The rand is riding a wave of optimism after South Africa’s removal from the Financial Action Task Force’s (FATF’s) greylist on Friday lifted investor confidence.

Image: IOL Graphics

The rand is riding a wave of optimism after South Africa’s removal from the Financial Action Task Force’s (FATF’s) greylist on Friday lifted investor confidence.

Annabel Bishop, Investec chief economist, said the local unit hit R17.19 to the dollar yesterday and could strengthen further this week.

This is as markets celebrate the FATF’s decision and await the US Federal Reserve’s rate decision.

As of mid-morning today, the local unit was trading at R17.27 to the greenback.

“South Africa’s exit off the greylist as expected on Friday has provided some underpin to the rand,” said Bishop.

The FATF confirmed that South Africa “will no longer be subject to the FATF’s increased monitoring process”, having completed its action plan in time.

But National Treasury warned there was no room for complacency.

It said the exit “is only start of a broader process to continue to strengthen key institutions, improve enforcement and governance processes”.

National Treasury said neither government agencies nor regulated entities in the private sector can afford to become complacent.

It added that both the public and private sector must continue to strengthen the anti-money laundering and combating the financing of terrorism (AML/CFT) system.

The AML/CFT system is a global framework designed to stop criminals and terrorists from using the financial system for illicit purposes.

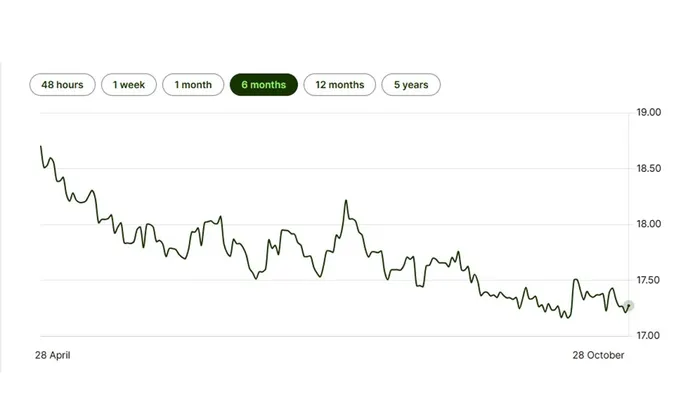

The rand has gained post South Africa's removal from the Financial Action Task Force's greylist.

Image: Wise.com

It includes a combination of criminalising money laundering and terrorist financing, implementing preventive measures for businesses, establishing financial intelligence units, and creating a framework for domestic and international cooperation.

The rand hovered around R17.30 to the dollar last week, supported by expectations of a US rate cut later this month, said Bishop.

Bishop said markets now expect more rate cuts from the US than from South Africa for the rest of the year, which could lend more strength to the rand.

Andre Cilliers, currency strategist at TreasuryONE, said the dollar was trading softer ahead of US President Donald Trump’s meeting with Chinese Premier Xi Jinping and the Fed’s interest rate announcement.

“The rand remains firmly anchored around the R17.20 level, with fairly good two-way trade in the market,” said Cilliers.

Yet, Cilliers noted that gains from the greylist exit were tempered by weaker gold prices and uncertainty over a US-China trade deal.

Louise Usher, Credo head, South Africa, said the FATF’s decision recognised major progress in cleaning up the country’s financial system.

“Effective AML and CFT frameworks are not only a regulatory expectation but also a cornerstone of integrity, transparency and trust in the financial system,” said Usher.

Usher added that the “FATF’s announcement is therefore a welcome acknowledgment of the progress achieved, and the commitment shown to strengthening the integrity of financial frameworks”.

IOL Business