movements are key for the rand,” said Bishop.

The gains are not just being driven by a strong rise in the global gold price and the rand’s long-term depreciation.

In 1995, one US dollar cost just over R3.60; today it costs more than R17.

Gold, a safe haven in times of trouble, has surged on the back of several factors.

Among these is the ongoing US government shutdown, which has fuelled uncertainty in the market.

The yellow metal’s latest rally also comes as investors hedge against uncertainty in global markets, persistent inflation pressures, and growing geopolitical tension.

Central bank demand, particularly from emerging economies such as China, has also supported prices.

Krugerrands, which contain one troy ounce of fine gold and are legal tender in South Africa, track the gold spot price closely.

They’re also among the most traded gold coins worldwide.

The calculation here excludes dealer premiums or buy/sell spreads, which vary between traders but don’t materially change the long-term picture.

IOL Business